Daily Briefing 6/17/25

Industrial Production (Fed)

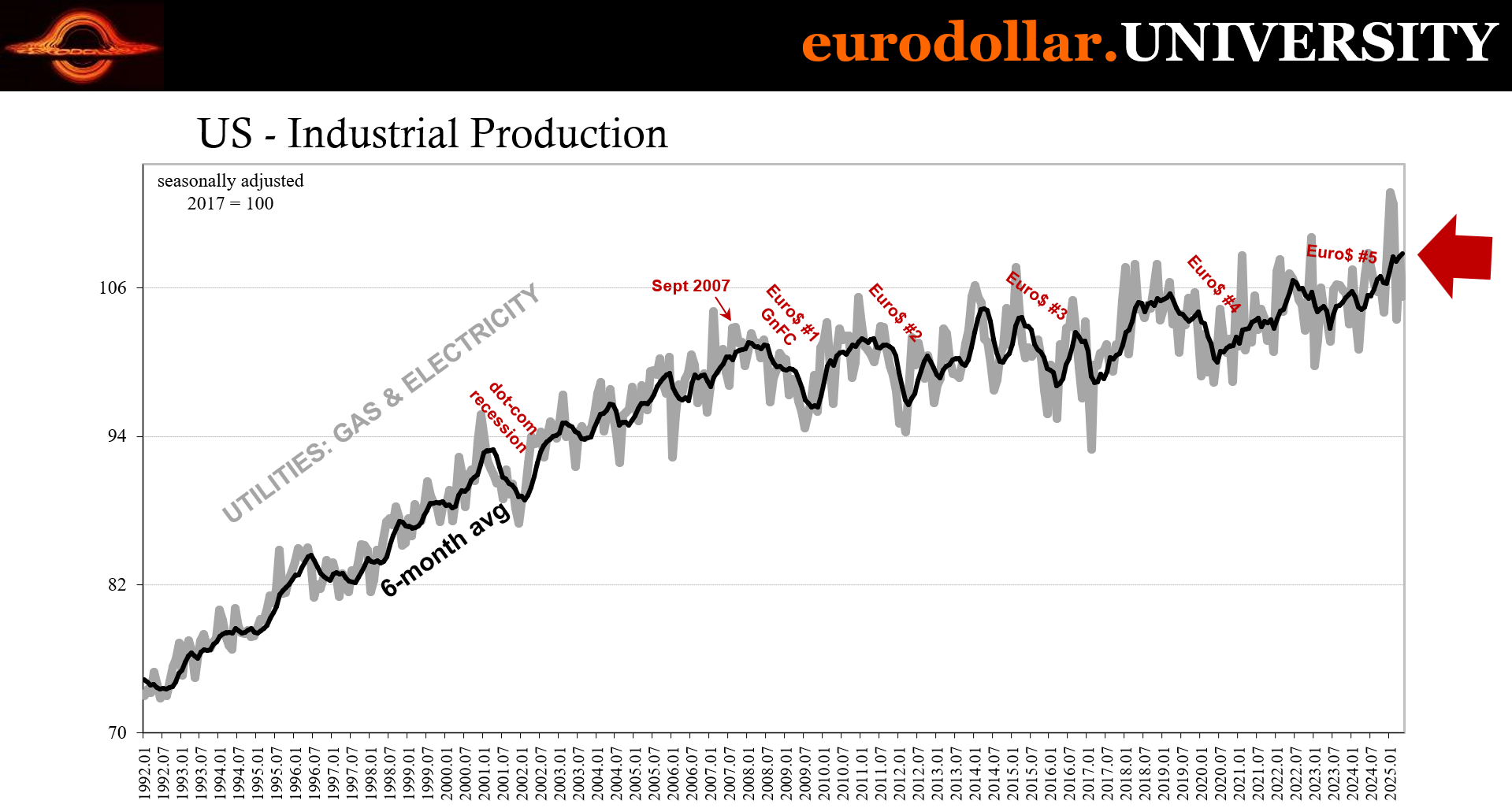

US industrial production (IP) fell by 0.2% in May 2025, following a modest 0.1% increase in April. Manufacturing output rose 0.1%, largely due to a sharp 4.9% rebound in motor vehicles and parts, while output excluding autos declined 0.3%. Mining output edged up 0.1%, and utilities output slumped 2.9%, driven by a 3.6% drop in electricity generation. Capacity utilization declined to 77.4%, remaining 2.2 percentage points below the long-term average. Durable goods production rose modestly, but several key segments - such as machinery and fabricated metals - contracted. Nondurable manufacturing fell 0.2%, weighed down by declines in petroleum, food, and printing.

Interpretation

May’s industrial production data shows a manufacturing sector that is running on fumes. Total industrial output fell 0.2%, reversing April’s modest gain and suggesting a sputtering pace even after more than two years of forgetting how to grow (contraction). This drop was partly offset by a robust 4.9% surge in motor vehicles and parts, but strip that away and the numbers turn sharply weaker: manufacturing ex-autos declined 0.3%.

That divergence is critical. Autos were likely rebounding from prior disruptions, while broader manufacturing output remains soft, as evidenced by contractions in key categories like fabricated metals, machinery, and nonmetallic mineral products, each down over 1%. These segments are tightly linked to capital investment and infrastructure, areas that typically signal confidence. Their weakness suggests industrial firms are either delaying capex or facing order backlogs amid rising uncertainty.

The utilities sector fell 2.9%, its worst drop since early 2023. While some of this is seasonal, the 3.6% plunge in electricity output - which more than offset a 2.7% rise in natural gas utilities - indicates subdued energy demand, often a harbinger of slower industrial and commercial activity. The mining sector was flat, up just 0.1%, continuing its muted performance after April’s decline.

Capacity utilization tells a similar story. At 77.4%, it remains 2.2 percentage points below its long-run average, and manufacturing-specific utilization held at 76.7%, 1.5 points below trend. The utility sector is notably weak, with operating rates at 68.5%, far underperforming historical norms. Mining was the only bright spot, with 91.1% utilization, well above its long-run average, likely buoyed by resilient oil and gas activity.

All in all, while headline figures remain above pre-pandemic averages (IP is 0.6% above May 2024), the underlying trend remains. Manufacturing can’t get going and now is staring at growing payback, capacity use is subdued pointing to more weakness in pricing power, and the reliance on auto-sector rebounds leaves the broader industrial economy exposed. The risk of contraction in the second half of 2025 is rising as global demand cools and domestic investment hesitates.