Daily Briefing 8/13/25

Financial Statistics Report/Total Social Financing (PBOC)

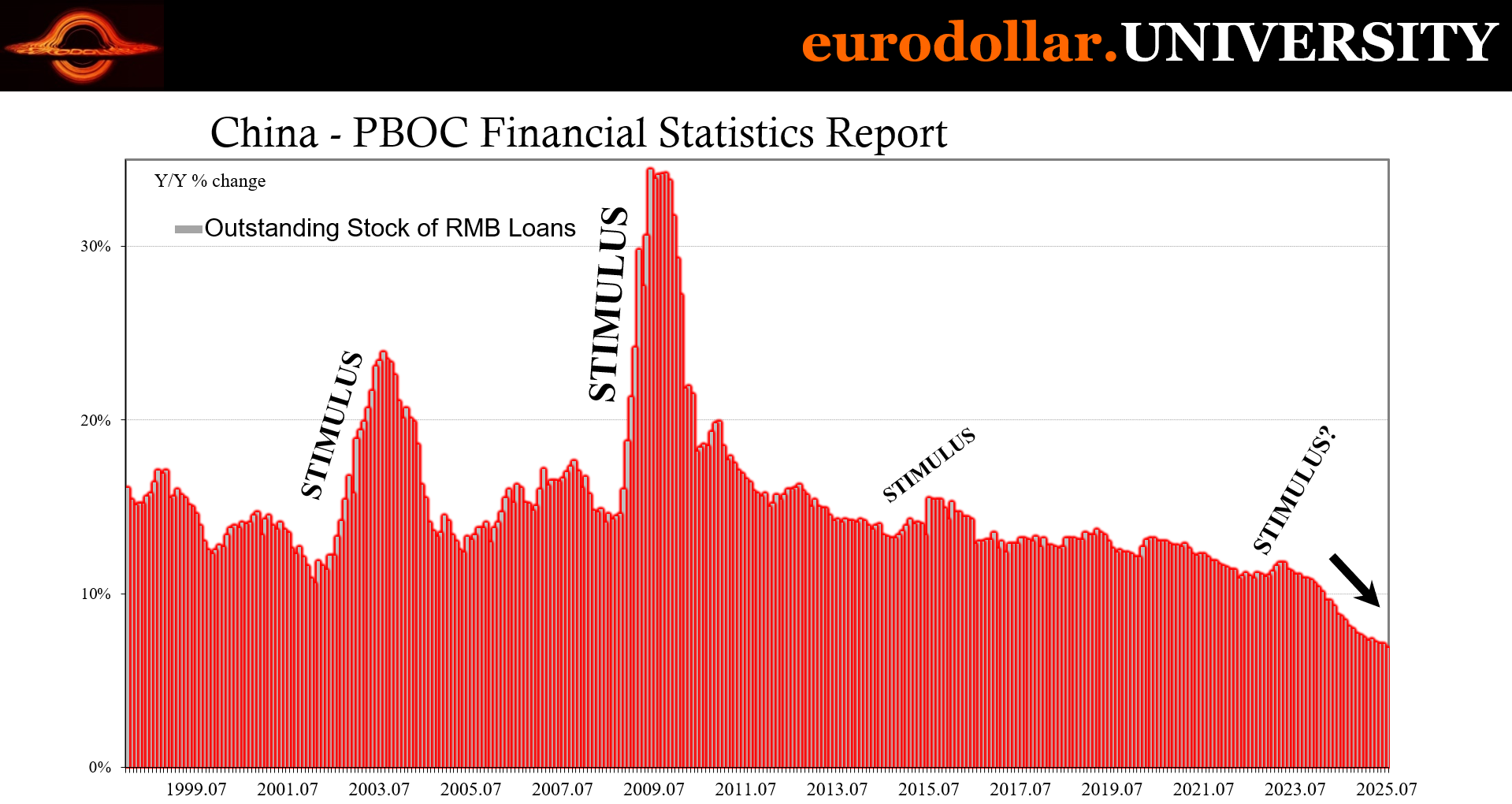

In July 2025, China’s new yuan loans contracted by 50 billion yuan ($6.97 billion), marking the first monthly decline since July 2005 and the largest drop since December 1999 (!) The figure sharply undershot analysts’ expectations of 300 billion yuan in new loans and contrasted with the 2.24 trillion yuan extended in June. While loan issuance typically slows in July after the June quarter-end, this year’s contraction points to exceptionally weak credit demand, particularly in the private sector. Household loans fell by 489.3 billion yuan after rising nearly 600 billion yuan in June, reflecting ongoing stress in the property market. Corporate lending also dropped sharply to 60 billion yuan from 1.77 trillion yuan the prior month.

Interpretation

China’s July credit figures show an economy struggling to generate sustainable lending momentum despite recent policy support (the financial “bazooka”). The headline contraction in new yuan loans, the first in two decades (!), cannot be dismissed as a seasonal lull alone. While July has historically seen a pullback after June’s quarter-end lending push, the sheer scale of this year’s decline indicates that the slowdown is rooted in deeper demand-side weakness.

The sharp drop in household lending is particularly telling. A nearly half-trillion-yuan contraction suggests that consumer appetite for mortgages and personal loans is evaporating under the weight of a prolonged property slump (showing yet again lower interest rates don’t matter). With home prices stagnant or falling and developer defaults continuing, sentiment in the housing sector remains deeply depressed. This reflects structural fragility in what has long been the backbone of China’s credit cycle.

Corporate lending followed a similar pattern, plunging from 1.77 trillion yuan in June to just 60 billion yuan in July. Businesses appear reluctant to take on new debt, even with what are supposed to be (but never are) accommodative monetary conditions, signaling caution about future demand, export prospects, and investment returns. The weakness in corporate borrowing also highlights that the tentative improvement in sentiment seen after recent trade talks has failed to translate into lasting investment commitments.

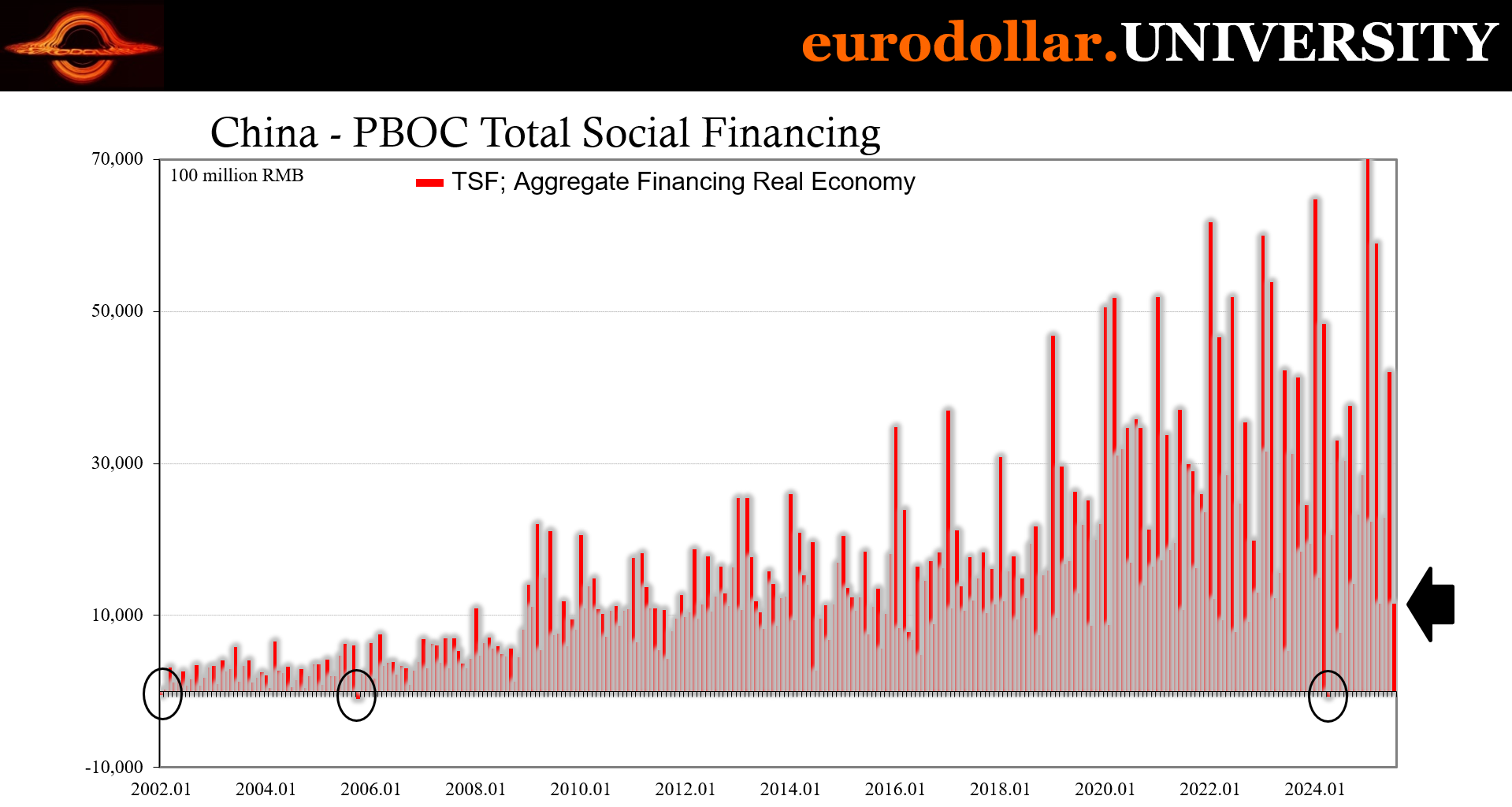

There is also a disconnection between sluggish bank lending and the faster growth in total social financing. Broader credit aggregates have been flattered by base effects and one-off debt resolution measures, on top of government bond issues, but these are unlikely to drive genuine, sustained expansion in private sector credit. And even so, for TSF, the January–July 2025 period is well below the growth trend comparable to the same period in previous years, which once again underlines the downward trend in lending.

In essence, the July contraction is yet another warning sign: credit transmission into the real economy is weakening even more than it had been, and without a turnaround in property and corporate sentiment, China risks slipping beyond its current managed decline.