If you aren’t a Eurodollar University member, become one and get access to Classroom vids, The Basics, Weekly Recaps, Q&As, and all the special presentations right here.

Q&A #100 Replay

Replay of the livestream Member Q&A 100 epic discussion. George. Jim. Steve. Mike. Eric. Brent. Emil and Jeff back together again. Two hours of back and forth. Including why Home Alone lied to you.

The Fundamentals of Interest Rates

The complete webinar presentation. Recorded on Friday, June 28, Jeff gives us the background behind the mainstream explanations for interest rates before diving in to the real story. In addition to the full presentation, the complete Q&A follows.

Conversation #10: Recession Question

Everyone wants to know the answer to the recession question. So, by very popular demand, Eric Basmajian of EPB Macro Research checks in with Jeff on the unusual state and status of the US business cycle. The whole monumental matter just might come down to houses.

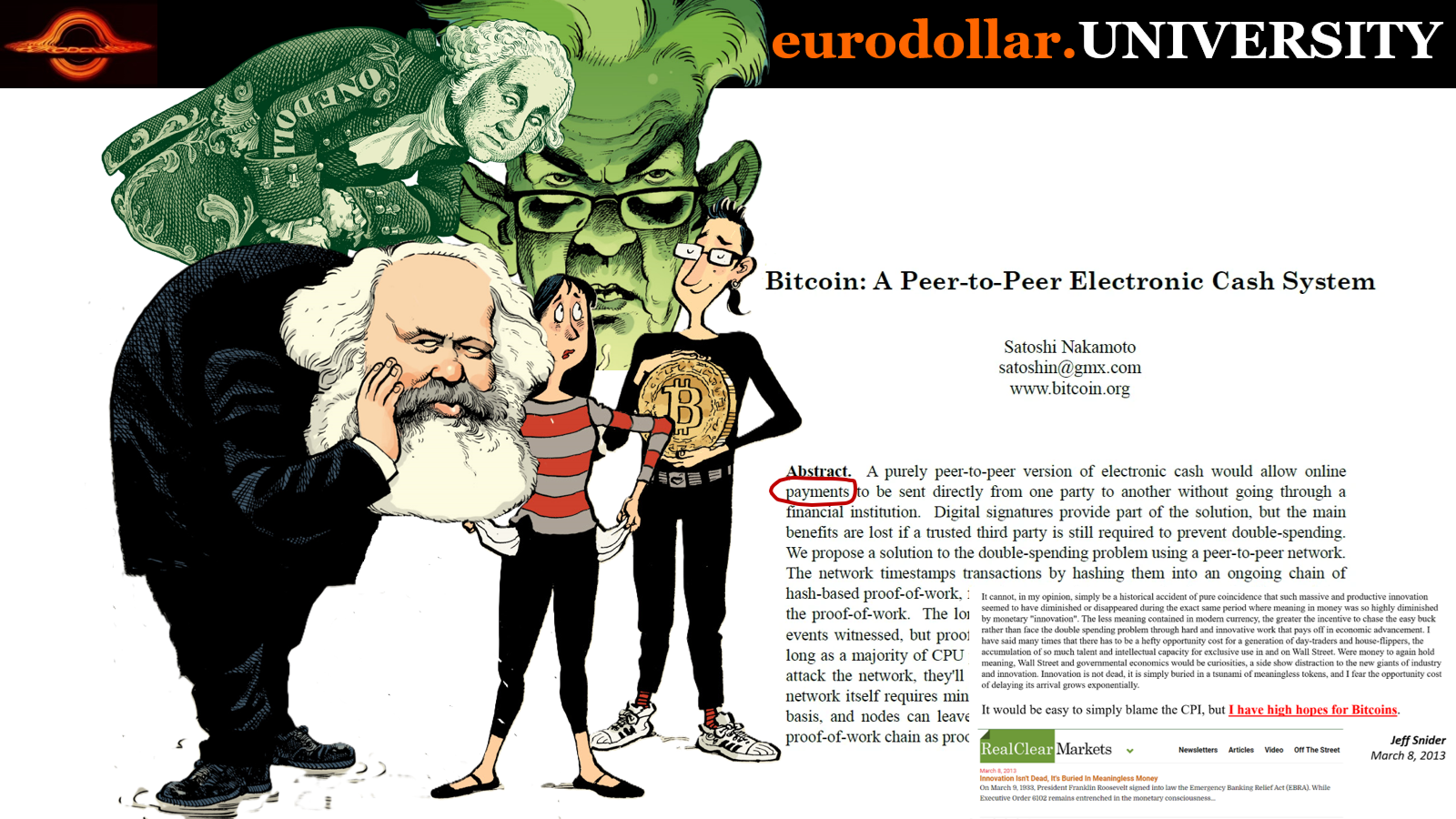

Real Money Can't Be Perfect (did Bitcoin take a wrong turn?)

Modern economies have been moving purposefully in the direction of ledger money for centuries. At every opportunity, free markets have decided to turn to it to fuel progress and growth, creating massive wealth in the process. It seems tailor-made to hand off to the next iteration. So why isn’t Bitcoin taking over when otherwise everything seems set up for it? Jeff answers that question and a whole more in his presentation at Rebel Capitalist Live.

Member Video #28: Integrating Ledgers

In Classroom #28, we take a further look at the critical dealer system from three perspectives. Starting with the macroscopic then working through the multiplier/circulation we end up back in the microscale thinking about individual incentives and perspective. Just like the eurodollar is a series of integrated ledgers, that process of integration comes from a combination of purposes spread out across this trio of layers.