VANKE, NPLs & PMIs

EDU DDA Dec. 1, 2025

Summary: More confirmation China’s economy is accelerating to the downside. The country’s official services PMI slid below fifty to its lowest since Zero-COVID while manufacturing just set a record for the amount of time spent consecutively in contraction. And that’s only the beginning, as more is coming out among critical property developers like China Vanke. Beijing may have also changed up its priorities where it comes to the bankrupt real estate giants, too. Also, an update where US$ repo stands starting December.

OVER A YEAR AND A HALF LATER, THE MATTER REMAINS UNRESOLVED AND WE KNOW WHY

Our main focus today has to be on China. The Chinese reported more confirmation for the significant downturn in the economy, led by services and consumers. That’s where the corroboration really turns, those internal sectors that increasingly point to either concerns over, or direct consequences from, a flat Beveridge environment.

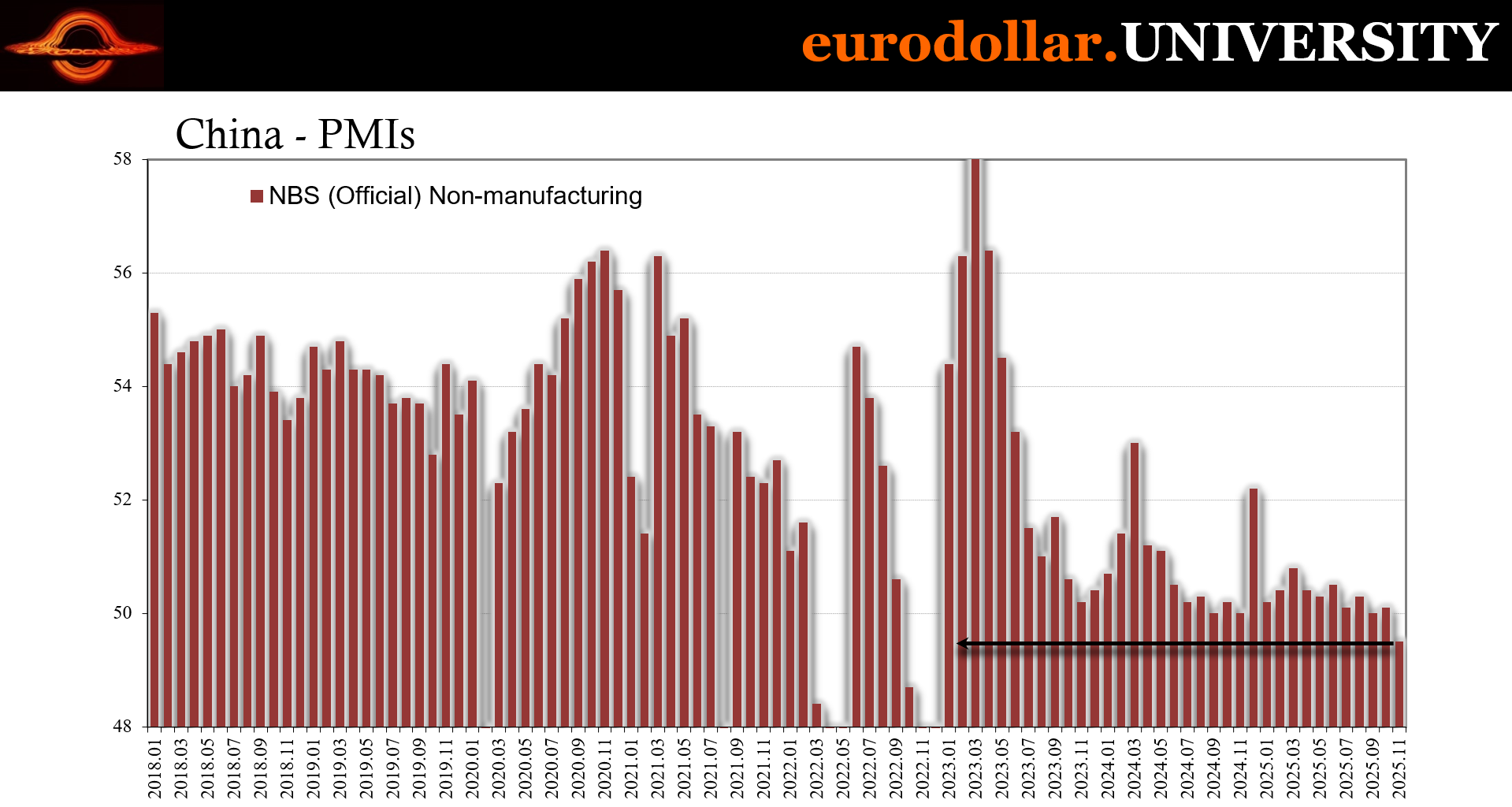

Beijing’s official manufacturing PMI was largely unchanged at 49.2, remaining among the lowest non-lockdown results in the series. Moreover, November represented the eighth consecutive monthly reading below fifty, a new dubious record especially considering all the “stimulus.”

More concerning is what came in over on the services side where the non-manufacturing PMI slid to 49.5, lowest since December 2022 (Zero-COVID). Having been suspiciously stuck just on the good side of fifty for most of the year, apparently that segment of the Chinese economy finally buckled joining retail sales and fixed asset investment in pointing to a summertime inflection.

There are also some related updates in various other dimensions, including China Vanke attempting to delay a key bond payment, reigniting more acute worries over the real estate sector in the process while also raising the prospect for a shift in the Chinese government’s priorities where it comes to the bust.

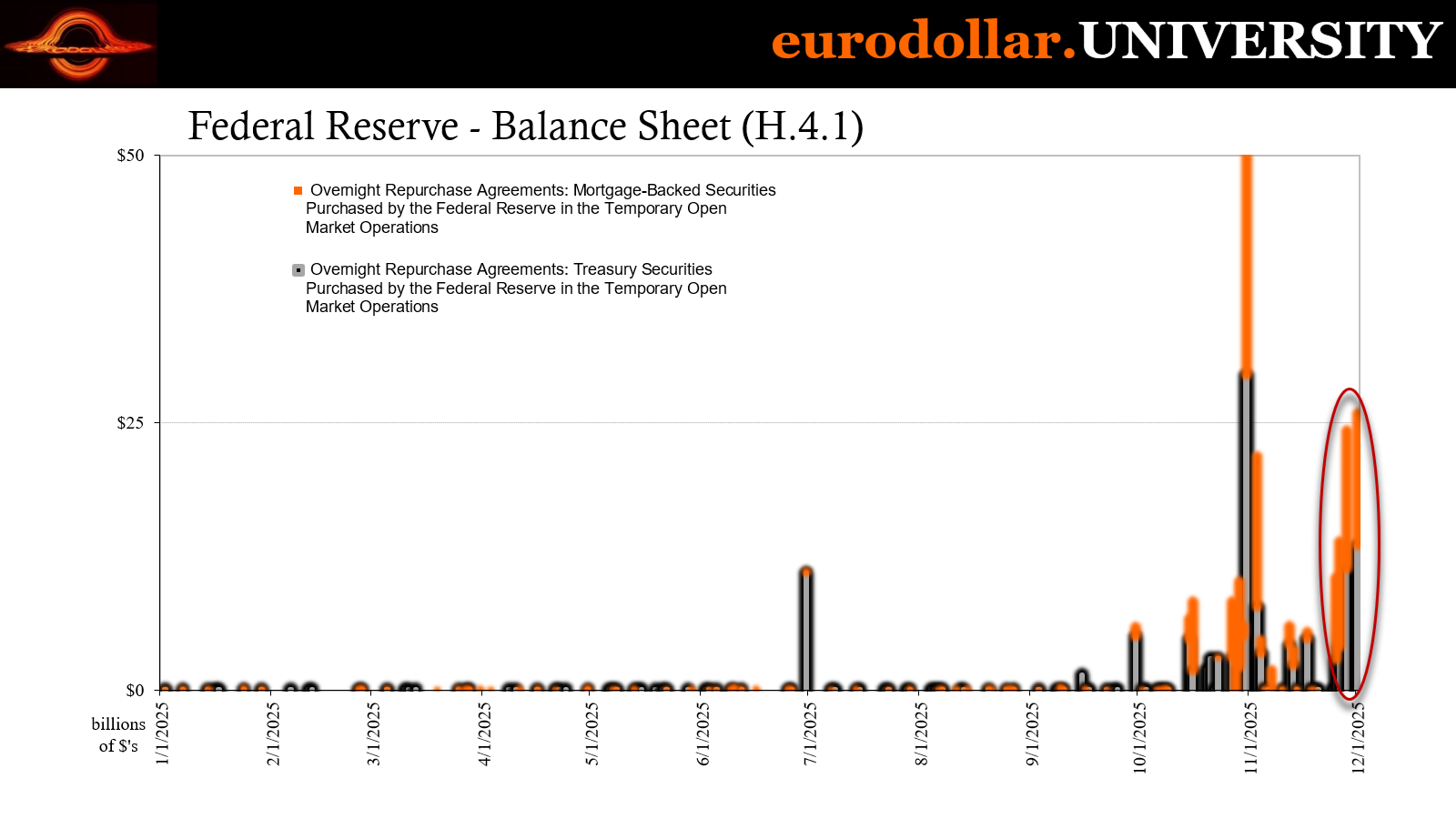

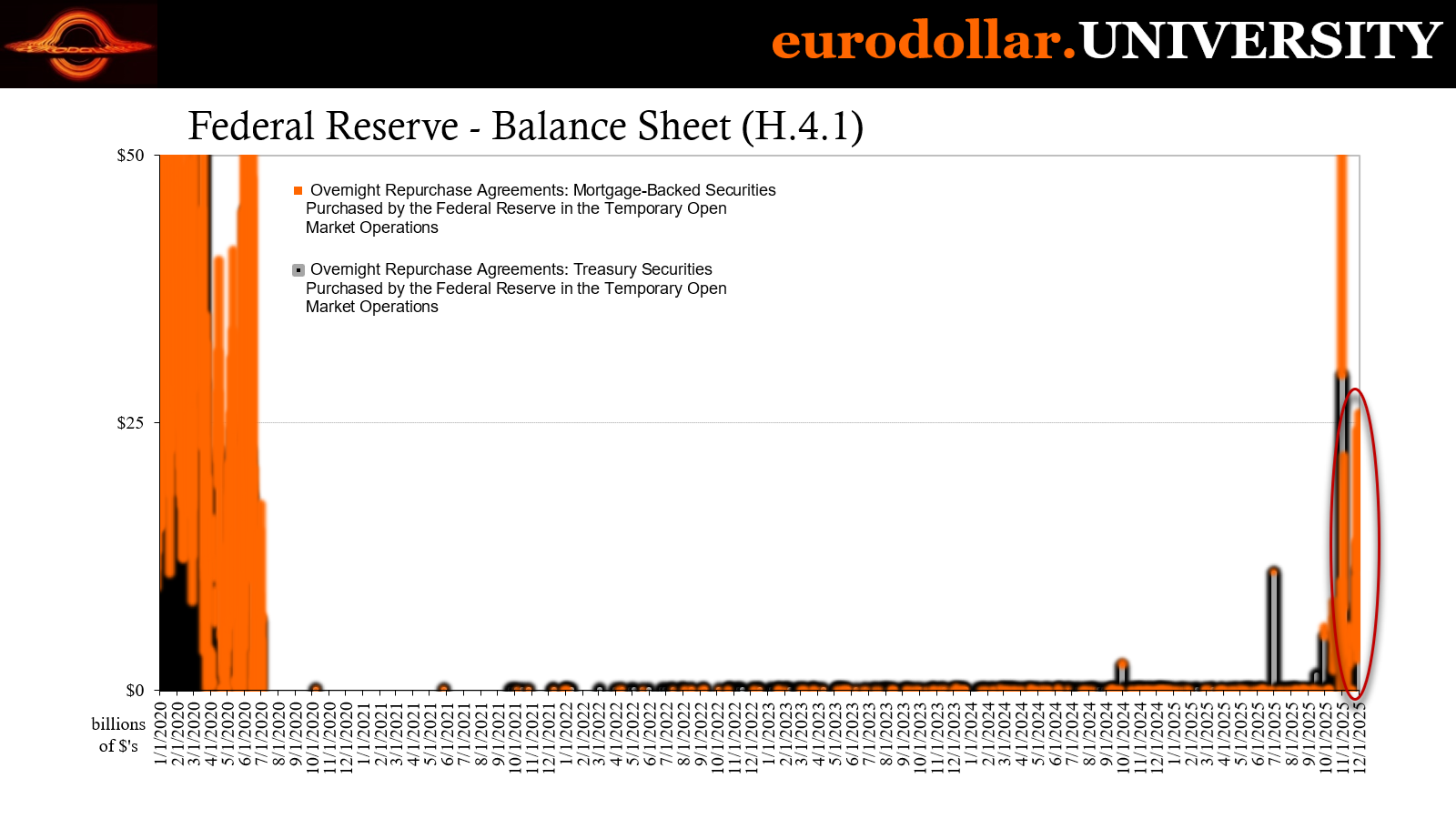

Before diving into the latest from the other side of the Pacific, a quick update on month-end/month-beginning for US$ repo, the onshore part of it.

Not as dramatic as October, though not far off

Today’s daily auctions from the Fed’s repo facility saw a pretty stout $26 billion in borrowings, up from $24.4 billion on Friday. The vast majority of the activity was in the morning which simply means borrowers are starting out the day in search of funds rather than, say, banks getting hit with unexpected cash outflows while being unable to cure them quickly through market repo.

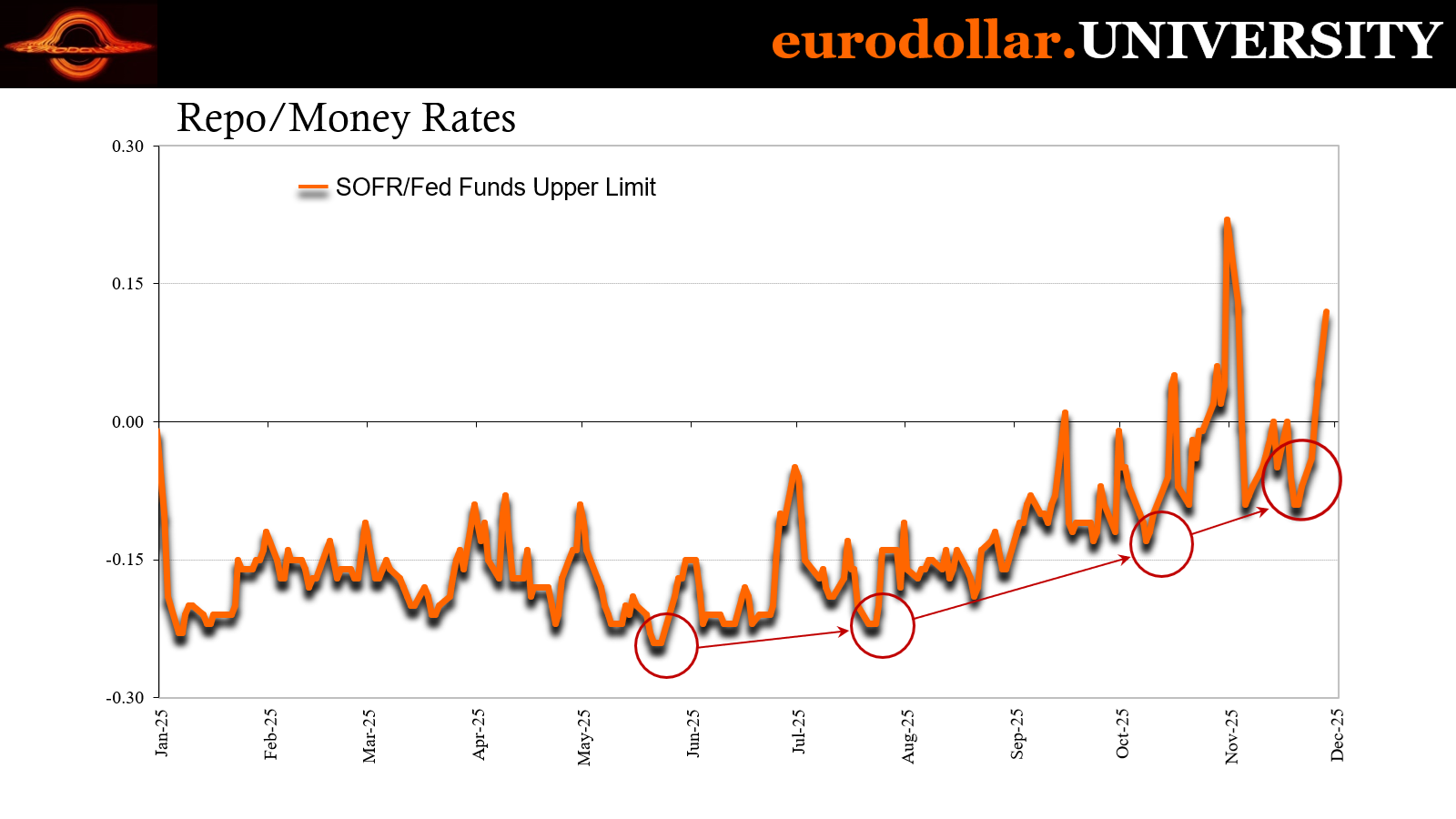

FRBNY’s benchmark SOFR jumped to 4.12% as of November 28, twelve basis points above the fed funds upper limit though ten basis points below the high from the end of October. There is still a chance the rate will end up slightly higher after today’s market action.

Either way, the repo market onshore remains tight and is repeating the pattern from 2019 with the slight wrinkle of tightening showing up a few days prior to month-end rather than straight from the start of each new month as had been the case six-plus years ago.

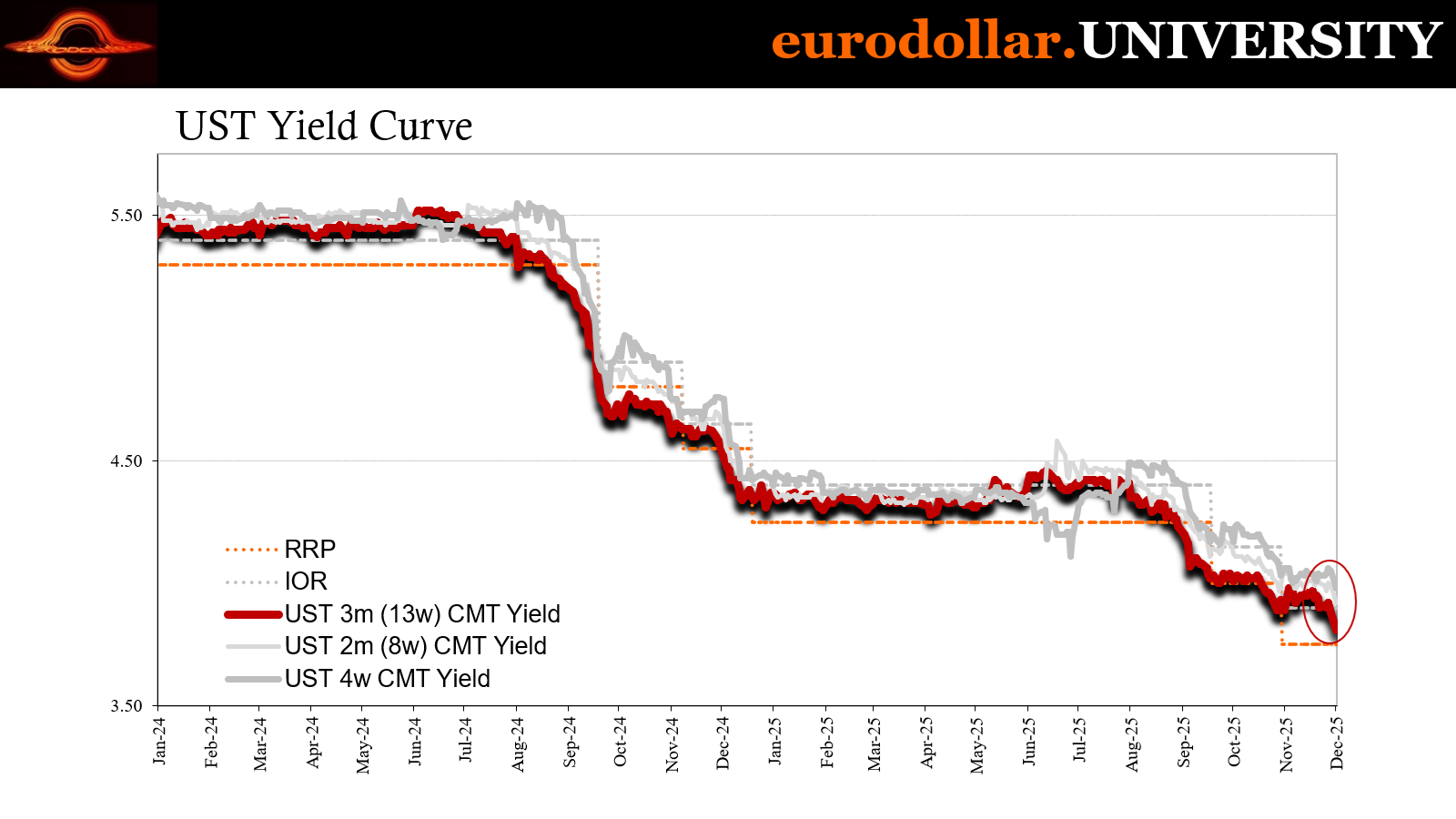

While repo rates are elevated, bill rates are moving the other way. The 3-month yield dropped down to just 3.81% having been around 4% up until last week. Like other markets, bills are beginning to price a December rate cut – we know it’s most likely the upcoming Fed meeting because the 4-week bill also saw buying which pushed its equivalent rate below that 4% line for the first time in several years.

This doesn’t mean the real money players of the bill market area figuring December FOMC doves for sure, however they do appear to be leaning more strongly in that way. November’s Beige Book might have something to do with it, meaning what was contained within its pages – and what wasn’t. The lack of tariff inflation discussion was quite telling, as was the explosion in references to “layoff” and “layoffs.”

Should the Fed ultimate go ahead with another 25-bps reduction, it seems unlikely there will be any adjustment to the balance sheet policy. In other words, with QT officially ending today, unless something big happens over the next two weeks the repo mess the market is currently putting up with doesn’t look messy enough for policymakers to consider both a rate cut and making an announcement to restart a QE (which won’t be called “easing”) at the same time.

For repo, officials are likely on hold for the time being, undoubtedly preferring to take their time to see whether the early termination of QT might be enough to calm money market volatility down.

With problems still plaguing crypto (risk assets more broadly), that suggests ongoing concerns throughout financial markets. Bitcoin’s latest deep selloff, which nearly set another new multi-month low today, suggests a risk-off mood prevails entering December which would apply to money and collateral circulation via wholesale markets like onshore repo (as well as the well-hidden offshore counterparts).

Summer hit

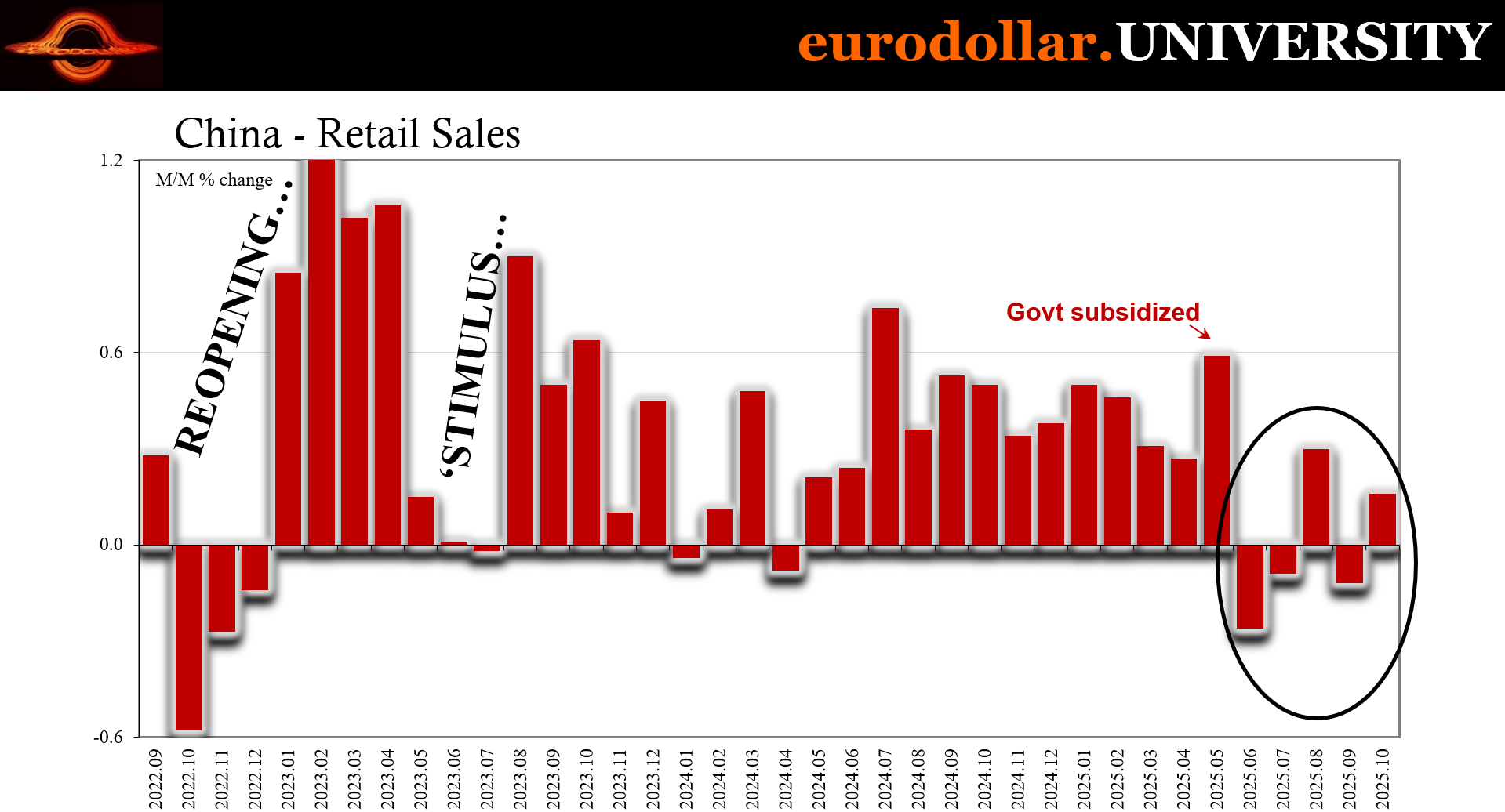

Fixed asset investment has crashed while Chinese retail sales dipped. Each one suggests that China’s economy stumbled significantly over the summer. As we’ve covered (repeatedly), the proximate cause appears to be the anti-involution campaign, meaning the CCP realized it can’t stimulate demand to cure its consumer price deflation.

The only other options are to do nothing and keep overproducing – which is a far bigger threat than most people imagine – or try to constrain supply enough to rebalance real economy prices while hopefully not so far as to trigger too flat of a Beveridge curve. After all, if authorities are going to be holding down supply, by necessity that means reducing employment.

Threading a very fine needle between enough to tackle deflation without triggering a major shift in unemployment. Early returns aren’t so encouraging.

This apparent shift in policy has already translated into worries about just that possibility. There isn’t yet any evidence unemployment has begun to materially increase. Some accounts and measures do point to growing slack on the hiring side, such as wage rates and help wanted. In short, China may have just entered the inital flat Beveridge zone, reaching the no-hiring/no-firing stage every worker across the West is only too familiar with.

It appears to be enough, however, to have set off a growing backlash anyway. I mentioned two of the Big Three, retail sales and FAI, we now also have China’s PMIs, particularly the non-manufacturing version. Having previously been seemingly pegged right around but just above fifty all year, with only modest variations even in March (Golden Week), for November the index dropped to 49.5. A six-tenth-point dip may not sound like too much, but that’s the first slide under fifty since December 2022.

In fact, at 49.5, it’s the worst non-lockdown result for the official services PMI in its long history. So, yes, big deal and big change. It isn’t too difficult to figure out what that is given the background and how much across the Chinese system had already been signaling as much. Fitting only too well with a growing list of evidence and accounts means just more corroboration of flat Beveridge dynamics.

Manufacturing wasn’t really any better. While the PMI did increase numerically from October’s 49.0 to reach 49.2 for November, there is no meaningful difference and, as noted above, this was the eighth consecutive month below fifty for the first time in this series’ history.

Economists may be stumped about China’s “sudden” weakness, there is no reason to be confused. The major problem as far as PhDs may be concerned is how, despite decades of experience and proof otherwise, “stimulus” doesn’t actually stimulate.

It may appear to occasionally, but only when the underlying economy is already moving in the reflationary direction. In fact, this is why most people including Economists believe stimulus works; it shows up typically at the end of a cycle and once again Economists and central bankers do what they do best, claim random correlation as causation.

But if the economy is going the other way, as China is now and has been for years, suddenly “stimulus” loses all its potency. The truth is these government and central bank measures never had any and we have even more proof as such from a growing catalog of evidence.

Real estate again

Central banks look like they are powerful institutions only when banks are doing what banks do. They expand their balance sheets at a sufficient enough rate, recirculate money (and collateral) while redistributing credit throughout the economy, that’s when “stimulus” looks like it is stimulating. Take away the banking, central banking is revealed to be the naked exercise of psychology and nothing more.

Chinese banks have been in full-on retreat (second derivative; meaning growing at too slowly a rate to be effective and supportive of the real economy) since the middle of 2023, so of course government efforts have failed time and again. Can’t make anything work without movement, mobility and circulation, and that’s the job of banking (for the time being).

Here, too, there is no mystery. Economists presume banks merely and blindly follow government diktat and command, especially in a top-down structure like Communist China. But even the state-owned banks over there have internal balance sheet constraints that take priority during times like these.

We know – and have known for quite some time – those banks are filled with bad debts. Just how much is the question. A lot of those have been piled up and left over from the real estate bubble turned bust, but not all of them. There were a lot of loans that have been made to struggling real economy (industrial) companies, especially the past few years of involution (overproduction).

Beijing says keep the factories running and people employed, banks initially gave out the loans to make it happen with everyone from government bureaucrat to factory owner to local banker believing a recovery would show up and make everything work just right, and the loans pay off. But the bigger banks weren’t buying in, and even those smaller banks which did provide financing for the loss-making firms found themselves only deeper in the bad loan hole.

Just going by the official numbers the PBOC provides, NPLs (non-performing loans, those most likely to be charged off) at the end of Q3 2025 across Chinese banks totaled up to an astounding CNY 3.5 trillion, roughly half a trillion in US dollar equivalent. Yeah. And that’s only what the government is willing to publish.

Who knows what the true number is.

The answer to that may, in fact, be the reason why anti-involution took center stage. The Chinese government simply couldn’t go on financing the oversupply charade any longer, banks having long since reached their max – which they already hinted by scaling back so dramatically on loan growth and lending flows (TSF) the past two years.

This isn’t strictly a real economy problem, either. While it is a big one, there remain lingering and unresolved matters for the real estate bust. For one, developers have hardly been stabilized. There is no bottom yet for property markets, nor does the Chinese government have the ability (without banks) to create one out of “stimulus” plans.

Housing rescues have repeatedly failed alongside the bazooka and everything else.

In fact, according to the last monthly home price estimates from the PBOC, they also showed a material deterioration in October right along with general economy. Given the NBS PMI on services for November, it’s actually a safe bet the situation worsened in both areas last month, too.

All of which is still exerting significant pressure on bankrupt and struggling developers, those previous princes who no longer enjoy a top slot in economic supremacy. Even the quasi-state supported firms like China Vanke have been left to twist in the wind.

Vanke’s bonds have been sinking like stones ever since October 6 (there’s that date again, not only the top in Bitcoin also the date when US credit spreads began to reverse course and rise, a globally synchronized risk aversion to all kinds of risky debts and instruments). At issue is whether Vanke can pay on some of its bonds.

The market doesn’t think that will happen nor is there any sign China’s government is going to come riding to the rescue. From last week:

China’s property market is bracing for a worsening crisis at state-backed China Vanke Co., as the builder struggles to convince investors it can avoid default in the months ahead without clearer signs of government support.

Once China’s largest developer and now a bellwether for the nation’s struggles to ease broader property woes, Vanke plunged in credit and stock markets this week. The builder’s local notes extended their declines Wednesday, with its bond due in May 2028 dropping as much as 29 yuan to 65 yuan, triggering brief trading halts.

Normally, these kinds of announcements with any of China’s property giants is related to Eurobonds, those offshore (Hong Kong) dollar-denominated borrowings. Up to recently, the Chinese have been clear about where they wish to assign property debt losses, sticking dollar investors with as many of them as possible without being too obvious about it.

This is why creditors are always desperate to sit bankruptcy proceedings in Hong Kong, the offshore center where contracts are more likely to be honored, than to have them moved to the mainland where everyone expects arbitrary decisions made to benefit what the government perceives as its immediate interest.

But Vanke last week said it was trying to postpone a principal payment for onshore local currency bonds that are due in less than two weeks.

“The extension is very surprising to the market,” Yao Yu, founder of Shenzhen-based credit rating startup RatingDog, adding support from Vanke’s largest state shareholder over the past year “has become suddenly meaningless.”

In other words, yes, we know the property sector continues to bust and developers are under significant liquidity pressure from both the bust and the banks who don’t want to keep pouring renminbi down an endless loss-provoking hole, but with Vanke we have to also ask if, in addition to anti-involution, Beijing might also be taking a different approach to the whole real estate mess, too, and all its various unmovable pieces and in irreducible trends.

After all, what happened to the bank recapitalization plan announced over a year ago during the bazooka?

That might account for why private FAI has absolutely crashed, with everyone rushing for the exits, so to speak, basically halting work in the area. There’s no support from banks, the credit markets, or Xi Jinping.

This would certainly raise the chances of flat Beveridge in China that much higher than they already are. It might seem unlikely Beijing would simply pull the plug and maybe there are some background discussions taking place no one outside of a very small few would have any knowledge of. Perhaps a last-minute solution is being ironed out for at least Vanke.

Or maybe this really is a new age, which would mean greater risk of violent transformation.

We have to wonder why the Chinese have been such voracious buyers of gold, of all things. While gold-sellers will say it’s because China is working on a gold-backed currency to compete with the dollar, we all know that’s complete nonsense. Instead, the Chinese understand where the risks truly are…and also whether the odds truly have shifted dramatically.

What we do know or can reasonably assume without going too far into speculation and interpretation, is that China’s economy has taken a turn for the worse; one that appears to be multi-faceted and broad-based. Services, manufacturing sentiment, loan losses and banking, now Vanke comes back into the spotlight.

One thing is for sure, there is no shortage of reasons for why Bitcoin is struggling the last month and a half.