EVEN SHELTER SHAKES OFF THE FAKE

EDU DDA Jul. 15, 2025

Summary: That makes five in a row. Five months after tariffs were applied to the USA’s largest trading partners, evidence for any possible “inflationary” impacts remains thin. The fact it isn’t completely absent, however, has become the latest basis for the new tariff-inflation expectation coming later this summer. Meanwhile, what was actually in the CPI related more closely to real economic conditions came to show the opposite. Believe it or not, the latter now includes the shelter index for the first time since early 2021! Just as we predicted, even that significant shift won’t matter to the wafflers.

We are now deep in the waffle portion of the tariff process. Today’s release of the June CPI data proved for the fifth month running there has only been an absence of broad price pressures. The core rate, in particular, came in below expectations, rising only 0.23% for the month rather than the 0.30% anticipated.

And that was with another fake contribution from OER imputations, which were muted by real economy weakness in discretionary spending at hotels, among other activities. In fact, the shelter index increased by the smallest monthly rate in more than four years, finally breaking down at long last even though its fake part refuses to do the same.

The drop in lodging costs goes along with the softness in airline fare pricing. Even auto prices fell, where the BLS said those for both new and used cars declined yet again. The former is a critical indication given how much – and how directly – tariffs were supposed to have impacted the auto trade.

Yet, there were a few categories which did pick up on tariff-price pass-throughs, notably appliances and furniture. Despite the distinct lack of any broader acceleration, the hawkish faction among the financial media (meaning practically all of it) latched onto those few as evidence “inflation” is indeed building.

These price changes in the narrowest of categories will feed the waffles since they can, as I warned, use it as the thinnest evidence for the possibility that perhaps there could sort of be some kind of inflationary breakout psychology owing to curtains and the occasional new stove. Like the breakfast food, interest rate waffles lack substance.

This was all very much expected. As was just how much weakness in prices and more confirmation the consumer economy has changed is being overlooked to keep the idea of tariff-inflation alive for a little while longer.

The fakery means well

The CPI has been constantly plagued by its own incomplete construction. For very legitimate reasons, the BLS long ago added what’s called Owners’ Equivalent Rent to the index as a means to include housing prices into the overall consumer economic experience. As the BLS will tell you (and does), buying or improving a house is making or adding to an investment not consuming shelter.

To separate what is consumed from the investment, the government’s price keepers ask a sample of homeowners this simple, straightforward question.

If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?

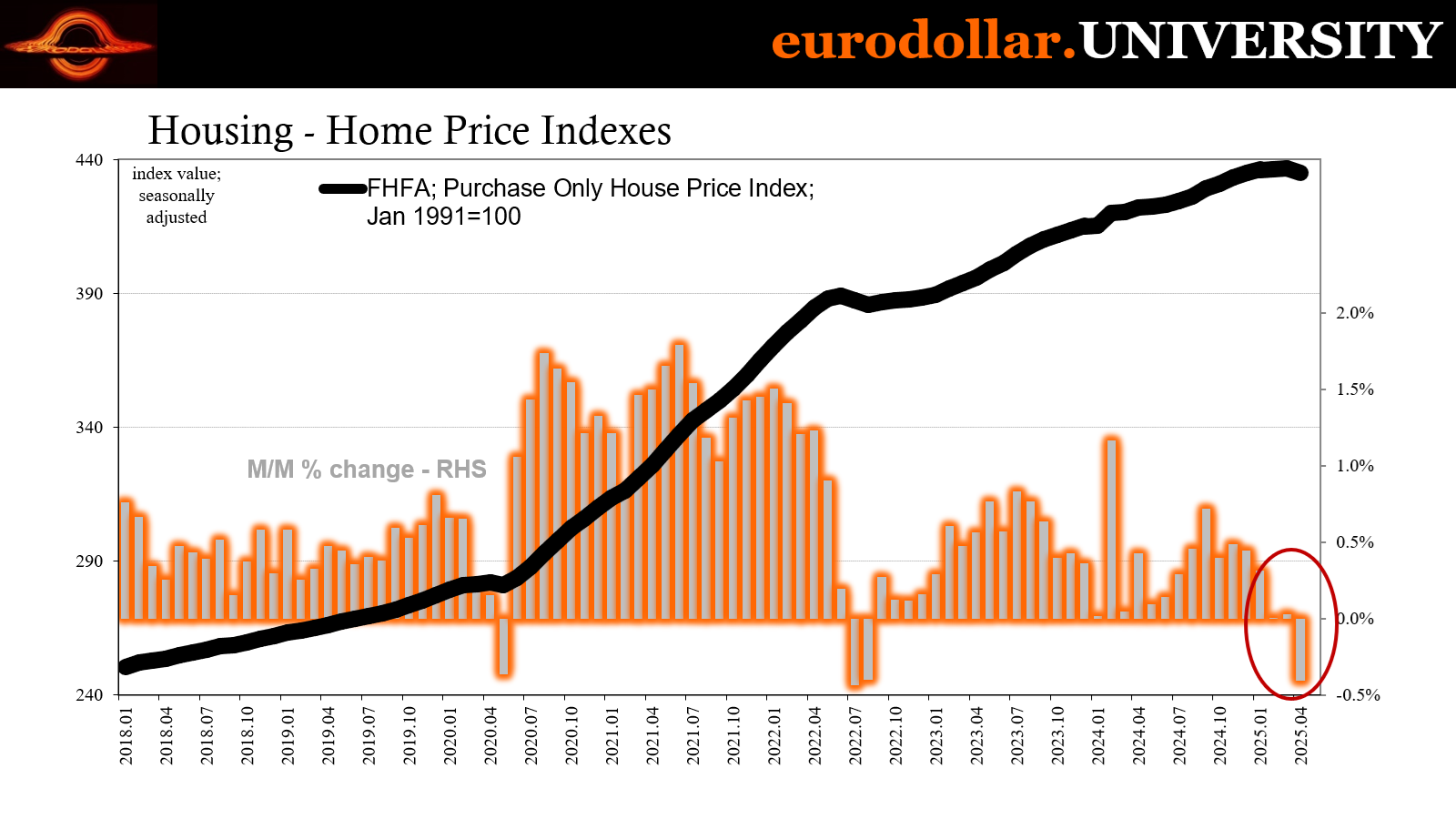

Since this isn’t based on recorded or any real transactions, individual perceptions and biases understandably influence anyone’s answer to this question. This is why OER tends to correlate strongly enough with home prices – with a lag. People tend think about how much rent their home might fetch in terms of how much it is worth.

Perceptions of real estate prices are sticky, though. Should values go up on the market, it wouldn’t immediately translate into rent perceptions until owners become normalized thereby relatively confident in those new and higher (or lower) values. As a result, many studies show how housing values influence OER in the CPI (or other consumption price measures) with around a year to 18-month lag.

One example from the Dallas Fed found:

This calculation reveals that current house price growth is most strongly correlated with rent inflation 18 months later, with the correlation coefficient reaching 0.74 at its peak.

Likewise, current house price growth is most strongly correlated with OER inflation 16 months later, with a maximum correlation coefficient of 0.75 (Chart 3, right panel). Our analysis focuses on the inflation rates measured in the PCE data; CPI data generate similar results.

From a very basic level, OER is essentially describing broad shelter prices derived from economic circumstances which existed as long as two years ago. That’s why I (and many others) consider it misleading to the point of being fake. Conditions can really change on the ground over a two-year period.

The big problem here is that since housing costs in the real economy make up a large portion of consumer expenses, and given how many more consumers own homes than rent, OER takes up a large portion of the shelter index which itself accounts for roughly a third of the entire CPI bucket. That means the fakery of OER fills up about a quarter of the whole price index.

Finally shelter from shelter

In the case of the 2020s, the early years of the decade were visited by a sizable housing bubble, one that’s still being worked down just like the general economy’s aftermath from the same supply shock (aka, forgot how to grow). The US CPI has been kept up on unhealthy dose of those past real estate price changes, maintaining the overall index far more elevated than any current consumer is experiencing.

This is also why we’ve been looking for shelter prices to eventually slow, catching up to the downshift in the housing market which materialized around 18 months to two years ago. The first real dip in prices registered in early 2023, before they then accelerated again, if at a far slower rate than the bubble conditions the year prior.

For OER, then, we had expected a significant deceleration later in 2024 and throughout 2025. There has been one, rather two, though more modest than those expectations perhaps owing to that reacceleration in real estate into the rest of 2023. There is no precision here, so we’re really only talking about rough outlines for both home prices and then the even more vague translation of them into the CPI format.

That’s just what the data shows, steps down in the monthly OER changes: the first in the second half of 2023, then another in the middle of last year. There will likely be a further step at some point this year. However, that didn’t happen in June; OER remained at a 0.30% monthly rate and still high compared to what any reasonable observer would say about the current shape of real estate pricing (verging on bust conditions).

Yet, even as OER was steadily rising in the same range, the overall shelter index finally diverged to a significant degree. Even with its pretend parts, total shelter prices slid to a 0.18% monthly change, the lowest for the whole index going all the way back to February 2021! What slowed it down was instead its constituent items that really are from the real economy, in this case a large drop in hotel and lodging prices.

In other words, the consumer pullback in discretionary spending was sizable enough to knock something noticeable off the otherwise fake-influenced shelter subindex. That’s how difficult the consumer experience has become.

Even at a more-than-four-year-low, it was still the biggest positive influence on the whole CPI. Had OER experienced its next step-down here in June rather than at whatever unknown future month, the headline would’ve been closer to 0.20% while the core rate likely would’ve pushed down around 0.15% for the month.

Yet, it wouldn’t have made a waffle of a difference. The wafflers are all focused squarely on the few parts of the CPI that did sport a tariff imprint. Appliances costs rose 1.9% (seasonally adjusted) on the month, following two straight months (April and May) each at 0.8%. That helped accelerate the category for household furnishings to a 1.0% m/m rate after it had risen 0.2% and 0.3% in the prior two months.

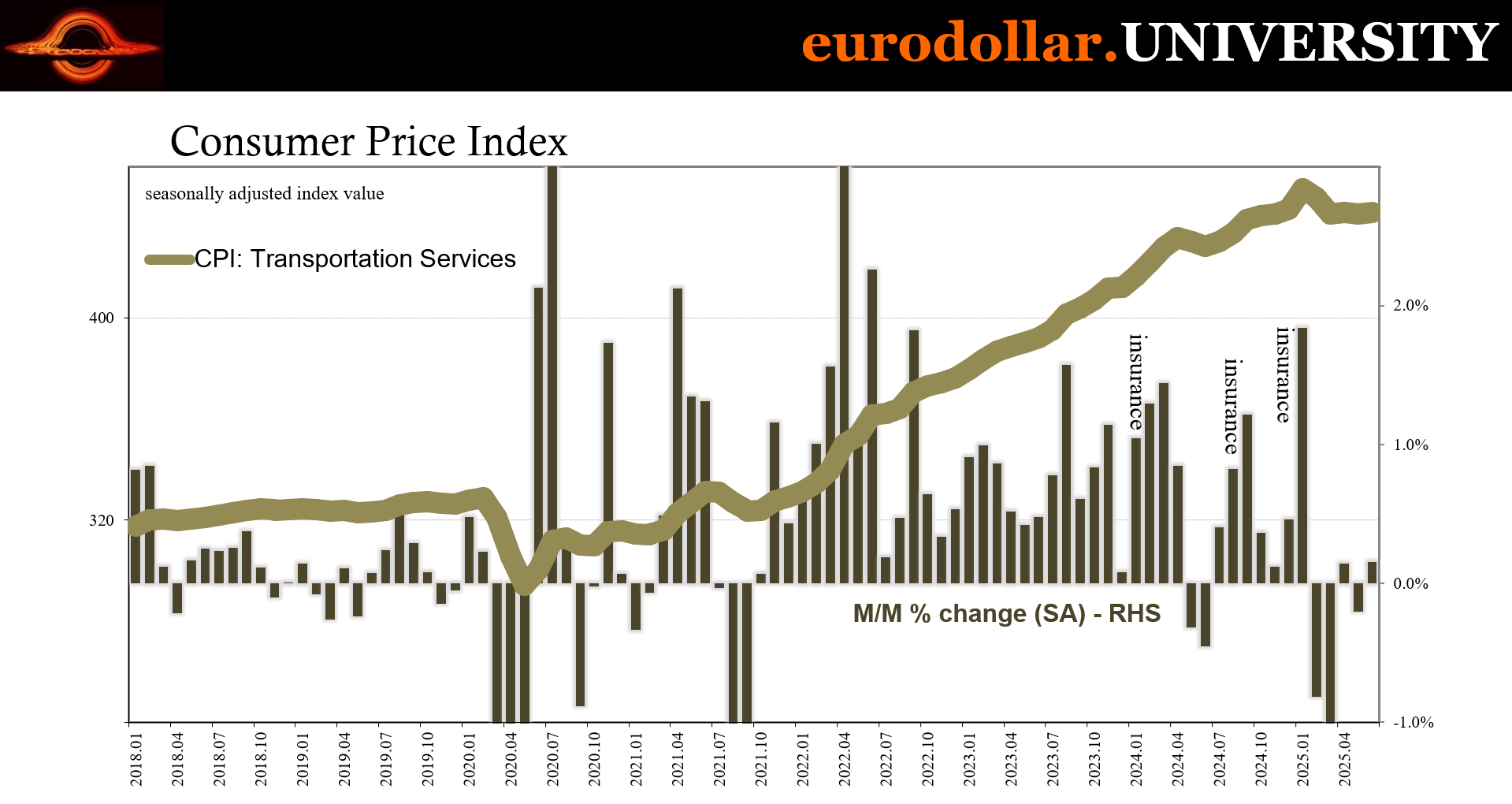

While clearly accelerating, the relative importance (weighting) of the entire subindex is just 3.36% compared to 4.34% for new cars or 6.30% for transportation services. Even hotels and other stays (lodging away from home), which fell by a sharp 2.9% rate in June alone, are weighted at 1.42%.

The waffled media are definitely cherry-picking parts of the CPI which fit the idea of tariff-inflation while overlooking or dismissing, often intentionally, the far broader and more entrenched weakness across consumer pricing; most of all the lowest shelter rate since the supply shock began.

And these other weaker categories are driven by actual economics, a very real, visible deterioration already taking place unlike the “inflation” from tariffs which remains entirely theoretical even after the few loud categories recorded an uptick.

Real economics (small “e”)

The car business was Ground Zero for tariffs; at least, it was supposed to be. The idea of blanket trade duties being applied to imported vehicles sent consumers (and a fair number of businesses) scrambling first to the credit union for a loan and then straight to dealer lots. There was a sizable rush of buying back in March as everyone everywhere declared the price of cars as the future primary example of tariff inflation.

Not only has it failed to materialize, according to the BLS numbers new car prices are accelerating lower. In the latest month, the new vehicle index dropped another 0.34% after falling by 0.29% in May. Those two make it three declines in a row (April -0.01%) since trade wars ramped up.

Rather than indicating or even implying something like inflation, the data are strong evidence for payback more than anything. The front-loading of demand based on unfounded price fears created an air pocket which has left new car dealers having to discount vehicles every Economist and central banker (and media commentator) was near-certain would undergo dramatic price hikes.

Instead of applying so much emphasis on appliances, there should be far more consideration for why car costs aren’t exploding, even before getting to the larger allocation for vehicles within the CPI. The economics of the consumer economy have changed for the worse, meaning however much costs are rising – and they are – among producers and through parts of the supply chain, they’re all left with little to no pricing power.

Another category related to lodging is air fares, more discretionary spending on services. Like the former, travel services prices have been ugly recently. Fares in the BLS index dropped by 2.8% and 2.7% monthly in April and May, respectively. They rebounded by “only” falling another 0.1% in June.

As a result, transportation services costs, with their 6.30% relative importance, managed a slim bounce of only 0.2% last month following what had been a -0.2% rate in May (the decline in air fares and others were balanced by a small increase in motor vehicle repair prices and a slight gain in motor vehicle insurance).

There is far more weakness related to conditions in the consumer economy spilled out across the majority of the CPI bucket than there is for tariffs being passed-on to them. And even where that is indicated, given what we find more generally for consumer prices here for June, higher costs that do make it will only make the situation worse, starting with discretionary intentions.

Every additional dollar it will take to buy a new dishwasher or clothes dryer will have to come from vacation plans or a possible down payment on a new vehicle, therefore putting both off indefinitely. This isn’t some mystery, either, as I’ve covered the shift in jobs and especially incomes right in this same calendar window (even revolving consumer credit as a reflection of consumer perceptions of jobs and incomes).

Falling incomes mean it will be very difficult for the overall economy to absorb higher prices and businesses absolutely know it. This explains why five months into tariffs, there isn’t clear “inflation” from them as had been predicted. Even the media, or small parts of it, can see this:

Part of the reason why some companies see price hikes as a last resort is that they fear consumers, who have grown more pessimistic on the economy this year, will only tolerate so much and eventually spend less — which economists will be looking for in a report Thursday on retail sales.

See, economics is actually pretty easy. It’s Economics that confuses everyone, starting with those practicing it.

This ain’t ‘21

At the more extreme ends of tariff-inflation are those who are seeing a repeat supply shock on par with the big one from four years ago. That group is headlined by Jamie Dimon, as discussed last week. Whether or not JP Morgan’s public face really believes any of it is a matter for debate. Banks, including that one, are not buying inflation even if bond yields globally are moving higher.

It’s the waffles which are moving LT rates upward as the latest short run fluctuation. We see it happening everywhere, too, from Germany to Canada, with Treasuries along for the same ride. ST rates have been relatively steadier consistent with the slow yet persistent bull steepening. It might not seem like that’s been happening but the charts show it’s still there even if, like the overall economy, the downturn has been unusually slow and remarkably incremental.

THE BULL STEEPENING IF MUCH CLEARER FROM THE PERSPECTIVE OF ST MATURITIES, AS IS TYPICAL

Everything about this “cycle” since 2022 has been. The snail’s pace owes to the nature of these conditions, the unique circumstance of the bubble period, the supply shock, then the slow strangulation of impoverishment as the combination of lost purchasing power and lack of income opportunities have finally, recently conspired to trip up the American consumer in a bigger way.

But with central bankers pushing bad “inflation” theory based on nothing more than an unproven mathematical property of equally dubious needs of econometrics, market participants have to take said theory as part of their investment analysis rather than ignore it like any rational observe would immediately do. That’s the problem of attempting to gauge and gameplan for bureaucratically determined interference in the realm of interest rates.

Everyone knows today’s CPI will fuel the waffling rather than have it put out to pasture as the evidence demands. If after five months of tariffs being applied to the country’s largest trading partners any remaining fears over wider price effects depend entirely on parsing very fine CPI details to find some small grain of evidence for them, all the while conspicuously overlooking all the rest which explains why there hasn’t been more obvious tariff-inflation over these long five months, this is something other than analysis.

The notion of a resurgent supply shock in 2025 is already shaky to begin with. We’ve experienced several far more noticeable and difficult subsequent supply shocks after the main one in 2021-22, and in a far more vital area of the economy, too. Oil prices surged in 2023 and again in 2024. Despite the visible increase in CPI rates because of them, the effect was only ever temporary for prices (the overall economy was a different story).

Even the Big One in 2022 failed to produce inflation; the “inflation” which came with it instead ended the limited recovery and triggered the shift to forgot how to grow in the first place. None of the oil shocks produced lasting inflation.

There is zero economic reason to believe that somehow tariffs will lead to a different inflationary outcome. In fact, the only motive anyone can put forward is expectations theory; even the Phillips Curve “tight labor market” has been cast aside by the horribly weak labor conditions here in 2025.

Yet, waffling will persist anyway. If the thorough debunking of oil-inflation didn’t kill the idea, nothing will if only because it’s not science.

Given how little there is for tariff-inflation now after five months, you might begin to suspect, as I already do, it has become more wishful thinking than any legitimate question. What I mean is, Economics is desperate for a “win”, for something to go the way its adherents say. And for Fed Chair Powell specifically, the desire is far greater.

They said tariffs would be inflationary. Made a huge stink out of it, too. Powell himself said a couple weeks ago the Fed would be cutting rates right now if not for these trade wars. After making that bed, these people desperately want to lie in it.

So, they are overhyping the thinnest of evidence in order to keep alive the dream of “inflation.” Not for the sake of the economy, for the sake of the ideology. Only a corrupt dogma would continue to overlook the mountain of evidence which keeps showing deteriorating conditions - and the June CPI is definitely included in that category – in favor of waffling that is based on something that hasn’t happened yet, that would have to be far worse than the last three massive oil price spikes, that ultimately rests on little more than model-determined psychology.

As frankly stupid as all that is, I told you we’d be here.