If you aren’t a Eurodollar University member, become one and get access to Classroom vids, The Basics, Weekly Recaps, Q&As, and all the special presentations right here.

Member Video #27: Dealer Center

Why was the September 2019 repo dislocation so significant? It wasn’t how far money rates rose. Instead, the episode actually made officials partially admit the truth. Everything is about dealers and here in Classroom #27 we’re going a little further in the black hole. Armed with a diagram and experience, we’ll start putting theory together with observation.

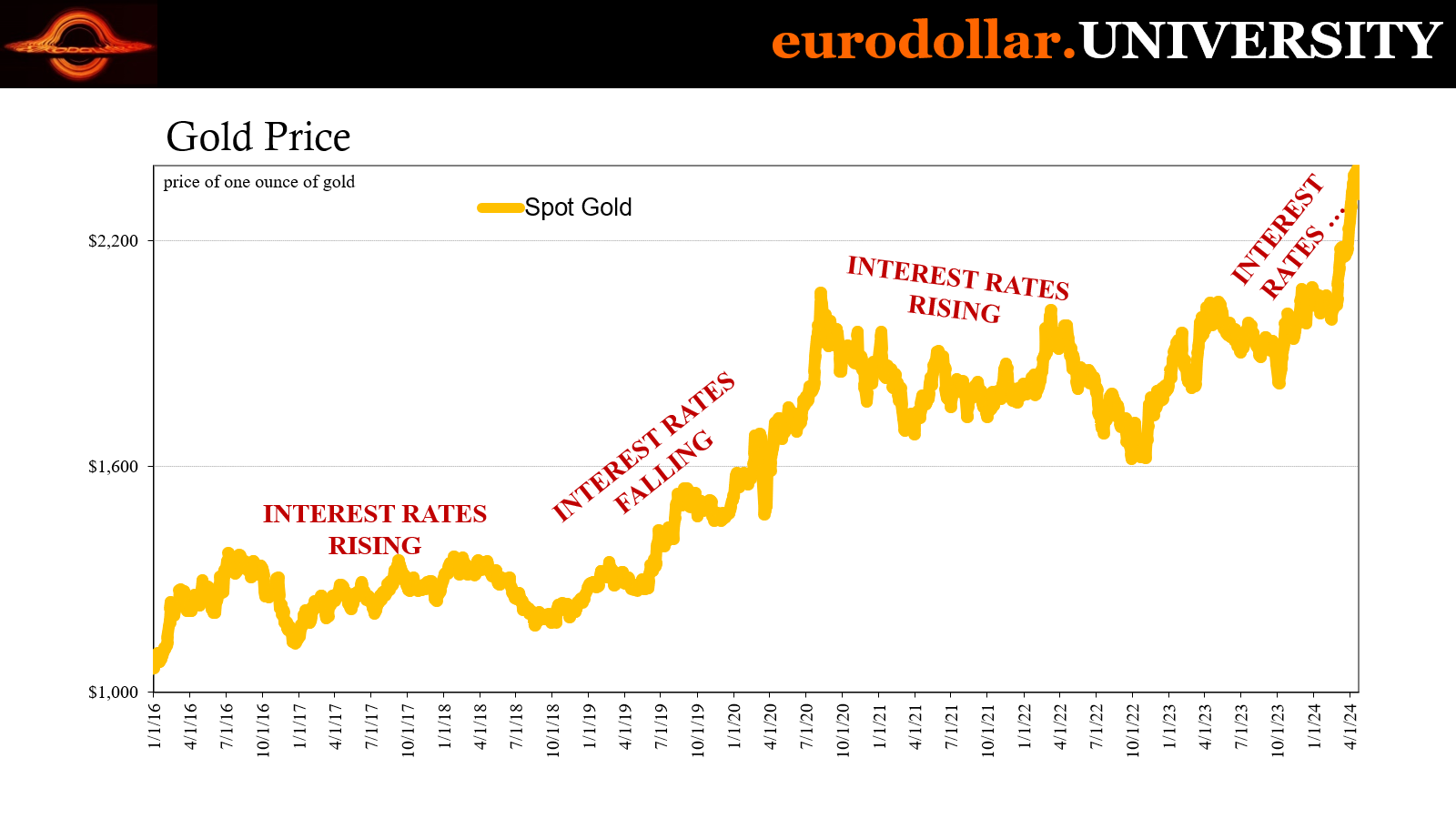

Conversation #9: Gold Takes Off

To get a golden insider’s perspective of the metal’s currently really, Jeff is joined by founder and chief of Monetary Metals, Keith Weiner. Keith is someone with extensive historical knowledge and has a deep passion for monetary topics from well before it was cool. Whether or not Bitcoin was a CIA plant will have to wait for another day.

The Basics #10: Quantitative Tightening

After tackling QE in Basics #9, the next installment could only be about what many consider to be QE’s inverse: QT. While Jeff worried this one might be a letdown, this one is far from it. To understand the debate (such that there really is one) about “tightening”, EDU’s Basics #10 does more than just QT. As a necessity, this one gets neck deep into bank reserves.

The Basics #9: Quantitative Easing

The ninth installment in the series tackles the most requested subject of all of them: QE. We’ll explore what this thing is, of course, also where it came from and why central banks started to use them. Peering behind the money printing myth to the basic facts about one of the most controversial and misunderstood aspects of the entire modern monetary landscape.