Daily Briefing 5/1/25

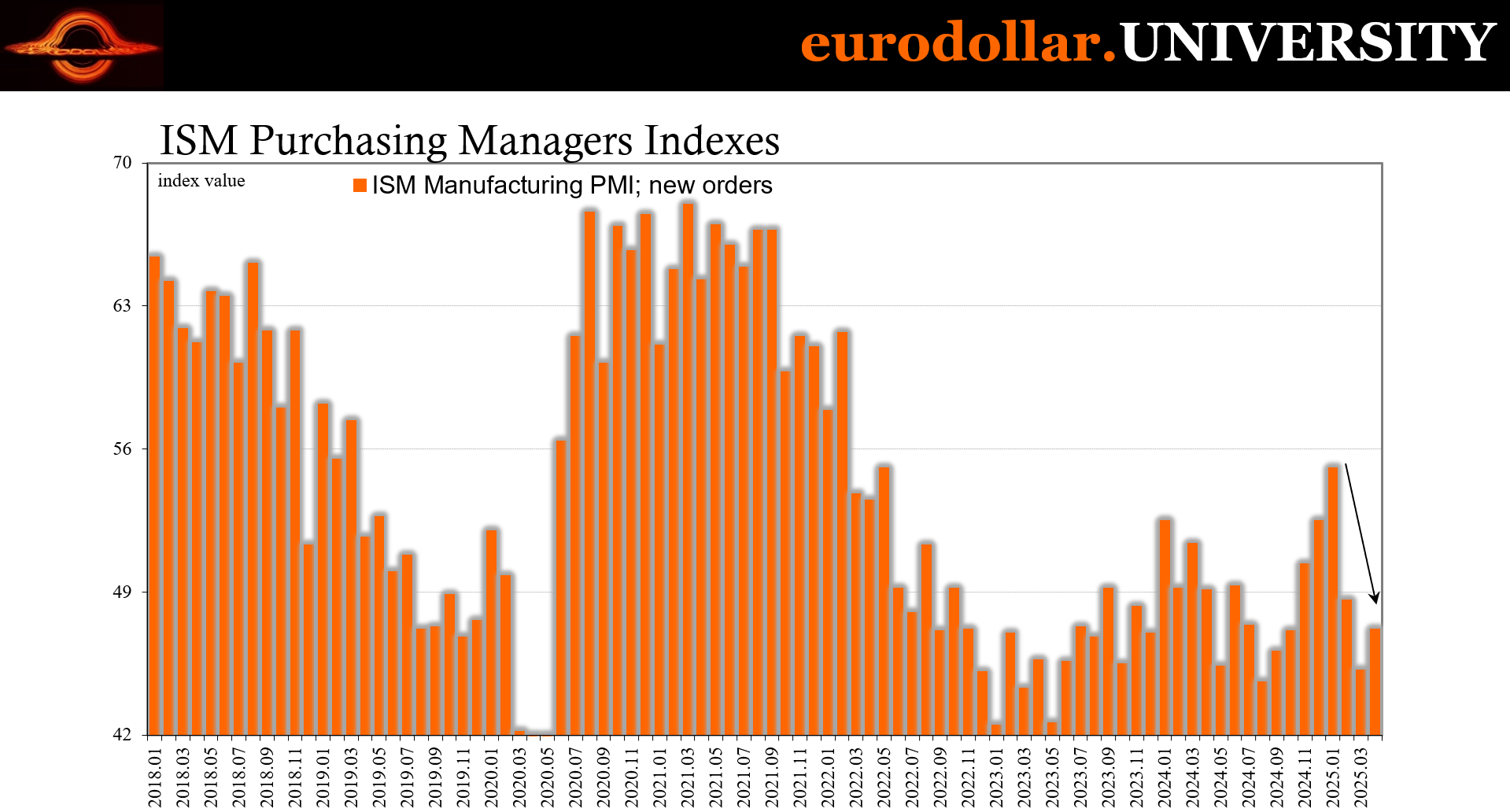

National Manufacturing PMI (ISM)

The ISM Manufacturing PMI for April 2025 declined to 48.7 from 49.0 in March, marking the second consecutive month of contraction in the US manufacturing sector. While new orders contracted at a slower pace, output fell more sharply, and export orders deteriorated significantly due to ongoing tariff disruptions. Input prices continued to rise, adding pressure on manufacturers already facing weakening demand and rising costs. Employment contracted more slowly, but overall activity showed further signs of stress. Supply chains remained unstable, with slower deliveries and complex cost structures, while inventories slightly expanded. Manufacturers reported volatile customer demand, rising uncertainty, and increasing difficulty adjusting production plans in response to changing conditions.

Interpretation

The April ISM Manufacturing PMI signals deepening stress in the US industrial base, with the index slipping to 48.7 - a second consecutive contraction and a continuation of the sector’s long struggle to regain post-pandemic momentum. Beneath the headline figure, key subcomponents reveal a troubling mix of softening demand, shrinking output, and persistent cost “inflation.”

Most striking is the steep drop in the Production Index, which fell to 44.0 from 48.3. This signals not just a pullback, but a more aggressive scale-down in factory activity, as firms respond to faltering demand and rising uncertainty. Export orders plunged to 43.1, a clear casualty of tariff-related disruptions and payback that continue to scramble global trade flows. Shipping delays, shifting cost structures, and complex duties are no longer just operational headaches - they’re becoming structural constraints on growth.

While the New Orders Index improved marginally, it remains in contraction territory at 47.2, reinforcing the idea that demand is neither steady nor reliable. Backlogs are shrinking, customer inventories are still deemed “too low”, and yet, manufacturers are not rushing to replenish - indicating a lack of confidence in future sales. The slight improvement in the Employment Index (46.5 from 44.7) is hardly a silver lining; firms are shedding jobs more slowly, but hiring plans remain restrained, consistent with a defensive, wait-and-see posture (See Section 2).

Input costs continue to rise, with the Prices Index climbing to 69.8, an environment where manufacturers are being squeezed from both ends: eroding margins and unstable customer demand. This is a particularly dangerous cocktail, as it limits the ability of firms to pass on costs or invest in capacity, forcing them instead to cut output and realign labor.

In short, US manufacturing is stalling in real time - caught between weakening domestic and international demand, rising input costs, and persistent supply chain distortions. April’s data suggest not a sector poised for recovery, but one adapting to a harsher, more uncertain operating environment.