Daily Briefing 8/12/25

Consumer Price Index (BLS)

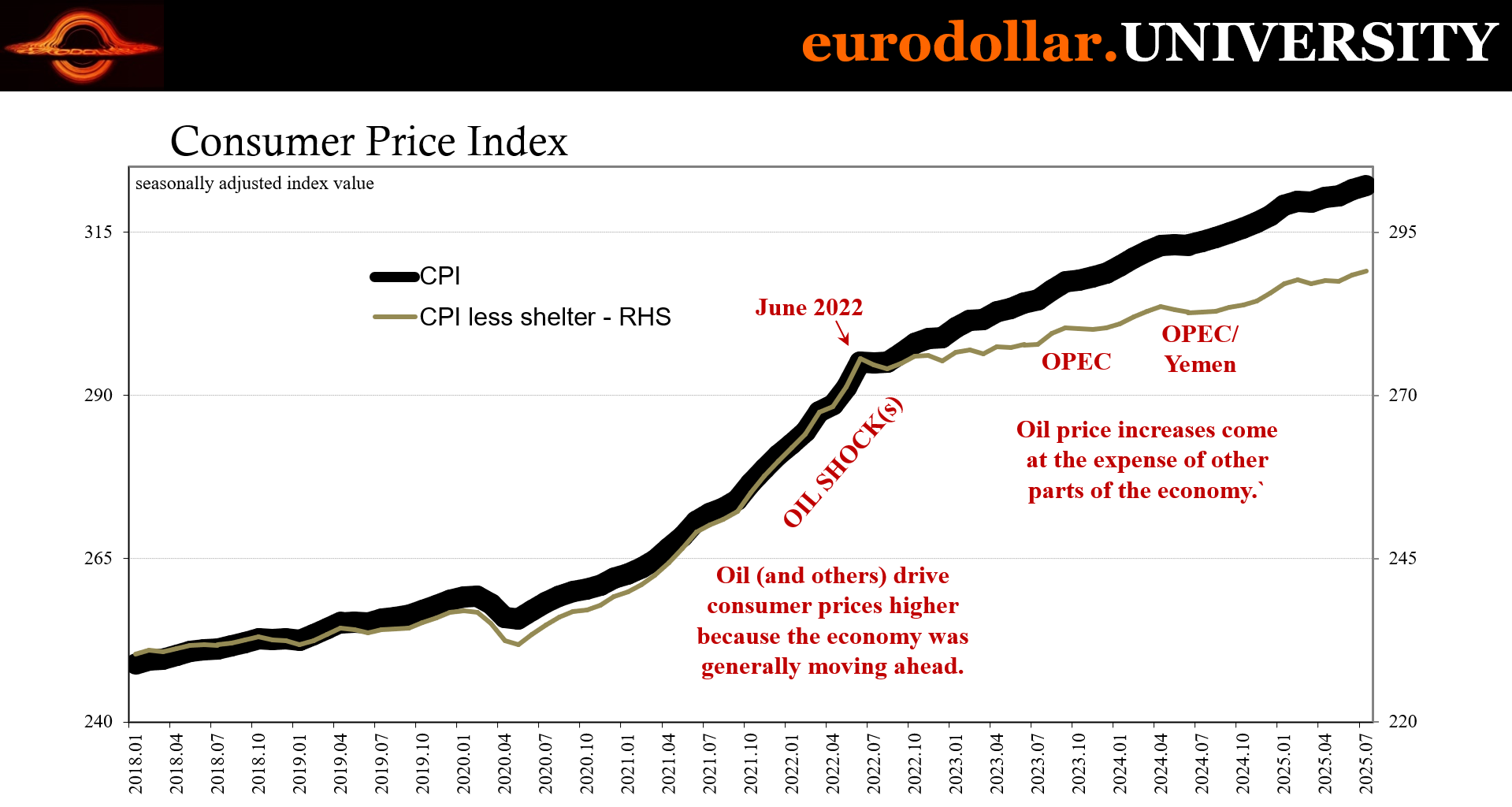

The US CPI increased by 0.2% in July 2025, down from 0.3% in June. Over the past 12 months, overall inflation remained steady at 2.7%, slightly below expectations of 2.8%. Shelter costs rose 0.2%, driving much of the monthly increase, while energy prices fell 1.1%, led by a 2.2% drop in gasoline prices. Core inflation, excluding food and energy, accelerated to 3.1% annually, the highest in five months, supported by rising prices in medical care, airline fares, recreation, and used cars and trucks. Food prices were flat monthly but rose 2.9% yearly.

Interpretation

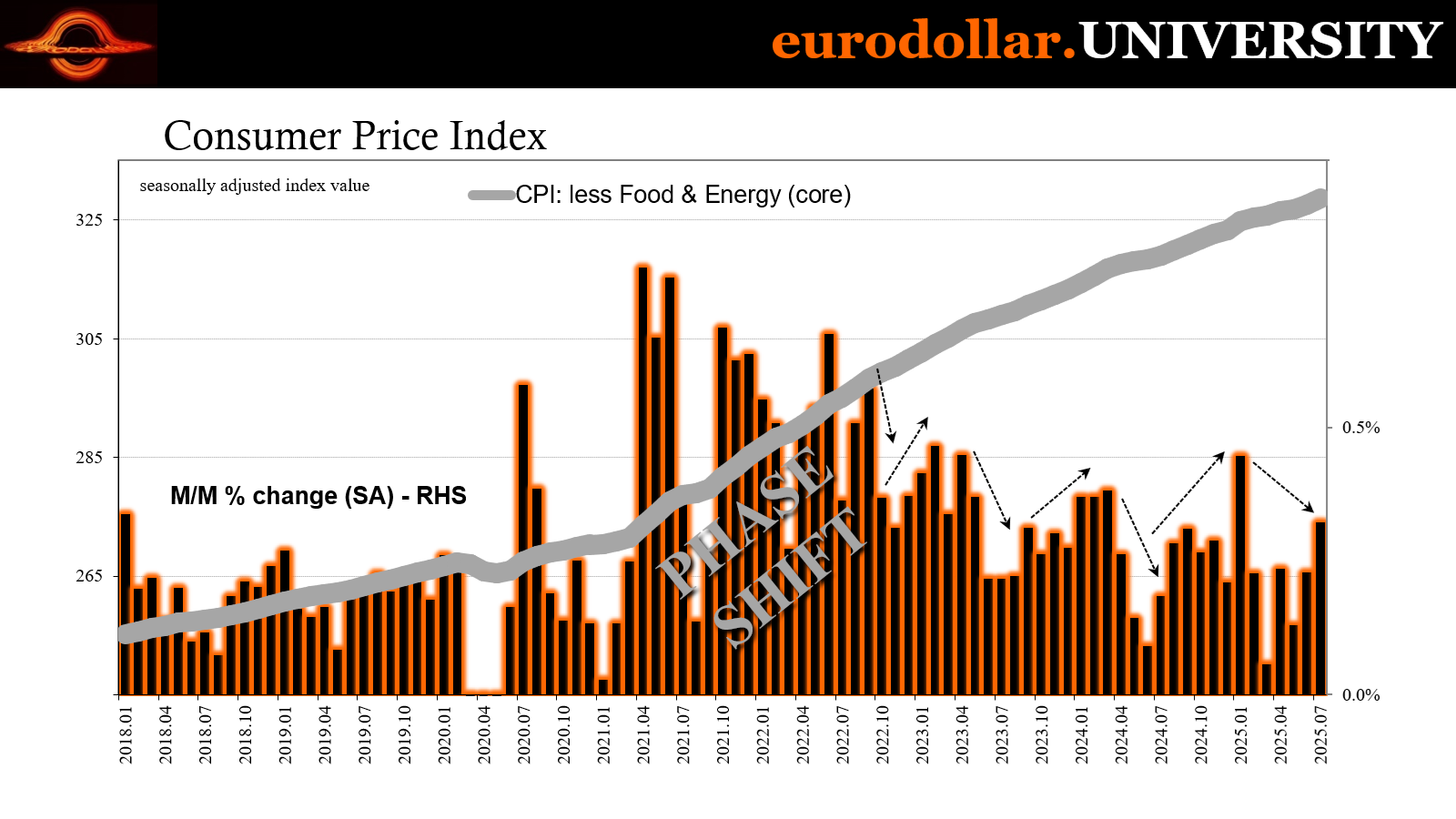

July’s inflation reading, while showing a slight monthly increase, is still consistent with an economy where underlying demand remains subdued leaving policymakers with the “tariff inflation” they’ve been focused on. The headline CPI’s 0.2% rise is largely the result of category-specific movements, (fake) shelter costs creeping higher, used car prices rebounding, and seasonal adjustments in certain services, rather than the sign of a broad-based acceleration in price growth.

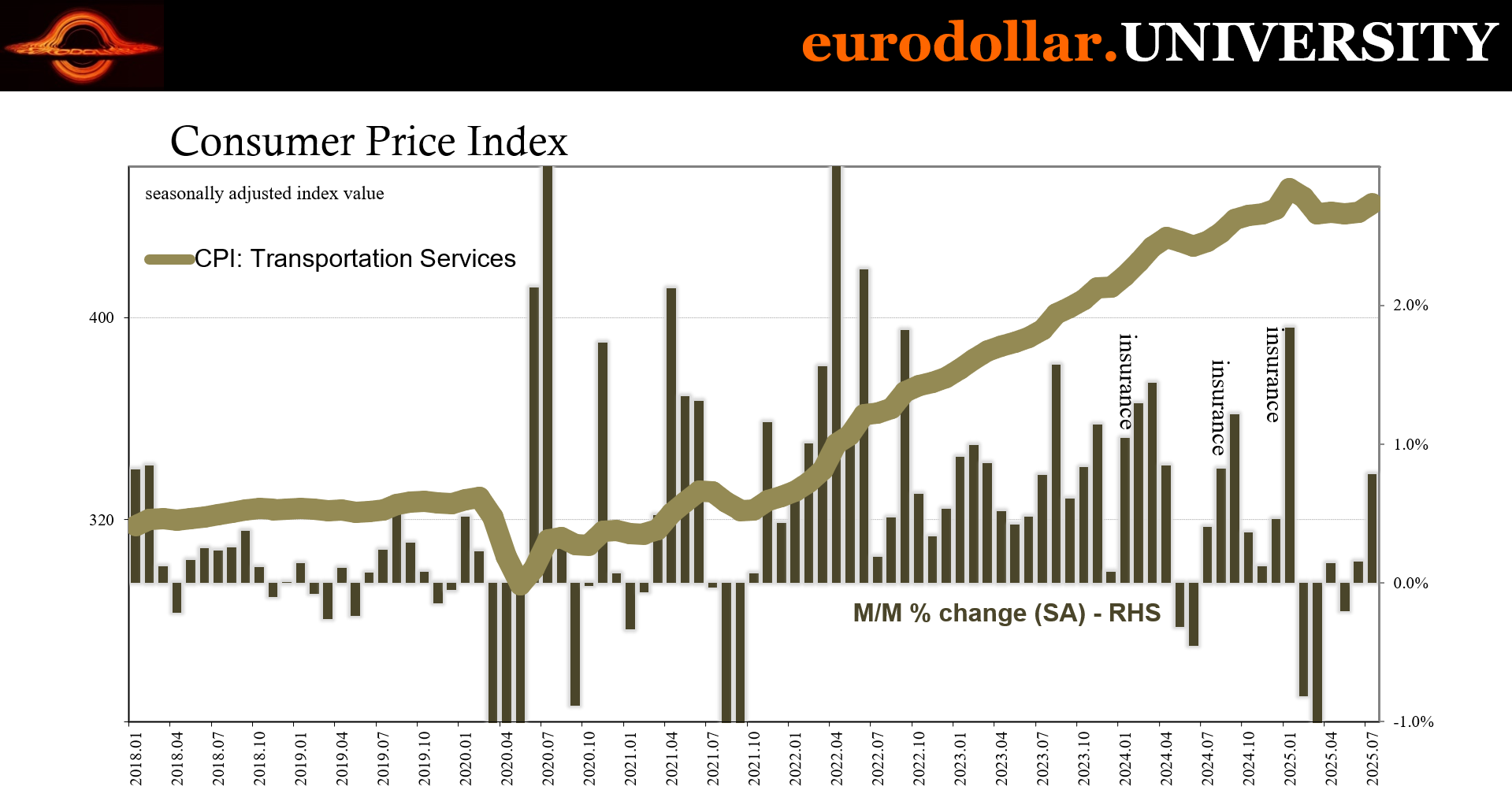

A closer look reveals that energy prices continue to exert downward pressure, with gasoline costs down sharply and annual energy changes remaining negative. In more detail, the downward energy trend, led by a 2.2% drop in gasoline, might appear as a relief, but it shows once again how subdued the energy consumption remains, this year-over-year decline in gasoline pointing out to a retreat in transportation and to some extent in industrial activity.

In that vein, food inflation is steady but unremarkable, with grocery prices slightly declining over the month. Much of the upside pressure came from core categories such as used cars, which is up by 4.8% month-over-month. But these are movements that are often short-lived and prone to reversal as supply conditions stabilize, not signs of tariff-driven inflation as one could speculate.

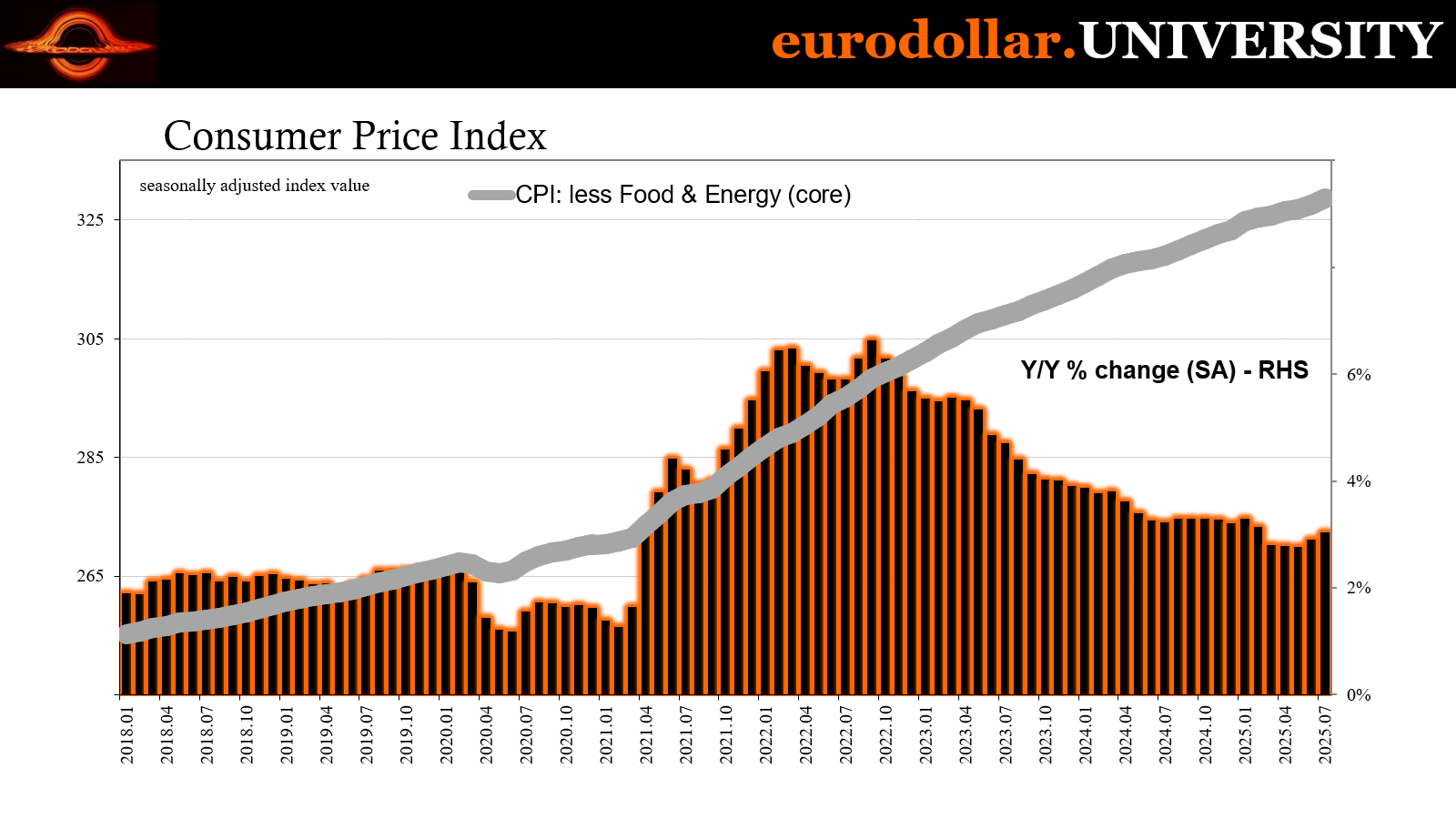

As such, the broader backdrop points to limited demand-driven pressure. For instance, not long ago the Fed reported the second straight monthly decline in revolving consumer credit, a cyclical signal as credit card use is often correlated with labor market metrics. And we know what disaster payrolls showed. That is why, even the 3.1% core inflation rate (its highest in five months) looks less threatening when viewed in the context of weak credit card usage and a slowing labor market, both of which suggest that households and businesses are not in a position to push prices persistently higher.

The steadiness in annual headline inflation at 2.7% is therefore less a sign of entrenched price stickiness and more a reflection of these transitory drivers. Seasonal patterns in travel, temporary supply disruptions in certain goods markets, and service-sector adjustments linked to summer demand have temporarily nudged prices up, but these forces are unlikely to carry through into the autumn without a meaningful pickup in lending and consumption.

In short, July’s CPI report again falls well short of “tariff inflation”, the sixth straight to do so. Instead, it fits the picture of an economy still held in check by weak credit dynamics and cautious consumer behavior, with occasional category-specific price spikes masking the underlying softness in demand.