Daily Briefing 6/4/25

National Services PMI (ISM)

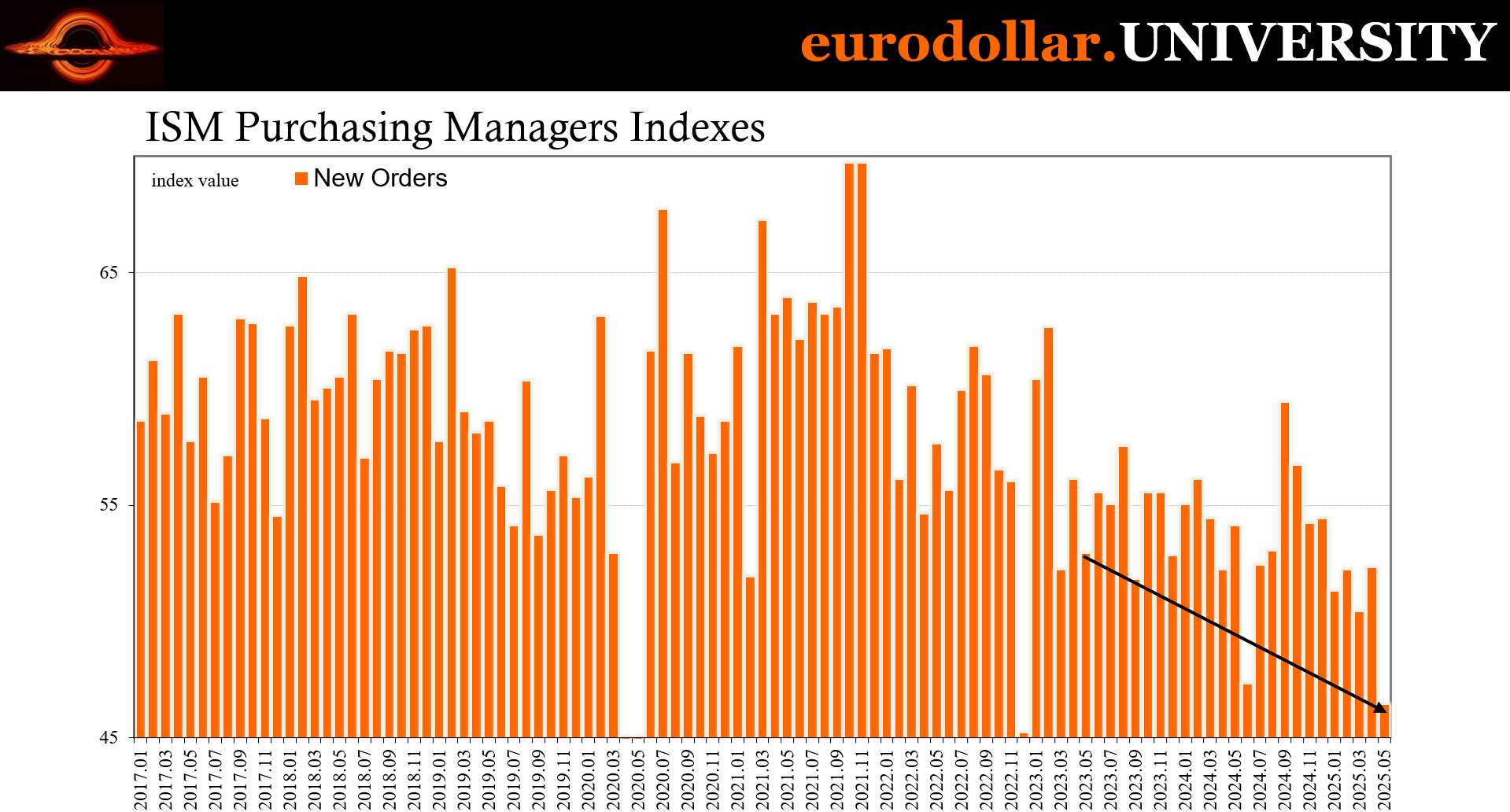

The US services sector contracted in May 2025 for the first time since June 2024, with the ISM Services PMI slipping just below the 50-point threshold to 49.9. Business activity held flat at 50 – lowest in five years - while new orders dropped sharply to 46.4, second lowest since the middle of 2020. Employment inched into expansion at 50.7, and supplier deliveries slowed further, indicating strained logistics. Prices surged to 68.7, their highest level since November 2022, driven in part by tariff-related cost pressures. Inventories fell, and backlogs shrank for the ninth time in ten months.

Interpretation

The May 2025 ISM Services PMI reading of 49.9 marks a psychological turning point in the post-pandemic recovery. For services, anything below 53 indicates serious general weakness while being under fifty has been almost exclusively full-on recession. Just as important, the index’s recent history aligns with practically every other data series, rising at the end of last year on artificial factors that are now fading leaving the economy where it left off last summer and now exposed to growing downside pressures – including the margin squeeze tariff shock.

At the heart of this weakness lies demand. The New Orders Index fell steeply to 46.4, its lowest since December 2022. This reflects a widespread hesitance among businesses and consumers to commit to new spending. Firms are beginning to delay purchases, waiting for greater clarity on trade costs and future economic conditions. This mirrors patterns seen in late-cycle slowdowns, when businesses become increasingly risk-averse and cautious beyond purely sentiment.

The Business Activity Index, stuck at 50, reinforces this sense of inertia. Activity isn’t collapsing, but it’s no longer expanding either. This flatlining suggests many firms are operating in a “wait and see” mode, already a highly negative signal given services activity is also very rarely even near fifty. Meanwhile, the Employment Index’s slight rise to 50.7 provides little comfort - it signals modest hiring, but not enough to counteract overall weakness especially as it appears temporary.

Perhaps most concerning is the surge in the Prices Index to 68.7, its highest since late 2022. This suggests that input costs - likely exacerbated by renewed tariffs and supply chain disruptions - are rising even as demand wanes. In this context, businesses are squeezed between higher costs and hesitant customers, with limited room to pass on price increases except to take the hit before passing that on to workers.

Supplier deliveries continue to slow, indicating that logistical strains are persistent, not easing (hence the higher Prices Index). At the same time, inventories shrank, and backlog orders dropped further, meaning firms are not restocking and have little cushion in future work pipelines. Inventory sentiment, by contrast, jumped, suggesting companies may feel they are already holding too much stock relative to anticipated demand. With tariff uncertainty fueling cost pressures and suppressing visibility, there is a very real risk the payback quickly becomes a hard stumble.