IT COVERS EVERYTHING

EDU DDA Oct. 28, 2025

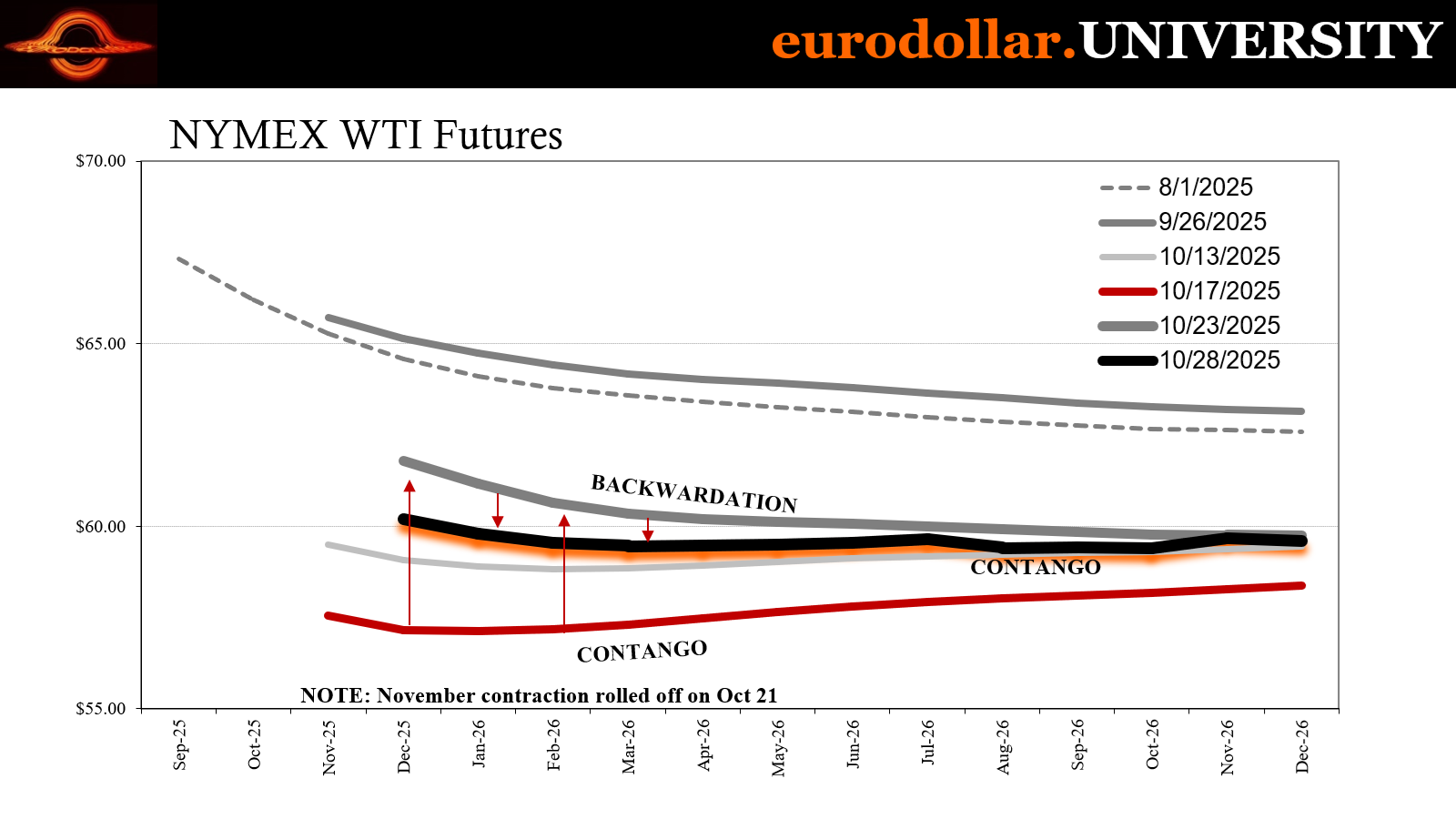

Summary: WTI futures quickly back into contango and recent developments in all three fundamental factors priced into the curve show why. It’s not just or even “a” supply glut. It is the combination of tight financing (more in Fed repo and SOFR today), lack of demand (confidence and holiday spending in the US) before finally oil supply (why Saudi Arabia “has” to produce now). Whatever might be left of the geopolitical premium in crude prices it is being overwhelmed by everything else. And that means a lot more than contango; in fact, it’s what contango means for everything else.

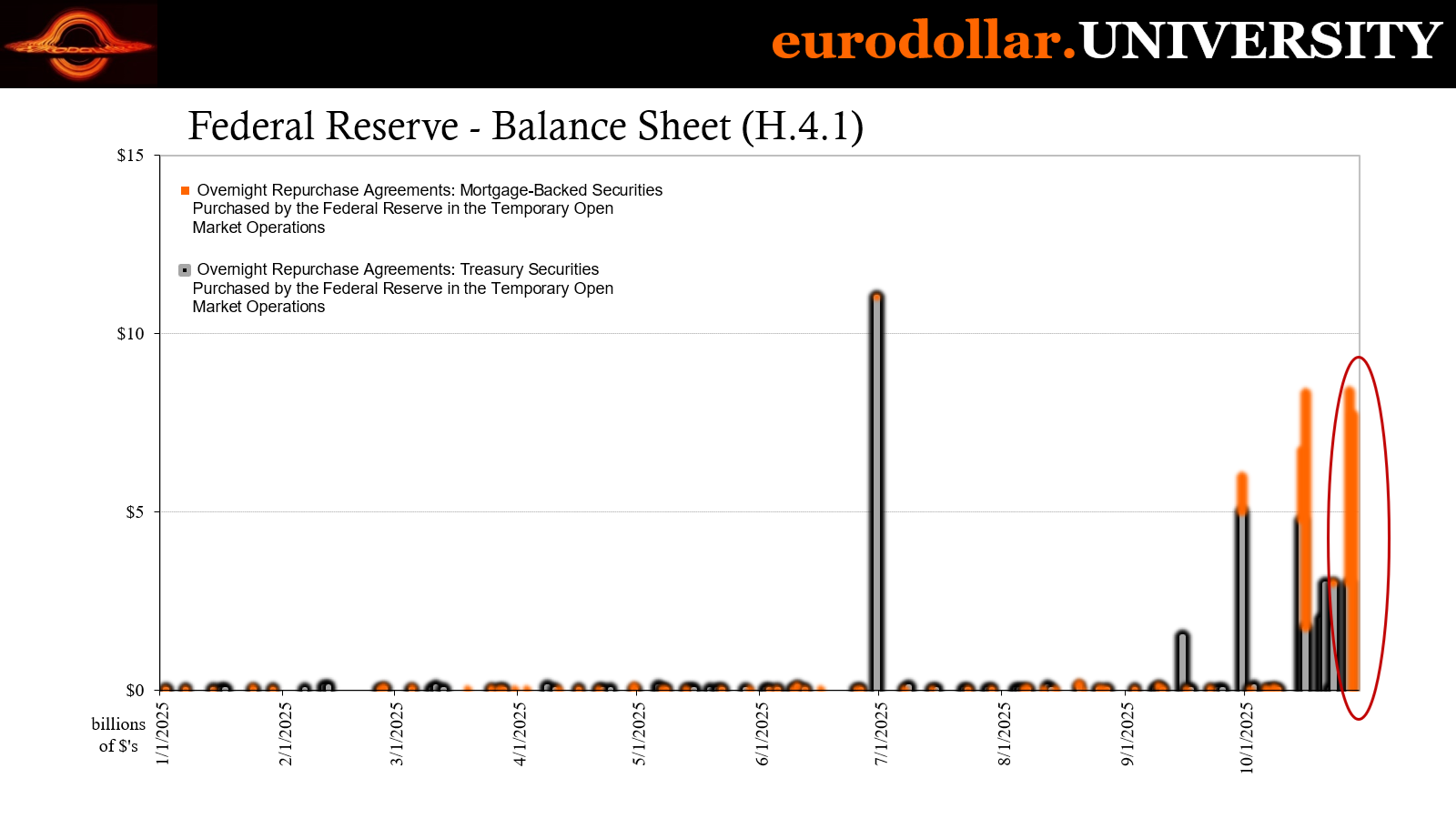

EARLY MORNING FED REPO HAS BECOME A REGULAR THING.

Oil prices flipped back into contango again today as the market contends with competing pressures, at least here in the short run. Additional sanctions placed on the big Russian energy firms led to a rebound in WTI and Brent, with WTI futures shifting from pretty solid back-end contango to relatively steep backwardation in no time.

Since then, OPEC+ has signaled it is likely to add more to production quotas at its December meeting. Combined with weaker demand out of China as well as the US, the geopolitical premium is facing a shortening half-life. The curve backwardation lasted only a few days as the middle 2026 contracts in WTI today are back to being flatly contango-ed once more.

On the demand side, the Conference Board reported more recession levels for consumer confidence including the alarming notice of lower holiday spending plans. Combined with almost non-existent holiday hiring plans among retailers, both sides of the US retail economy are preparing for an increasingly dismal season.

That point was further highlighted by a late Monday report Amazon was preparing 30,000 corporate layoffs. This morning, the company said it will “only” be 14,000 but there is every indication that’s just the first round. Moreover, Amazon’s statement blamed the job losses on AI when Corporate America is increasingly axing especially management positions due to weaker economics (small “e”).

Flat Beveridge everywhere.

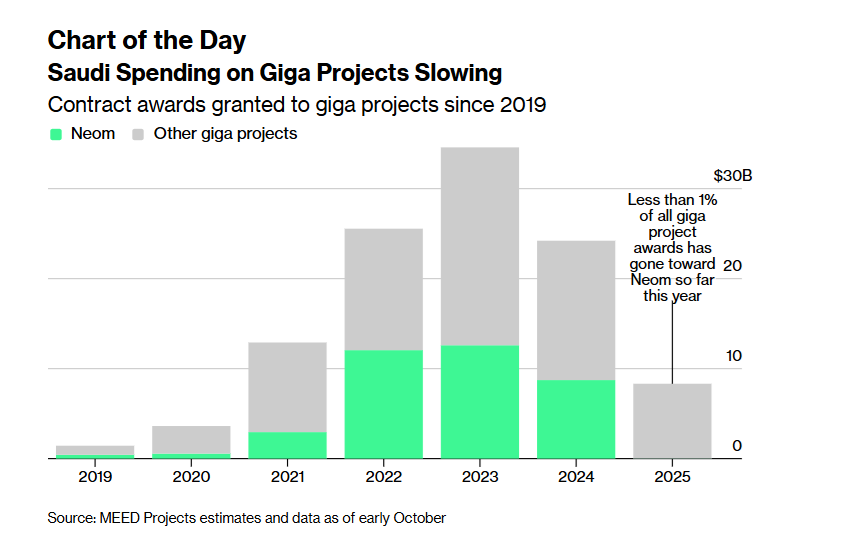

On the supply side of crude, there has been a fundamental shift in the monetary and credit position of Saudi Arabia that, along with simply accepting economic reality, explains the country’s bias toward production after several years of fantasizing about global recovery supporting forever-$100+ barrels and being willing to hold back crude supply hoping to someday achieve it.

Last year, with oil revenues down, the country experienced a negative net foreign asset position (private) for the first time since 1993. Dollars aren’t coming in like the Kingdom requires and the deficiency is filtering down into everything, including delays in funding the various megaprojects - if not shelving some entirely.

Together, supply and demand, there are the fundamental reasons behind the global warning that comes from WTI and general oil contango. Those plus money, of course.

Brief money update

Taking the last oil factor first, as expected the Fed’s benchmark SOFR rate rose yesterday above the fed funds upper limit. At 4.27%, this was the third time over the past two weeks being that high. And while the FOMC does not specifically target repo rates in setting its interest rate (not monetary) policy, even SOFR, officials are very aware how sustained tightness and volatility in repo during 2019 eventually spilled over into fed funds when the effective rate in that market – which is what the Fed effectively targets with its policy – did breach the policy limit for the first time.

There is also every reason to suspect SOFR will be equal if not higher today, too, when FRBNY gets around to calculating it tomorrow morning (you can tell it’s a bureaucratic benchmark since they take their sweet time crunching the trades, tabulating the daily figure and then lazily letting the rest of the world know what it is). For the second straight day, and seven for nine, there was activity at the Fed’s repo window.

Tuesday morning began with $7.5 billion borrowed on MBS collateral, slightly less than yesterday’s total but continuing the streak just in time for this week’s FOMC gathering. Depending on where SOFR does settle, I believe it settles the QT decision for policymakers at today and tomorrow’s FOMC meeting.

And, as discussed extensively yesterday, it won’t matter because bank reserves aren’t the problem. Just like at WTI contango.

For WTI, however, there is a critical monetary component in the futures curve which means contango, most of all, is sensitive to financing conditions. If it’s tight in repo, that’s likely to be having an effect on WTI futures and the shape of that curve.

Already a reason for it to be back into contango so quickly.

Demand nothing less

The Conference Board’s estimates for consumer confidence in October only dipped slightly, however that was enough to pull it back to a 6-month low. With the trajectory unchanged, that meant nothing was materially improved as consumers continue to grow concerned about especially the labor market shape even as stocks – or certain stocks – soar to all-time bubble heights.

Normally, stocks and consumer confidence are correlated enough to be moving in the same direction at the same time; such as earlier this year when confidence plunged with the NYSE and NASDAQ and then initially rebounded from April’s lows. The divergence was already evident in that early stage, whereas share prices continue to go up in nearly a straight line through summer, American workers stopped seeing equities as representative of the overall economy and labor market with confidence rolling over.

Even modest job shedding truly is enough to grab the public attention and refocus it on what really matters.

For CB’s data, expectations continue to be dour, if not quite as bad as the University of Michigan’s estimates. These are not categorical differences among the surveys, particularly when you get into each’s details. The Board’s expectations index, for example, at 71.5 (down again) is firmly beneath the 80 mark which has traditionally been the dividing line between economic expansion and recession.

It’s been that way since February (coinciding with the current bull steepening trend on the yield curve that does, surprising to some, go all the way back that far) but threatened to emerge from the doldrums in May and June along with the stock recovery but was unable since it was interrupted by the real economy setbacks.

The most alarming aspect of CB’s consumer confidence report may be what it uncovered about holiday spending plans. They are down significantly, estimated to potentially drop by 4% in nominal terms compared to last year which would be devastating to retailers and beyond. Even worse, Americans said they are making key sacrifices just to do that; CB also estimates consumers may be making 12% fewer non-holiday purchases just to be able to fit even that diminished holiday total into this year’s family budgets.

While Amazon put the blame squarely on AI for its layoff announcement, let’s be honest the corporate jobs are being shed because price pressures are stout and haven’t abated at the same time the company is looking at this kind of holiday season ahead. And the Conference Board data aligns alarmingly well with other sources, not to mention the hiring plans – the utter lack of hiring plans – already reported by Challenger et al.

Challenger had tracked the fewest number of announced holiday hiring intentions in forever, going back to the dark days in and after the Great not-Recession; their figure was an astonishing one-quarter of last year’s announcements by the start of October, and those were already down from pre-Christmas 2023.

It is still highly likely retailers will end up hiring more than they have said thus far, the fact those businesses were unwilling and maybe unable to commit to doing anything more than the bare minimum was the point. Some like Target didn’t announce any seasonal hiring, instead intending to rely on existing employees, giving them more hours (they probably are only too willing to take) to meet what has to be exceptionally weak anticipated holiday demand.

There have been a number of additional datapoints also suggesting the broader services economy, in particular, has already retrenched before getting to this month. While S&P Global’s service sector PMI was not one of them, that one continues to be the outlier in the space and is contradicted by ISM’s non-manufacturing along with the balance of Fed surveys on the sector.

In fact, just today the Dallas Fed’s Texas Service Sector Outlook Survey dropped for October, thanks in part due to its employment index crashing to -5.8, lowest since May 2020. One of the comments accompanying the result says it all:

We are trying to budget and forecast, but it is impossible, and I'm on the edge of laying off an employee now. Business has felt recessionary for over a year—no wonder we knew the jobs numbers were off and kept saying there was no way they were as good as reported, and we were correct. These are very tough times for small and midsized businesses.

And no wonder we’re seeing widening cracks in private credit whose bread and butter was small and midsized companies. As far as tariff inflation, this other comment cements the demand side for oil: “We are seeing major price escalation resistance.”

This is just what’s happening in the US. For the oil market, there’s also China’s flat Beveridge flirtation to consider, as well.

House of sand

Saudi Arabia’s financial system has been facing a funding shortfall for some time now. Borrowing needs have greatly and consistently outpaced deposit growth for obvious reasons considering the behavior of oil prices and the government in Riyadh’s response to it. You can’t blow a huge hole in the baseline economy and expect to skate by without suffering some consequences.

To be clear, the country is not heading toward some major crisis, either in debt or banking. There are some concerns, though the banking sector is genuinely solid and overall indebtedness is far below most everywhere else. The economy is generally operating in decent shape, certainly when compared to some of its OPEC partners and others around the rest of the world.

That said, strains have emerged that aren’t going away soon. Moreover, they are already greatly impacting the Kingdom’s future plans. The Saudis consistently state they are no longer an oil-based system when reality doesn’t agree. Officials may plan to move farther away from petroleum, the truth is they have a long way to go and a very uncertain road ahead of them.

Back in 2022, the Saudi interbank system experienced a major liquidity crunch forcing the central bank, SAMA, to intervene. Lending was still growing at massive rates due to expectations oil prices were going to be permanently high and that the global economy was about to experience a rapid recovery which would finally allow the depressed world to escape the economics of the 2010s Silent Depression.

What that would do for already $120 per barrel crude.

Once forgot-how-to-grow materialized instead, deposit growth slowed leaving financial firms, banks and non-banks, to compete for funds leading to a cash shortfall that pressed interbank money rates upward.

That condition has never been alleviated now three years later. There remains a huge mismatch between loan growth, much of which is demanded for the megaprojects the royal family insists on pursuing to transform the country and its economy. When oil prices “unexpectedly” softened and then the decision to try to support them via production cuts was implemented, it meant even less deposit growth as the byproduct of lower petroleum revenues.

The government simply expected the global economy would roar back to life later in 2023 or maybe 2024 after only a short-lived setback. Instead, forgot-how-to-grow grew all over the planet and oil prices were doomed by lower demand to follow it, further exacerbating the liquidity disparity. Borrowing demand kept up but internal funding did not; could not.

By last year when Riyadh finally realized where this was all going, meaning the opposite of global recovery, Saudi Arabian banks had already been looking outside the country for funds. They started borrowing heavily on global markets (eurodollar and Eurobond) as the only alternative caught between the government’s insistent demands for megaproject financing and the lack of petrodollars (not “the” petrodollar, which doesn’t exist) available therefore local currency deposits.

According to SAMA, external bank liabilities had exploded by 50% just in the twelve-month period through August 2024. Before the end of last year, the Saudis were net negative in terms of foreign assets; borrowing more in dollars than they were taking in dollar assets. It was the first time since the oil crunch of 1993 that had happened.

The Saudis had already relented to a large extent on project financing in 2024. Megaproject funding peaked in 2023 (with Abdulaziz still expecting his lollipop gambit to work) at an enormous $34 billion equivalent. With that gamble instead blowing up and a hole in interbank availability, demands were dropped back to $24 billion in ’24.

And with everything falling further apart with the oil market heading for glut and contango-signal downturn, there’s only been about $8 billion in megaproject borrowing/financing so far this year as the government has had to trim its demands way down. And still it’s too much. Heavy external financing is less than ideal in monetary, financial and political terms, raising risks of potential destabilization Riyadh would rather avoid even if otherwise Saudi banks and the system’s overall position is outwardly and legitimately solid.

The further this mismatch goes, the less that gets to be the case, and revealing the truth tends to be non-linear.

Saudi Arabia won’t take that chance. As a result, it is not just cutting back on megaproject borrowing demand but also accepting the worldwide downturn and not being able to do anything about it. So, the only option Riyadh has is to pump. Prices are going to weaken regardless, so put out as much product as possible as fast as practical to raise revenues before something like 2016 returns.

Or 2008.

Whichever lane you want to look at the “supply glut” in oil, the contango signal on the futures curve is a product of each fundamental factor. Monetary conditions are tightening in increasingly obvious if not also escalating fashion. The Fed will sell a QT solution to it – either ending balance sheet runoff tomorrow or announcing the intention to do so in the near future – which won’t make a meaningful difference.

Meanwhile, demand is weakening in every direction. I’ve covered China’s Beveridge moment already. The US economy keeps putting up more concerning developments by the week. Consumers not spending for Christmas risks sending smaller and medium-sized businesses into a real tailspin, with both macro and monetary consequences that impact a lot more than WTI futures and Middle Eastern cash positions.

Finally, the Saudis are among the better positioned to handle falling oil, yet even they are impacted by it more than enough to have had to adjust a number of internal parameters and demands. Thus, from there and other parts of OPEC we should only expect more production.

Contango is back on the curve, and while it might disappear again in the short run the global signal contains fundamentals from all three parts that are nothing more than the same thing from different perspectives. That’s what makes the “supply glut” a dependable downturn warning.

It actually covers everything.