Daily Briefing 6/4/25

Private Payrolls (ADP)

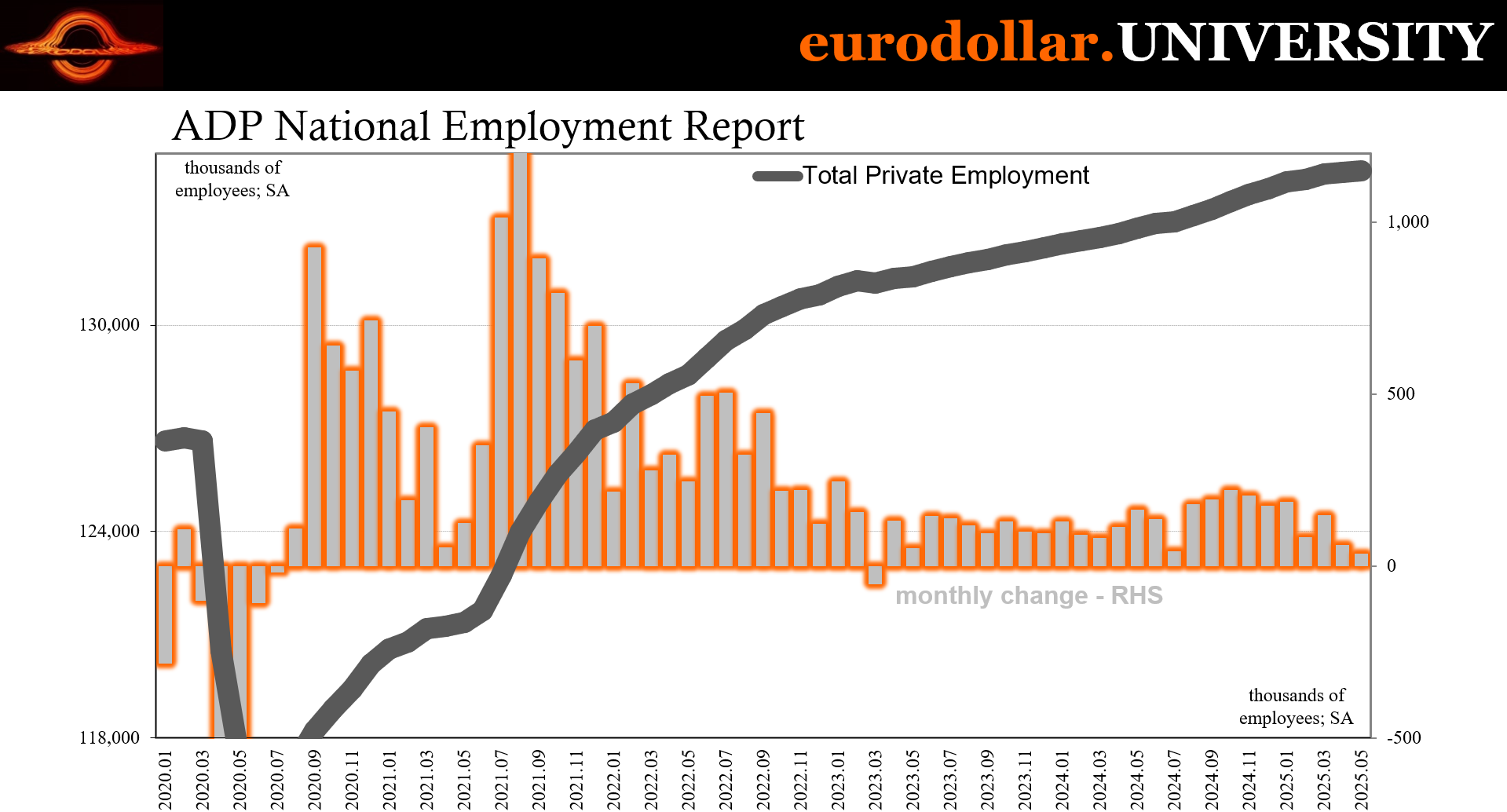

The US labor market showed clear signs of deceleration in May 2025, with private employers adding just 37,000 jobs - far below expectations of 110,000 (!) and the weakest showing since March 2023. The services sector contributed nearly all gains and primarily in leisure and hospitality, too, while job losses hit professional/business services, education, health, and trade. Medium-sized firms led job creation, while every other category produced net losses. The goods-producing sector was net negative, particularly in mining (oil) and manufacturing.

Interpretation

Though not the most reliable indicator, the May 2025 ADP employment report is becoming a clear-enough signal that recent artificial labor market momentum is dissipating more rapidly than previously assumed. With private payrolls rising by just 37,000 jobs - barely a third of expectations and the lowest figure in over two years - this report marks a sharp break from the relatively solid gains seen in the first quarter of the year when artificial factors were creating a mini-revival.

ADP’s data over the past several years does corroborate ISM’s services PMI more closely, one key reason to take note here despite its prior reputation.

While not catastrophic, May’s number speaks to a growing hesitancy among businesses to expand headcount amid rising costs, policy uncertainty, and weakening demand. ADP’s data reinforces a broader narrative: that the labor market is entering a more fragile, uneven phase. The fact that April’s number was revised down to 60,000 only sharpens the picture of gradual erosion, meaning two months rather than solely one.

Sectoral breakdown shows a bifurcated market. Leisure and hospitality led job growth, adding 38,000 workers, which is likely seasonal, driven by summer travel and dining. Financial activities and information sectors also added modest jobs. However, this modest strength is more than offset by weakness elsewhere. Professional and business services shed 17,000 jobs. Education and health, typically stable sectors, also saw job losses. The goods-producing side of the economy continued its downtrend, losing 2,000 jobs, particularly in manufacturing and mining, industries sensitive to global demand and commodity cycles.

The composition of job creation is also telling. Only medium-sized firms added jobs in a meaningful way, with small and large employers showing limited or negative net change. This could indicate tightening credit conditions or heightened cost sensitivity among smaller and larger enterprises alike.

The key takeaway is that the labor market is faltering back to its state from last summer. If the trend continues this time around – with no artificial positives to interrupt – it will put additional pressure on household income growth, consumer demand, and ultimately, the full system. As it is, there are indications consumes are already pulling back which would further align with the data here in our first two sections.