THE SHADOW OF LAWYERS AND EUROPEANS

EDU DDA Jan. 5, 2026

Summary: The lawyer sharks now circling Blue Owl ‘get it’, as in what’s really happening. European banks proved it in October and November by undertaking the largest shadow bailout of shadow banking yet seen. It was foreign officials using their reserve assets who first alerted this trend, and now it has been confirmed all over the place. Not only that, the confirmation shows it’s still escalating whether anyone mainstream-wise sees it or not.

AND YET THEY’RE GOING TO STICK WITH BANK RESERVES…

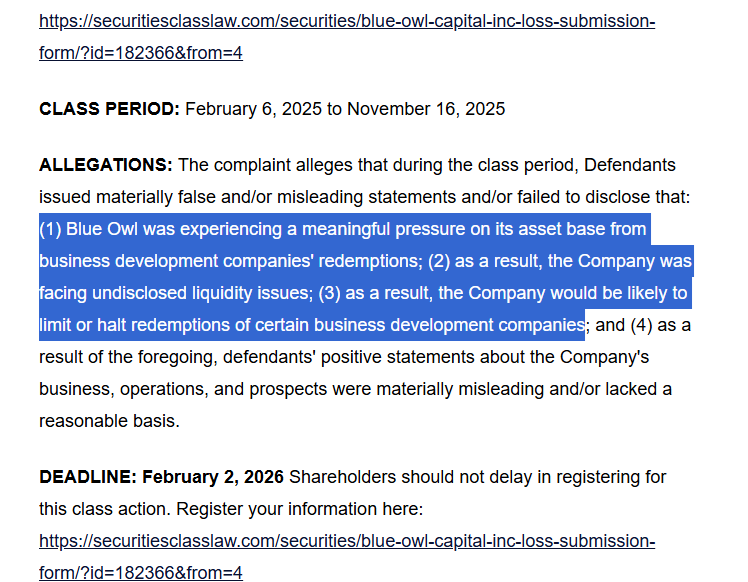

Unsurprisingly, Blue Owl is being sued by practically every class action lawyer with even a passing familiarity with securities law. That’s not really the important part, after all lawyers gonna lawyer. Instead, it’s what the alternative asset manager is being sued for. Not exactly a surprise around these parts, still it does offer more confirmation of credit cycle deterioration on the liquidity side.

Even more came from European banks. I swear, no one ever bothers to check the data or to look for useful information. Financial services has to be the laziest industry there is, apart from only perhaps financial media. The Europeans – what do they have to do with the Fed? – sat by and watched as their banks undertook the largest shadow bailout of shadow banks yet seen.

I’d write “yet witnessed” but, again, no one bothered to look into it. At the risk of being immodest, there are so many of these cases when it does seem like I’m the only doing any actual research. Meanwhile, the rest of everyone is talking endlessly about QT rather than what matters.

And that isn’t just Blue Owl’s legal problems. The main issue behind them has spread to others, including one of the biggest of the Big Ones: Blackrock. When the R-word comes for Larry Fink’s funds, it’s another one of those that lets you know it’s getting serious.

If that wasn’t enough, we’re going back to the one key eurodollar figure which sort of started it all. I don’t mean that in the respect this is where the monetary downturn began, rather this series was the first one which indicated something big was taking hold.

We’re awash in extremes yet hardly anyone sees or recognizes them because Jay Powell. The Fed is the most powerful narrative ever conceived, yet in anything that matters it doesn’t matter. Proof is everywhere from the Owl to its fellow BDCs and, right now, most of all what European banks were doing in at least October and November (we’ll see about December a month from now when the ECB releases those figures).

But bank reserves...

Set the stage

Cockroaches and garbage. Those are the two phrases uttered by two of the biggest names on Wall Street. As we discussed on one of EDU’s live member Q&A’s a little while ago, normally we’d take what Jamie Dimon or Jeffrey Gundlach says with an enormous JP-Morgan-balance-sheet-sized grain of salt. However, in the case of cockroaches and garbage lending there continues to pour out a massive amount of smoke surrounding the cycle.

For Blue Owl, the fear relates to too much garbage that didn’t catch enough of the cockroaches as it was onboarded. More than that, no one has any idea the exact status – information asymmetry. All investors have to go on is the tainted say-so of portfolio managers and fund execs, the same who have every incentive to outright lie (or at least color the truth enough) if only to avoid creating a stampede which might then trigger distressed selling and maybe even some devastating fire sales.

Those systemic dangers are heightened by a number of factors, including how “alternative lending” and private credit funds increasingly turned to what are called “evergreen” vehicles. Most hedge funds and similar private lending firms are traditionally funded by “long term” investors, those who put up sizable cash understanding they won’t be able to get it back anytime soon because they are gated to where redemptions are strictly controlled.

Blue Owl’s version which fell under scrutiny, and is now the subject of dozens of lawsuits, is one of those. And yet it is facing liquidity pressures anyway.

Evergreen funds, by contrast, are far more open to regular withdrawals from investors. These intend to move closer to how stock-type ETFs operate even though the biggest downside facing any lender – be it shadow bank or one of the traditional regulated type – is its susceptibility to a run owing to maturity transformation (funded by short-term money that is lent into longer-duration loans and securities) and the typical illiquidity that comes with credit assets.

In other words, what causes banks to fail is usually not loan losses themselves but getting stuck with illiquid loans of indetermined quality which when made public creates a backlash as investors/depositors overwhelm the firm with demands to get their money back. If there isn’t some way to control them, and without a dependable way to liquidize those assets (either selling them or using them as effective borrowing collateral), it’s lights out.

They have to be monetized, liquidated at any price.

WHAT COULD POSSIBLY GO WRONG? AT THAT TIME, JAY POWELL WAS STILL TALKING SOLID LABOR MARKET

Evergreen funds actually lean into that deficiency under the cover of the fatal conceit they’ll be able to adequately manage the risk. Having allegedly learned from past crises, fund managers have claimed there is no maturity mismatch they can’t handle, even if investors come calling for redemptions in bunches.

The industry has been mostly reliant on long-term investments, not potentially flighty shorter-term deposits, reducing systemic risk and the threat of bank-run scenarios. Open-ended funds are also forcing a rethink about issues such as liquidity and fee structures.

“There’s always a delicate balance between targeting higher returns and maintaining sufficient liquidity to honor redemption requests as they come,” said Khang Nguyen, chief credit officer at Heron Finance.

Note the timing – this article was published in early August right before the cockroaches started appearing. It details the growing popularity of evergreen vehicles of that kind – just before the wheels started to fall off the credit cycle. They never ring a bell at the top, but such high degree of hubris about liquidity risks sounds a lot like one tolling.

The more pressure on gated funds like Blue Owl or others, the more there are going to be cash withdrawals at these others forcing them to sell assets to a greater extent. In other words, once the selling really ramps up, the potential for distressed sales to spread is a lot higher than people might imagine.

And that’s even before considering systemic liquidity conditions surrounding shadow banking globally that no one appears to have any interest in finding out.

Now the owl

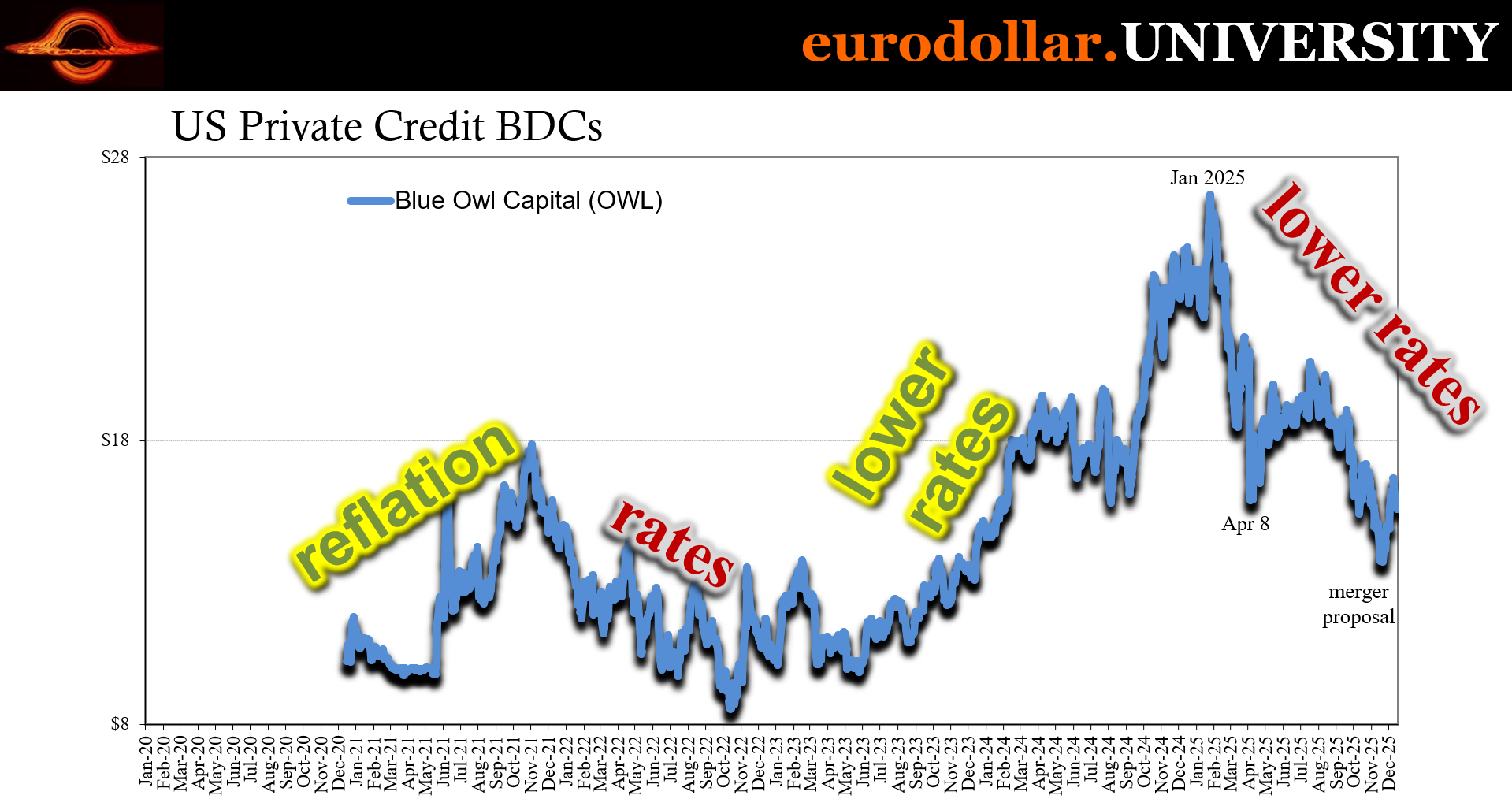

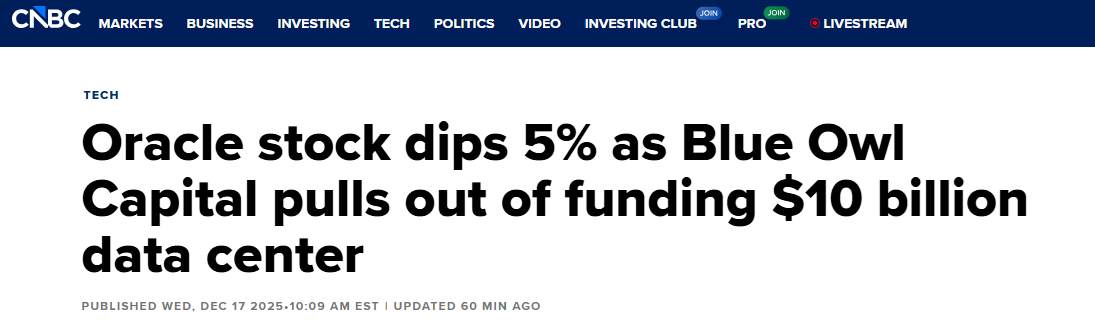

Recall where we left off with Blue Owl in November. In December, the manager was suddenly refusing to lend to Oracle in a blatant act of self-preservation, not wanting anything to do with its longtime partner now seen by the wider market as a black sheep. Already a black mark.

Prior to that, Blue Owl had tried to merge its not-publicly-traded private credit vehicle into its larger one that is. Management made the laughable claim it was seeking greater efficiency via the merger (since called off), attempting to create more investor value by eliminating duplicated research and management, tossing out superfluous parallel structures.

No one bought it. Instead, it was a blatant attempt to halt redemptions. The fund (or funds) was clearly getting whacked by angry investors who didn’t care what statements management put out or which canned reassurances they offered. The story of cockroaches was finding an audience.

That continues to be what is behind the cycle shift, understanding only too well how lazy Wall Street (and beyond) had become during the upswing. Jay Powell said everything was perfect and solid, so nobody bothered to check to see if it was so in the actual loans. Pure bubble behavior, everyone chased volume and deals therefore fees and profits - for credit providers, anyway.

Uncovering such widespread dereliction, of course hedge fund investors have been pulling what funds they can. The more Blue Owl and its peers claim there’s no reason to be alarmed, the louder they say their portfolios’ fundamentals are totally solid and unimpeachable, the more money providers know they’re full of it.

So do the lawyers. Over the past week, week and a half, the class action specialists have been aggressively mining for claimants. There are ads in basically every form of financial media, each one hoping to build the biggest possible plaintiff list to get a front row seat at the class action settlement.

What’s alleged is simple lying; Blue Owl’s ad hoc farce of a merger was hastily arranged to block shareholders from exercising their rights of withdrawals, meaning Blue Owl management outright lied about the scale of redemptions it was facing. As I stated, not exactly a surprise but confirmation of sorts from the legal side.

It wasn’t, or isn’t, solely the poor bitten owl, either. The R-word is simmering under the surface, a key reason and source for all the credit cycle smoke we’ve been uncovering and therefore covering:

Fundraising for non-traded vehicles for private credit has stayed steady over the past year. Blackstone’s non-traded fund BCRED raised $2.8 billion in net new equity in the third quarter, the most for such funds, followed by Blue Owl’s vehicle OCIC, which pulled in $1.9 billion, according to data from Moody’s Ratings.

But for some of the largest, investors have also upped their requests to pull cash out. Redemption requests into Blue Owl BDC, OBDC II, exceeded 5% of the fund’s net asset value in November. Blackstone Private Credit Fund expected its redemption requests in the fourth quarter to reach 4.5% of the vehicle’s NAV as of Sept. 30.

Those two paragraphs written just last week show what the next stage looks like. Right now, current shareholders have seen enough, or enough of them have, to create the initial wave of redemptions.

Those, however, are being balanced out to a degree by a new class of suckers investors who haven’t quite got the message about what’s truly going on in the shadow banker world. The latter are putting money in what increasingly looks like a kind of stripped-down ponzi scheme which, for now, has balanced inflows to outflows holding the distressed sales at bay.

Plus bank funds (see: below).

If or when the suckers new investors realize they are being set up to become the Greater Fool, the inflows dry up leaving fund managers no choice but to start the selling and angry shareholders queueing up seeking to get out, repo banks liquidating collateral they’ll be stuck holding.

And lawsuits. Piles of lawsuits.

Did it already happen?

While the financial media continues to connect the Fed’s balance sheet to ongoing (US$) repo market difficulties, the Europeans obliterated that ridiculous (given the last almost twenty years of QEs and the long irrelevant history of Fed bank reserves) narrative while simultaneously connecting it to cockroaches.

During October, European MFIs (monetary financial institutions, meaning regulated banks) lent a staggering €103.6 billion in additional funds to euro area financial corporations other than MFIs and ICPFs reported by MFIs excl. ESCB (essentially shadow banks, these same kinds of private credit and other non-bank investment funds). That was – by far – the most in any single month on record. But then it was followed up by a further €47.7 billion in November.

That created a two-month increase of €151.4 billion which was 50% more than any other two-month period, including February and March 2020!

While a few optimists might be tempted to claim this was European regulated MFIs feeling a sudden breeze of risk-taking owing to the ECB’s rate cuts and its president’s constant assurances Europe and the European system are in “a good place”, there is absolutely no reason to believe that, well, garbage. If anything, the constant drumbeat of “a good place” coming from European officials demonstrates the opposite, the same way Blue Owl keeps saying everything is awesome in its operations only proves what the lawyers are going to crucify it for.

We’ve already seen this from US banks in the TIC data, particularly back in March and April. They stood behind offshore (US$) shadow banks, lending hundreds of billions to them via resales (repo from the cash lender perspective) and on questionable collateral (not T-bills). The implication is that the banks have little choice or desire to find out what happens if they don’t put up the emergency funds.

The distressed sales, is what.

While that recurred in October (the latest from TIC), it appears to have really gripped the European shadows this time more than anywhere. And the timing could not be more obvious for what it truly represents. That was when the full scope and the details behind First Brands was coming to light, the same month when Dimon uncorked his cockroaches quip.

Are we really supposed to believe Europe’s banks suddenly lending historic amounts for shadow banks wasn’t related?

Of course it was.

The European bank data proves the widespread systemic trouble shadow banking felt in October and November (we’ll see about December), while also establishing – once and for all – this widespread systemic tightening has had nothing to do with the Fed and everything to do with growing worries about the credit cracks and risk aversion tied to the growing possibilities of a cyclical turnover.

Throw in US$ repo and fails, not to mention the initial warning about tightening, the escalation is basically hiding in plain sight.

Not just synchronized

Use of UST reserve assets previously held in custody by FRBNY was the first to signal serious strain. It began even before the cockroaches, too, months ahead of Dimon’s statement and weeks prior to Tricolor filing bankruptcy.

From the moment the BLS spit out its July payroll report, the one with huge downward revisions to prior months which had the effect of completely erasing Jay Powell’s solid labor market, it appears the eurodollar system began taking away liquidity from that point onward anticipating the downside implications for what flat Beveridge would mean credit-wise.

A negative payroll number (confirmed the following month) meant all that previously hidden garbage lending would no longer stay hidden. The potential losses and bad loans would pile up in such a way it was all going to get uncovered and put into the spotlight at some point. Eurodollar providers began pulling back straight away all the while the financial media stayed true to the false ideas behind QT and Jay Powell.

It was the sharp decline in Treasury holdings reported at FRBNY which first suggested this was really bad and having nothing to do with bank reserves. In those initial days even months, however, the series was an outlier pointing out the gravity of what was taking place in the shadows. Repo wouldn’t really come up until October.

Repo fails began to show up at the same time reserve holdings were disappearing, but nowhere near the same extent at first. They would match the damage until mid-December. Dealer holdings of securities did rise, too, and have reached a new record as of the end of last month, but once again it wasn’t as clear until later on in the year.

Then, of course, European banks.

In other words, the foreign use of UST reserves assets was the proverbial canary in the monetary coal mine. Four months after it first spotted the trouble, and made it clear it was big trouble, confirmation is showing up in more places and across several dimensions; not just repo or collateral, even US$s, also hedge fund investors and outflows.

It is highly likely that the surge in shadow bank borrowings from banks – both euros and dollars in the eurodollar world – was precipitated by those redemptions, offering the final balance to them along with the inflows put in by the suckers new investors which, for now, have managed to hold off distressed sales.

Banks and suckers before the fall.

The flatter Beveridge data we see, the more the macro loss of momentum is confirmed (ISM today the latest to do so), the greater the difficulty in keeping everything above water. The erosion hasn’t just begun, it has already progressed significantly in a lot of different ways.

That said, the usual caveats apply. Nothing is for sure until it happens. There might still be time and some way to turn the credit cycle around before the monetary angle gets degraded down too much and the credit problem spills over into fuller liquidity one.

However, given what we do know and can reasonably infer elsewhere, the chances for a way out have greatly diminished and keep going down with each new development or shining light on the shadows.

You don’t need perfect information on the state of each credit portfolio to get a decent sense. The more they all protest there’s nothing to see here, the more this is going to escalate because all the data confirms this thing isn’t some minor annoyance. The UST data from FRBNY made that clear from the get-go, the flat Beveridge starting point.

And now there’s confirmation from repo, fails, a massive European shadow bailout of shadow banks, hedge funds, and so on. Hell, even the lawyers get it.