NO PLACE FOR POLITICS

EDU DDA May 20, 2025

Summary: Catching up on March’s TIC from last Friday. There were a number of noteworthy results in it, everything from more resales, near-record China selling, deflationary correlations galore, and a sudden appetite by American banks to lend to Emil (at least to parties located near him). China, Japan, Cayman Islands, Treasuries being sold, repo being done, exchange values being set. Eurodollars everywhere leaving no room for politics.

YEN CARRIES MORE DOLLARS THAN MANY REALIZE

Sifting through the TIC data for March, which came in last Friday, a few more points than usual stood out. This isn’t necessarily a surprise since March led right into the chaos of April, so we were bound to see sizable deflationary imprints no matter what.

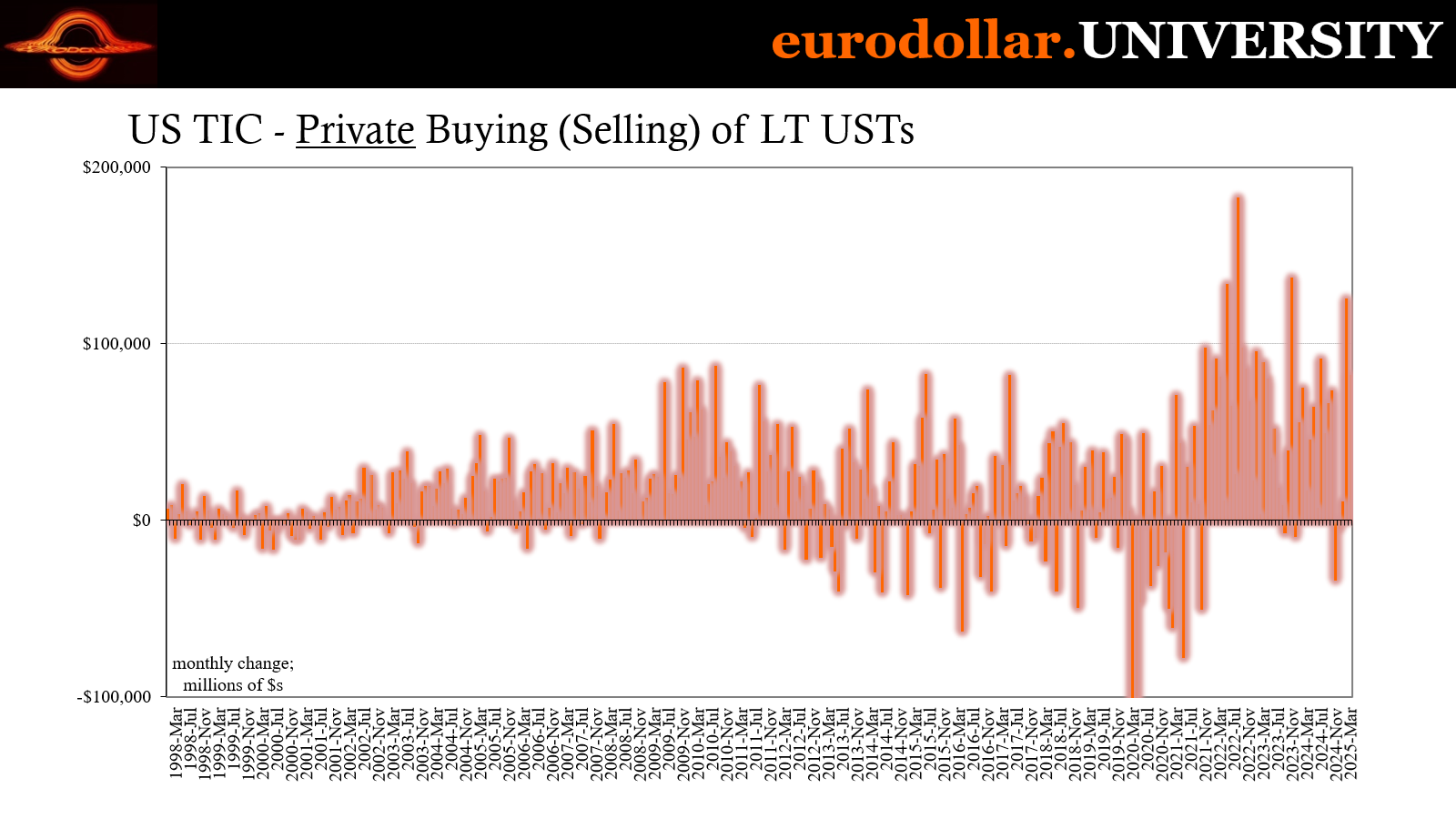

To start with, resales soared even further, raising the total for all of Q1 by more than $315 billion, a 20% increase. That’s not good for anything aside from those holding Treasuries. Sure enough, among the biggest buyers of them through March was foreign private entities and individuals who were hardly ditching the dollar or government debt.

Foreign officials did, in part. While overall overseas central banks and reserve managers bought more LT notes and bonds, on net, for the one month (a technical fluctuation) the Chinese did the complete opposite, selling agency and Treasury debt by the third-most in any quarter (the other two being last year’s first and third quarters). This isn’t political, instead aligned closely once again with both swap spreads – therefore the funding environment described by resales – and then tellingly CNY.

In fact, the TIC data helps reveal the possible reasons therefore extent behind the Treasury selling from Beijing.

Meanwhile, the Japanese continue to withdraw at the same time American bank claims on the Cayman Islands and other Caribbean bank sectors utterly soared. Rising 41% year-over-year, what will it have been in April? We’ll take a stab at what’s going on down in Emil’s neck of the woods.

It wasn’t all straight-up de-risking and de-funding. US banks have shown they are utterly willing to lend hand over fist to non-banks both inside and now outside the county. TIC gives us a $333 billion rise in Q1 in claims on those funds – who just happen to like to set up shops in the Caribbean.

The data shows the dollar isn’t under threat, it’s the eurodollar which threatens to upset global money, finance, and therefore economy. Even as its exchange value has relented somewhat more recently.

Down on Dixie

DXY has come back from its multi-year low as the euro has let up slightly. So, too, the Swiss franc, though notably CHF is moving back higher again. Should it continue, that would be a negative signal for picking back up with all negatives described in the TIC data through March.

The sad truth is no one can ditch the (euro)dollar no matter how much they might want to or how much it makes sense in principle. This system no longer works and hasn’t for closing in on a couple decades now, producing almost regular volatility and worse for everyone to try and deal with. I’d be tired of it, too.

Any dollar doom narrative runs with several false assumptions, all of them starting from the belief reserve currencies are a political choice. Bretton Woods may have been, if only given the unique circumstances of the time: the utter destruction and distraction toward then end of WWII when governments were the only possibilities for doing anything if not everything.

Even then, while Bretton Woods should be lauded for helping set the postwar global economy on the right foot, providing badly needed stability after the Great Depression calamity, the truth is it failed almost immediately. I’ve seen references to a Continent dollar system as early as the late forties (continental referring to Europe and obviously not the paper issued during the War for Independence).

The latest anyone can honestly date the last somewhat untarnished BW is November 1961 at the formation of the London Gold Pool, which, in reality, was its quasi-official end. The eurodollar had already taken over, meaning BW could fade further away during the sixties until the ceremonial termination in August 1971.

There is no such benefit today. Funny thing how, in the wake of last week’s Moody’s downgrade, two of the world’s top central bankers both yesterday voiced the same sentiment – as each other, and what I just wrote. No one can ditch the dollar since there is nothing else.

First, the head of Switzerland’s central bank, an institution at the center of a money center to money centers:

“US Treasuries are very liquid,” Swiss National Bank President Martin Schlegel said Monday in Lucerne. “There is currently no alternative to them and it’s not foreseeable that there will be an alternative.”

Treasuries are inseparable from eurodollar function, sadly. While it would be far better for the world if there was a private alternative that didn’t perversely reward government debt during depression economics, this is the world we have not the one we might choose.

So, too, said the head of Singapore’s Monetary Authority:

Dollar-based assets have “enduring advantages” and remain virtually irreplaceable in the global financial system despite the US losing its top triple-A credit rating, according to Singapore’s central bank chief.

“They are the dominant, safe assets for use in the financial system, deeply embedded,” Monetary Authority of Singapore Managing Director Chia Der Jiun said at the Qatar Economic Forum on Tuesday. “The $28-trillion Treasury market is fundamental and systemic to the global financial system and there is no alternative for this point.”

You could argue both Schlegel and Jiun are doing America the favor of standing up for dollars and Treasuries, but, as the TIC leaves no doubt, the entire matter is function not politics. A reserve currency is the one that’s useful. Even as the eurodollar malfunctions and sputters, there (sadly) remains nothing close to challenge it no matter how many times dollar doomists will claim the currency’s demise is right around the corner.

It isn’t, therefore exchange value fluctuations are down to eurodollar mechanics and nothing else.

A good example is the “weakness” in emerging market currencies as a group. While everyone was going crazy over the euro driving DXY to its recent multi-year low, the funding currencies were the opposite of weak and more clearly showed the connection to monetary circulation; the Fed’s EME index reaching a record high not surprisingly by April 9 leading up to the worst of the forced liquidations as global funding dried up.

Since April 9, the dollar is “weak” now against this group, too. Not nearly as much as other exchange values, still lower against them anyway. That’s not dollar-ditching nor random coincidence. With tariff delays and possible trade deals taking some of the fear out of dollar providers, they’ve backfilled some of the missing activity from the months leading up to then – if temporarily (again, TIC setup).

There are no politics here, only monetary economics – which then precludes the Fed and its overfill of Economists. This is not the case with foreign central bankers who have to deal with the fallout from all this real money conditioning.

Revisiting resales

If you missed the resale review from last month, you can find it here. It isn’t necessary to have read it first, though it will help and not just with this section.

A brief recap: Resales are the opposite perspective in repo. Where repo, or repurchase, is borrowing cash on collateral, a resale is simply lending cash and getting collateral. Since the TIC data is from the perspective of American banks and we’re focusing on their repo activity with offshore counterparties, their lending cash to them is classed as a resale (also known as a reverse repo).

Resale activity is strongly inversely correlated with Treasury yields since rising resales mean difficult funding conditions outside the domestic part of the eurodollar. American banks since 2008 have acted as lender of last resort, basically becoming the Discount Window for offshore firms. That indicates deflationary conditions and may also include collateral problems, both generally positive for Treasuries, meaning falling yields.

After strong increases in resales in January and February, March came in with a third in a row. It made a $315 billion rise in balances, a 20% surge which pushed the total outstanding at the end of Q1 to just less than $1.9 trillion. It is a very fitting description of the fragile funding environment which existed just before the feces smacked the fan.

It’s also another reminder how it wasn’t trade wars; tariffs aren’t really enough of a negative on their own to have created this harsh of a eurodollar backlash (just like in 2019 when the global recession couldn’t have been created by Trade Wars 2018 Economists had to invent “trade war sentiment” to try to explain the discrepancy). I can only imagine what the data will show for April when it is released finally next month, if only so we can gain some more proportions and some better scale to the deflation.

China is ditching Treasuries again

Over the last dozen years, the Chinese have very often been stuck on the other side of that deflation, if not right at its center. Q1 appears to have been no different. There were few(er) stories in the media, however, of Chinese Treasury selling this time compared to Q3 last year or especially Q1 2024. In the latter of those, there didn’t seem to be any outward reason for China to have sold what was then a record amount, a net -$53.3 billion in Treasuries and agencies combined.

What else apart from politics?

We call it a blackhole for a reason. Only it was a bit less obscured by Q3 when the carry trade reversal led to more visible global financial disruptions. That didn’t stop the narrative from claiming the Chinese were leaving the dollar when it was the eurodollar more clearly impacting China’s global participation. The result was a record disposal of those dollar assets.

Even Q4 only let up somewhat, producing another $17 billion in net combined selling during what was a modest mini-reflation ironically produced, in large part, by tariff front-loading activities. By Q1, however, right back to bigtime selling at just over -$50 billion, third-most for any quarter. Though it was tempting for a time say it was Xi Jinping’s revenge for tariff threats, the market swoons from mid-February left the matter less open to such speculative interpretation.

What ends the discussion, however, are the correlations – plural. Start with interest rate swap spreads, the very essence of deflationary signals. Compressing swap spreads correspond with Chinese selling more than a little, especially the 30-year maturity which made a more decisive negative move from very early on in January 2024.

That was, you’ll note, the same quarter in which Beijing began its intermittent record-sized dollar asset sales. Unless Xi has somehow also found a way to manipulate the world’s biggest and most influential marketplace (swaps over Treasuries), these deflationary signal confirm the mechanical reasons for disposing of China’s previous holdings of safe dollar assets.

CNY down = you know the thing

Those disposals are also closely related to China’s currency exchange value, especially over the last decade and a half since eurodollar risk aversion began to more closely scrutinize risks/rewards of lending into the Chinese economy (especially originating from Tokyo).

While the correlation stands, there have been a few periods when selling of Treasuries/agencies has gone farther than CNY has. This doesn’t indicate politics over function, rather a political choice to support the currency value lest funding pressures lead the yuan to truly plunge.

The best example of this is 2015, its third quarter. In early August, CNY “devalued” falling sharply (why so many August 9’s the past twenty years?) and shocking the world. While many said at the time, and a few holdouts to this day, this was an economic policy intended to boost China’s export competitiveness (beggar-they-neighbor currency war), that was also nonsense.

Instead, eurodollar funding was yanked almost all at once, creating a vacuum which sucked the exchange value down as dollar providers greatly increased the premium they were demanding to exchange dollars. To limit the damage on CNY, the Chinese government sold a whopping $46.6 billion agencies and Treasuries (vastly more the latter). This kept up for the next year, as Beijing tried to limit the fallout on the currency exchange value as eurodollar funders pulled back fearing the “hard landing” scenario.

We see something similar happening since early last year, with CNY being artificially held higher after its fall in 2023 triggered by the failure of reopening (like 2015, there is always a pretty obvious risk-aversion case for yuan weakness, even if it eludes mainstream notice thanks to Economists and central bankers stateside who have no idea about any of this). So, Xi has been selling a lot of Treasury assets to prop up CNY to make it seem more stable than it really was.

Or, more accurately, more stable than the funding environment has been.

This isn’t a China-only factor/outcome. If we plot TIC selling of Treasuries across the entire world with the Federal Reserve’s dollar exchange index for EME currencies (since they are dollar borrowers, in general), there is a strong enough correlation between those, too, adding more to confirmed deflationary signals.

From Tokyo to Grand Cayman?

No surprise, either, the Japanese appear to be on the other side from China’s dollar woes. Japan’s big firms have been borrowing in dollars to redistribute to Chinese firms of one kind or another, a form of carry trading. While some of Tokyo’s dollar borrowings go to fund their own holdings of dollar assets, a fair amount are further transferred into other denominations, including yuan – this is, after all, what a reserve currency is really for and why the eurodollar really isn’t being replaced anytime soon.

What TIC shows is that, since last July, Japanese firms, largely banks, have been borrowing a lot less dollars from American banks. They may be sourcing dollars from somewhere or someone else, though not likely (we always have to keep in mind TIC or any similar data is still incomplete, to put it mildly). This fits with the last two Chinese selling spasms, if not the first one.

The Europeans aren’t making up any difference, according to TIC. As I noted in last month’s review, Europe has seen dollar borrowing correspond with conditions in or associated with Europe (first fears over crisis in 2022, expectations for a rebound late in 2023 that weren’t met in 2024).

Where we do see a massive amount of dollar lending via American banks is into the Cayman Islands. Rather than being an offset to eurodollar difficulties discussed throughout here, this shows instead a huge increase in funding non-bank activities. Many if not most big-name investment funds domicile their major activities offshore on Grand Cayman – an island which houses trillions of “dollars” despite a conspicuous absence of any bank anywhere.

There are, however, tons of office suits with bank names written on the doors, behind those doors staffed by accountants and lawyers.

A WHOPPING 41% Y/Y INCREASE IN MARCH

In other words, this is the offshore counterpart to what we’ve seen and documented among American bank activities here domestically as well as their counterparts in and across Europe. Both groups are behaving defensively at home, lending less to real economy participants, buying tons of safety in government bonds, yet also extending large loans to investment funds.

What TIC shows is very similar: large private buying of Treasuries from offshore (could be basis traders, too), with banks lending less to their traditional borrowers like to Tokyo if at the same time extending a huge increase in funds to Cayman Island non-banks (also called shadow banks).

To what end?

We don’t know nearly enough. It seems less like re-risking as banks taking some opportunity to do some lending while keeping it at arm’s length. Banks don’t want to go risky with their own funds on their own balance sheets, so they’ll let these shadow banks do it and take the hit if it comes down to that. This appears to be happening everywhere.

As always with TIC, the figures don’t necessarily tell us anything we didn’t already suspect. The confirmation is valuable nonetheless even if it still leaves us with too many unanswered questions. That is, after all, the nature of the blackhole. We can’t only tell some of what’s really going on on the inside only by what’s being shaped around it.

The upshot of March TIC, apart from more clearly defining the deflationary conditions leading into April, is that none of this leaves any room for politics.