Daily Briefing 5/29/25

Gross Domestic Product (BEA)

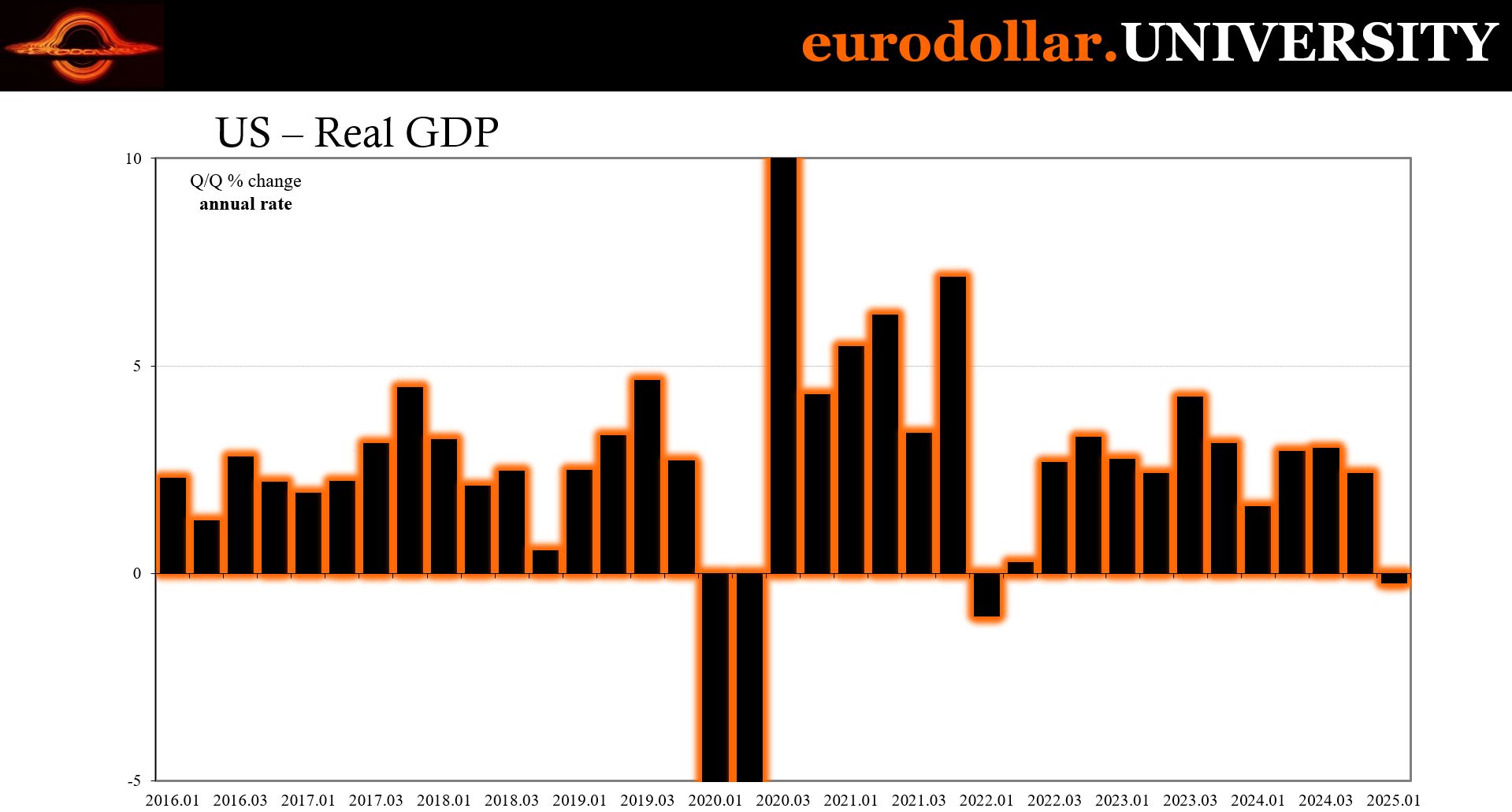

The US economy shrank at an annualized rate of 0.2% in the first quarter of 2025, marking its first contraction in three years, though slightly better than the earlier estimate of a 0.3% decline. However, final sales of domestic product fell by a steep 2.9%, the sharpest drop since Q2 2020, and worse than the initial estimate of a 2.5% fall. The positive revision was driven by stronger-than-expected fixed investment balanced by consumer spending which rose just 1.2%, the slowest pace since mid-2023, revised down significantly from the 1.8% initial estimate. BEA now believes more goods ended p in inventories rather than taken home by customers. “Inflationary” pressures persisted, with the PCE price index holding at 3.6% year-over-year, while core PCE (excluding food and energy) was revised slightly down to 3.4%.

Interpretation

The final estimate of the first quarter of 2025 has confirmed that the US economy has slipped into contraction, even it was slightly better than the first estimate.

There were several key “segments” that took the hardest hit. Most notably, final sales of domestic product - a core gauge of domestic demand that strips out the volatile impact of inventory changes - plunged by 2.9%, the sharpest drop since the pandemic lockdowns of Q2 2020. This measure, often seen as a bellwether of real economic momentum, tells a darker story than the relatively mild top-line GDP print. In essence, domestic consumers are pulling back, and with them the entire economy.

The driver of the minor GDP upward revision - fixed investment - masks deeper imbalances. While business investment showed surprising resilience, this was more than offset by alarming weaknesses elsewhere. Consumer spending growth slowed to an anemic 1.2%, the worst showing since mid-2023, and a stark deceleration from the 4% growth seen in Q4 2024 (and 1.8% as the initial estimate). At the same time, federal government spending fell 4.6%, the steepest decline since early 2022, subtracting more out of activity (even if a long run positive).

Trade dynamics added another layer of distortion. Imports surged a staggering 42.6%, not due to a booming economy, but rather as a defensive move by businesses and households racing to beat looming tariffs. This front-loading - while boosting Q1 import volumes - will likely mean weaker activity in the quarters ahead as inventories have swelled and demand subsides even more than it did in Q1.

“Inflation” remains persistent. The PCE price index stayed at 3.6%, while the core rate was revised only slightly lower to 3.4%.

All in all, the final estimate of Q1’s report marks a potential turning point where the post-pandemic recovery is out of the window (so we are officially done with artificial highs). With consumer strength fading and trade frictions reemerging, the coming quarters may test the economy’s resilience far more than the modest GDP dip initially suggests.