Daily Briefing 4/30/25

Gross Domestic Product (BEA)

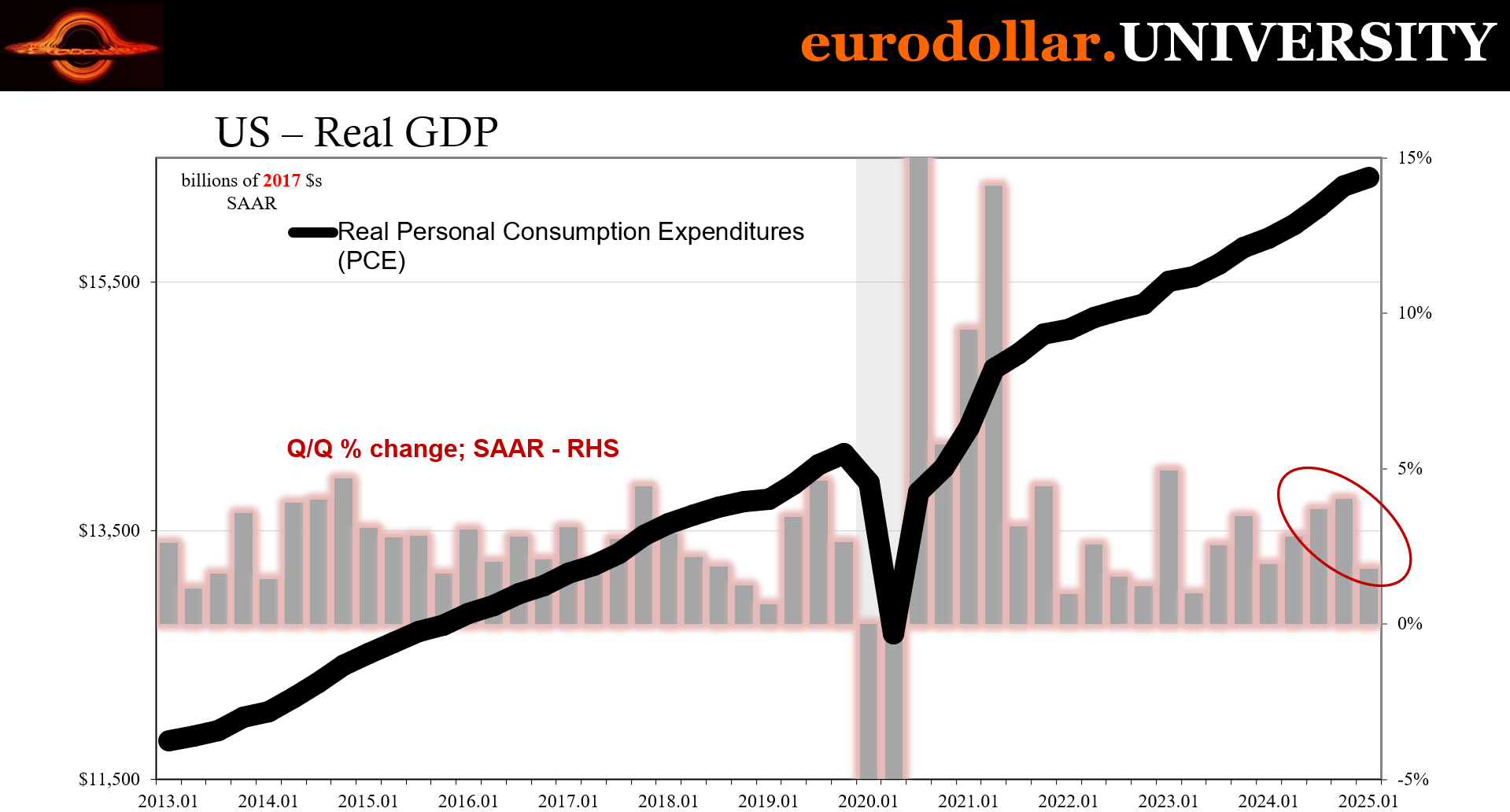

U.S. real GDP contracted by -0.3% (q/q annual rate) in the first quarter of 2025 - the weakest quarterly performance since early 2022 - signaling the sharp downturn amidst the payback from recent distortions. The figure came well below the consensus forecast of 0.4% growth and marked a stark reversal from Q4’s 2.4% expansion. The contraction was driven largely by a 41.3% surge in imports - fueled by companies rushing to get ahead of impending tariffs - along with reduced government spending and a marked slowdown in consumer activity. While some economists point to the technical nature of import-driven GDP declines, underlying data and sentiment suggest deeper fragility in the economy.

Interpretation

The latest GDP report has peeled back the facade of stability that markets and policymakers have been clinging to. A -0.3% contraction in real GDP - the worst quarterly performance since early 2022 - sends a stark warning: the US economy is not just slowing down; it is slipping into contraction. The fact that this decline arrived so abruptly, well below the expected 0.4% growth and a far cry from the previous quarter’s 2.4% expansion, highlights how fragile the so-called recovery really has been.

What makes this contraction particularly troubling is its structural nature. Imports surged an astonishing 41.3%, subtracting nearly 5 percentage points from the headline figure. While some may try to dismiss this as a technical quirk - firms front-loading goods in anticipation of tariffs - it speaks to a deeper disorder: deep uncertainty, policy-induced distortions and an increasingly erratic trade environment.

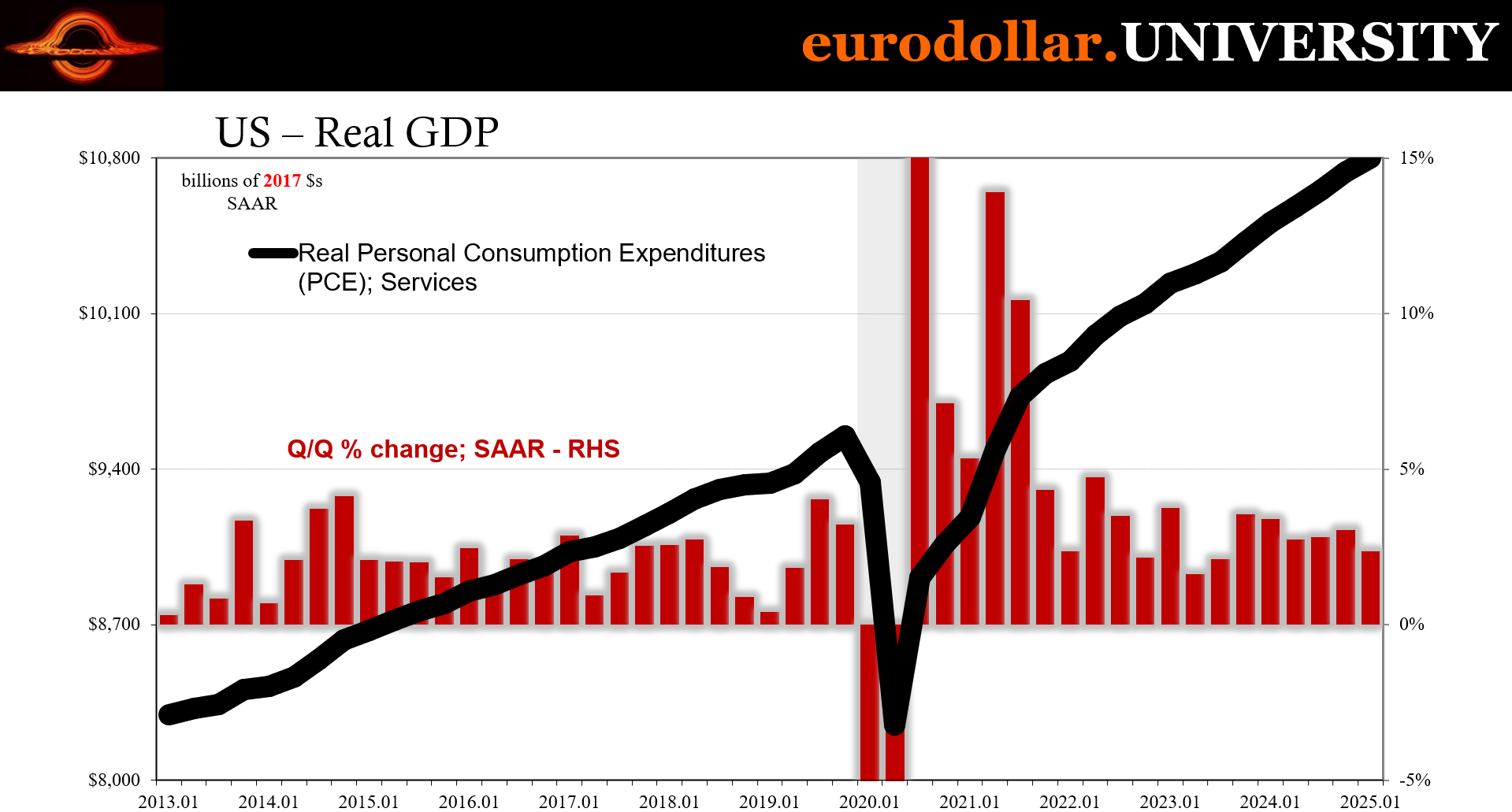

Consumer spending, the lifeblood of the US economy, has also faltered. Growth in household expenditures decelerated sharply to just 1.8% - less than half the pace of the previous quarter - driven primarily by a pullback in goods consumption. For an economy dependent on 70% of its output coming from consumers, this isn’t a slowdown it’s a red flag, especially in light of the March surge in tariff-beating purchasing here, too.

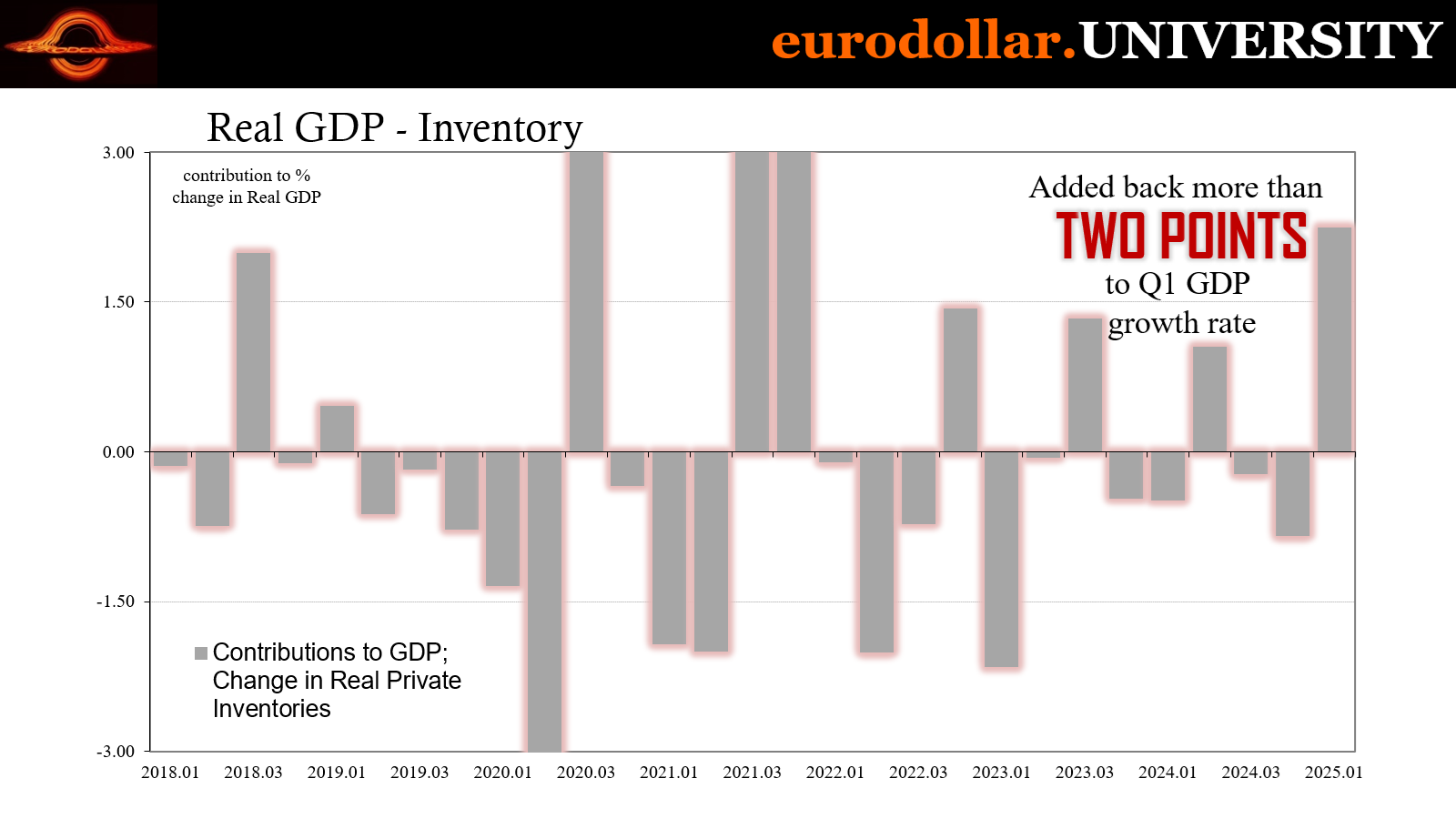

Ironically, business investment jumped 9.8%, not because of confidence, but also because of panic. Firms raced to get ahead of rising import costs, hoarding goods and capital in anticipation of higher tariffs. The spike in private investment - while headline-positive - is less a sign of strength and more of policy-induced hoarding which will likewise be paid back over the months and quarters ahead.

What makes this moment more perilous is the widening disconnect between hard data and public sentiment. While job growth and retail sales had provided a temporary cushion (until the JOLTS report from yesterday), surveys show confidence collapsing. The University of Michigan’s consumer sentiment index is now at its lowest since July 2022 - an ominous signal of deteriorating expectations.

In short, the economy is being held together by lagging indicators while leading ones flash red. The downturn may not be labeled a “recession” yet, but this GDP report suggests we may already in the early stages of one.