SHADOW LENDING NOT A FLAT FAN

EDU DDA Oct. 3, 2025

Summary: Monetary matters have force their way to the forefront, all because of payroll reports even as the next one remains delayed. Indicated eurodollar tightening has roared in several ways, starting with repo fails. Those don’t appear to be strictly quarter-end technical, either, with other indications strongly pointing toward risk aversion interrupting cash and collateral flows. In addition to payroll data, today the ISM’s service index also spotlights the likely macro suspect in everything. Shadow credit is not a fan of flat Beveridge.

BANKS WANT EVERYONE TO THINK THEY’RE AT MOST INDIRECTLY EXPOSED…

Repo fails spiked into the end of last quarter. Though that may have been due to little more than technical factors, the usual window-dressing by dealers and collateral providers/redistributors, there are several key reasons to suspect this one was more about risk aversion than not. First, USTs keep disappearing at a breathtaking pace from FRBNY, meaning FOIs are using tens now hundreds of billions of them. Second, suddenly FRBNY’s securities lending program has come roaring back to life.

Those two, combined with repo fails, strongly hint at serious and growing eurodollar tightening that would also appear to include collateral flow.

More importantly, the timing of these escalations leaves little room for doubt about why. Payrolls. Confirmation of job shedding. Rising unemployment meaning potential for a lot more. It wouldn’t be too much of a stretch from there to end up with a bevy of really distressed borrowers.

SERIOUSLY, HOW MUCH MORE EVIDENCE DO WE NEED? THE TRUTH IS OUTSIDE OF STOCKS THE POSSIBILITIES ARE FINALLY BEING TAKEN A LOT MORE SERIOUSLY.

That’s the link between payroll data and eurodollar tightening. The payroll data completely upended more than the previous narrative supplied by the always-hapless Fed and its Chair Mr. Powell. It made “real” the dangers in private credit hitherto willingly ignored. Can’t do that any longer, and it appears as though a lot of the system has been forced to confront the possible coming consequences of flat Beveridge.

And more data came in today to that effect. ISM’s PMIs for September illustrate these points only too well, with the non-manufacturing version down again among the lows of this cycle. Business activity slid just under fifty for the first time since May 2020 while the headline’s 6-month average was the lowest in fifteen years.

The kind of unusual weakness and deterioration flat Beveridge would expect.

Fail tightening first

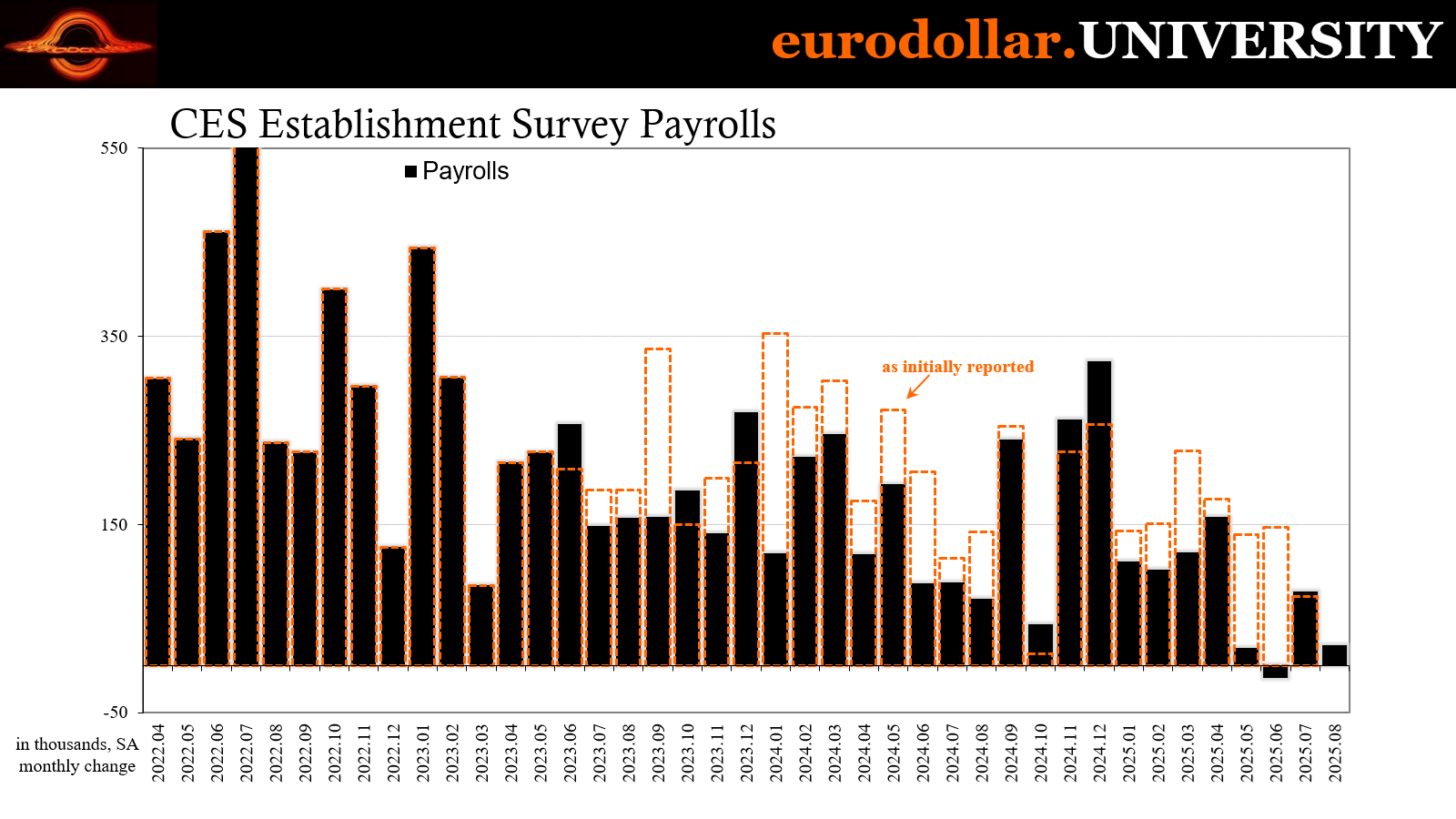

This one has a clear macro connection at play. July’s BLS payroll report put a spotlight on a labor market situation that was nothing at all like the “solid” condition Jay Powell and the Fed have been selling for way too long. Released in early August, it was like a bomb went off and you can see the aftermath wreckage all over markets and money.

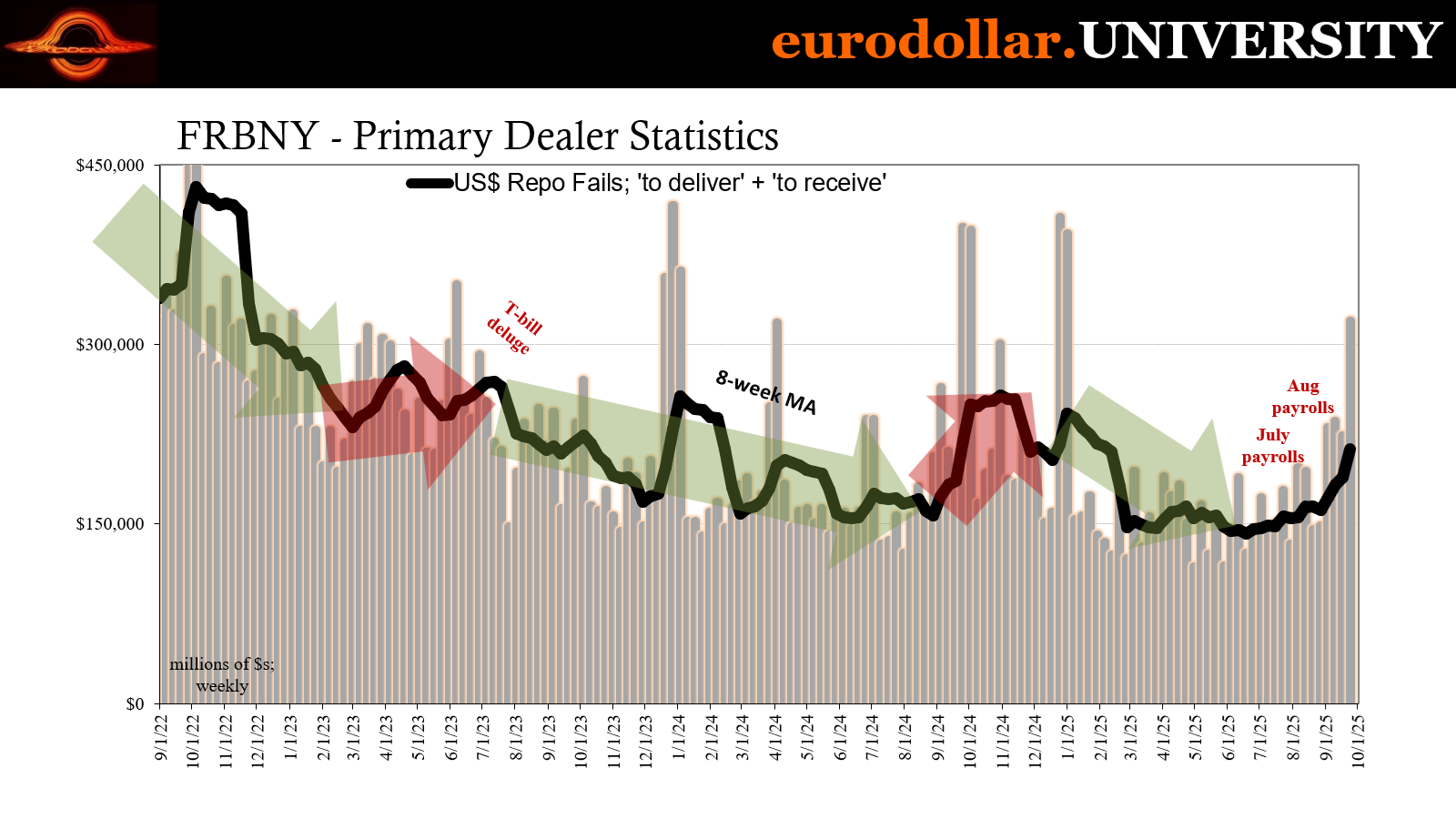

There were signs of trouble building even before early August when the Establishment Survey slammed into everyone’s screens. In terms of money and collateral, repo fails had already reversed their previous lower trend. It’s difficult to make precise assessments, but if we use the 8-week average for fails, it bottomed out in the middle of June and right in the window for the next stage of economic transition.

We’ve observed a lot of changes taking place around that time, starting with the yield curve (lower from late May) and then the dollar reversing higher in early July (looking past DXY).

Repo fails alone don’t necessarily mean much, but in this case there were a couple of subsequent big jumps for them clearly tied to macro concerns – first the July payroll report and then the following month when August’s numbers were published at the start of September.

Fails had shot up to a combined rate above $230 billion by the second of those, then finished off the third quarter rising to just more than $320 billion – highest of the year. While there has been a quarter-end pattern driving fails upward for technical reasons the past few years, there are several reasons to look at this latest reversal as being more monetary than purely procedural.

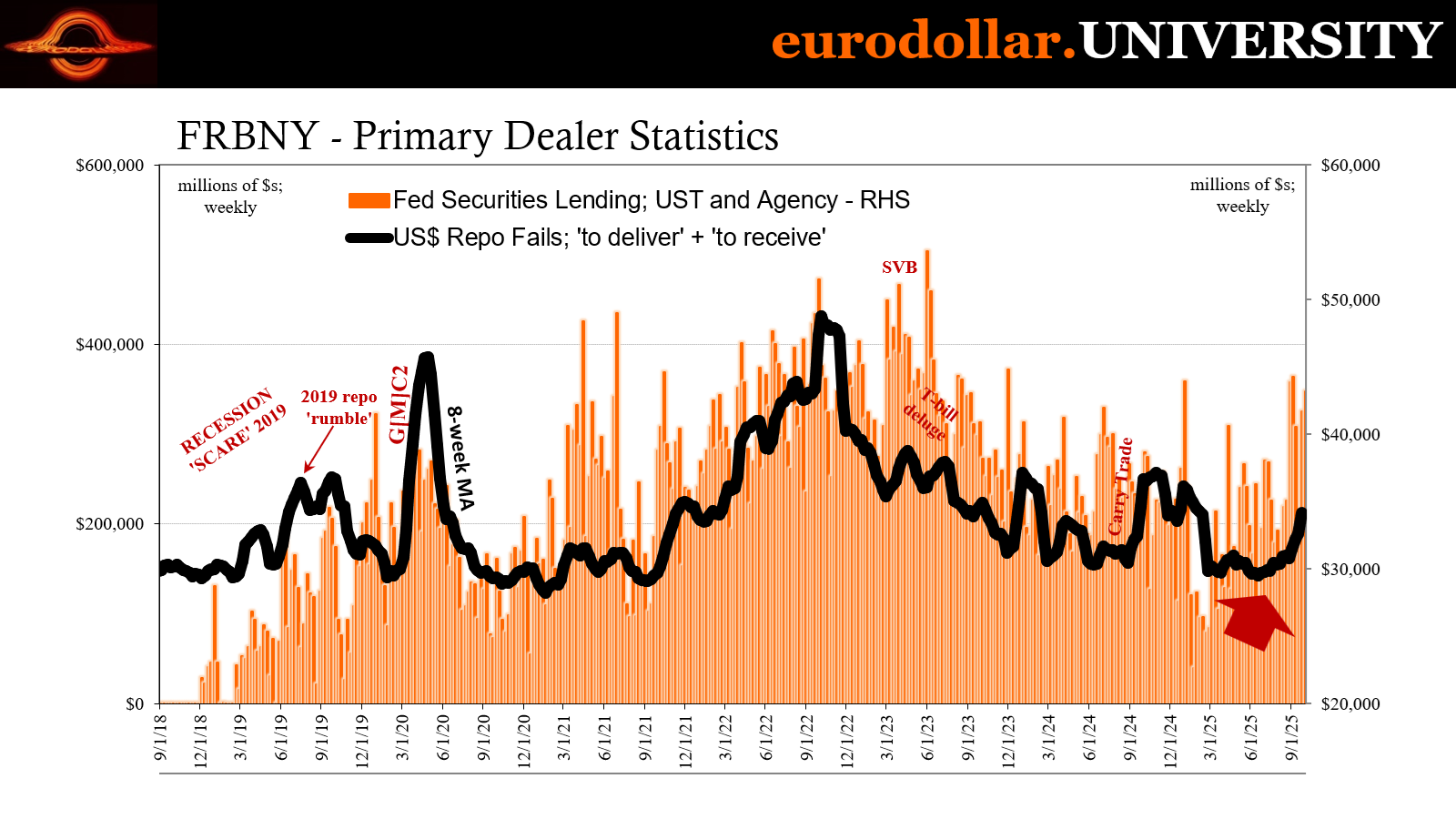

The Federal Reserve’s securities lending window has been coming back to life after solid dormancy before this year. This is an FRBNY-run program which is exactly how it sounds; dealers and banks show up and swap other kinds of collateral for USTs and agencies from out of the New York branch’s vast holdings. And the purpose behind doing so is to give the bond market some additional UST/agency supply to maintain smooth flow and operations.

It isn’t necessarily meant to be a collateral-lending-of-last-resort, nor has it ever been. However, there is a correlation with other measures indicating collateral strain, so it isn’t a huge stretch to infer intent behind financial firms accessing the Fed’s stash through securities lending. There are questions about how effective this might be since there are stricter rules about reuse, yet that hasn’t stopped dealers and banks from borrowing FRBNY’s bonds (strictly speaking, they are owned by the New York branch as each of the twelve are supposed to operate in this way as separate “banks”).

At the start of January, the Wednesday balance outstanding had slid to a multi-year low as Treasury bills – for the most part – were plentiful. That is one consistent connection, though hardly the only one (as I’ll point out below). Fewer bills supplied and less recirculation of them typically drives higher use of FRBNY securities lending.

From the middle of January (when Treasury yields overall began their current slide) to the week of April 9, height of disorder and deflationary money, securities lending nearly doubled from that low of $22.6 billion, rising to just more than $40 billion. Usage was largely maintained from there until another, bigger jump – the week after the July payroll report.

As you can see on the chart below, along with repo fails there was a rise in demand for Fed securities lending, strongly implying collateral conditions are and have been, in part, behind the rise in fails.

There isn’t always a solid connection between the two series, yet over the past seven or eight years, it’s clear enough that collateral difficulties anchor the pair. Since both relate to USTs one way or another, there’s no huge intuitive leap to collateral conditions, especially with other forms of monetary corroboration.

Nor is it a huge stretch in late 2025 to connect both to macro, especially where it comes to jobs.

Getting serious

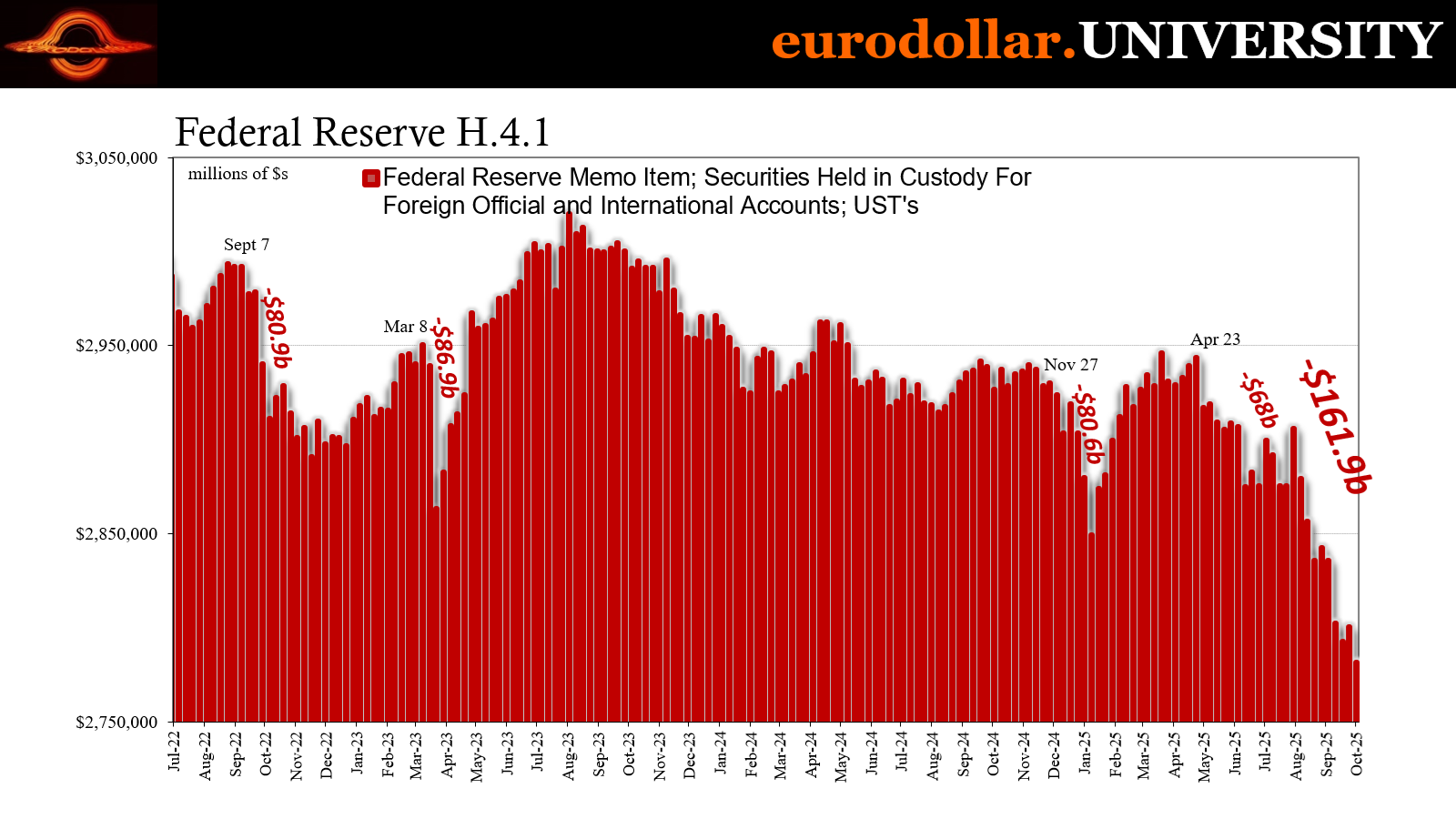

The amount of Treasuries which are being deployed by foreign official institutions is edging on historic. After a single week when a few billion of them floated back in to FRBNY’s custody, the first week in October saw another $19 billion leave again. That brought the overall balance in custody down to just $2.781 trillion, the lowest since 2012.

To anyone in the mainstream (who might even be aware of the data), this would be proof “sell America” is alive and well, being executed by foreign governments in their hate for Trump, tariffs, or just the United States and “its” dollar. After all, the “debasement” fairy tale is all over Bitcoin and crypto channels where all of these assumptions are taken as given, if only because no one knows there are other, far more plausible and realistic explanations for what’s going on.

Which is why they keep expecting the dollar to collapse when it continues to do the opposite. Same with Treasuries. Mentioning the word eurodollar to them is the first time they will have ever heard it.

Going back to late April, a massive $161.9 billion has “vanished” from the New York branch, which simply means they have been used in some fashion counteracting (euro)dollar difficulties. Those difficulties have accelerated since…the July payroll report came out to start August. From that week, the disappearance totals a whopping $124.2 billion. That puts the current wave at the top of the list, outdistancing last year, the banking crisis in 2023, and is running even with February-April 2020.

In short, this is already serious.

The fact that Treasury yields have been moving lower during that time, meaning Treasury prices higher, really slams the door on Treasury-rejection, instead connecting these and other dots to what can only be a high and growing degree of risk aversion being driven by macro fears.

Specifically, US jobs. The flat Beveridge curve being real.

What happens if it is? As the US labor market, previously believed invulnerable, instead experiencing more determined and visible job losses raising unemployment, more credit payments will get missed, delinquencies will rise, and defaults might realistically become a top-tier issue again in a way they haven’t been in almost twenty years.

Most of that credit, at the margins, has been supplied via offshore shadow banks. In other words, information asymmetry, as discussed with Tricolor (correlation). And that hasn’t helped, either, threatening to expose more of what has previously remained hidden behind the veil of, first, intentional ignorance, then, second, typical modern-day securitization opacity. We don’t really know what the quality is within these loan pools, funded via eurodollar wholesale.

Ignorance refers to how for the past several years nobody wanted to know. Jay Powell said the economy was just fine, employment was strong and resilient, or, at worst, this year solid. In the rush to bag juicy returns from private credit, lenders and those providing funding (a whole lot of regulated banks) looked the other way. They dismissed warning signs such as visibly rising delinquencies in regulated bank credit in the rush to reach for yield.

Greed always overcomes rational sense. We are humans, after all.

So long as the economy seemed solid, they could sell any soft spell as transitory therefore easily papered over. Turn a solid jobs market into one that has been shedding jobs at the very least all summer, and maybe longer, all of a sudden that completely upends everything.

It means pull back. Reassess. Find out information. Reduce exposures.

Dollar tightening. Collateral tightening as everything is now under scrutiny and suspicion.

The tie-in with the jobs report is therefore quite obvious. It was the wake-up call for this part of the marketplace, a direct rebuke to Jay Powell and his absurd optimism; the guy is paid to lie about the economy because he believes it’s in everyone’s own good. And Fed Economists and their models are almost never right especially when it comes to inflections.

So, you can easily understand why the July Establishment Survey, with its dramatic revisions, would have caused a major stir. It didn’t simply challenge Jay Powell, it yanked the rug out from under the willful blindness where it came to the macro intersection with risky credit that is suddenly a whole ton riskier in the aftermath.

As long as it appeared Powell’s position was plausible, everyone believed they could afford to look the other way on credit quality. All that began to change in and after the April deflation, as we’ve seen, but the big domino which appears to have fallen, maybe with an enormous thud, is the conventional thinking on US macro.

Flat Beveridge is becoming the baseline, if it hasn’t gotten there already in the eurodollar world.

Not just consumers

This potential ongoing credit reproach isn’t strictly for or about consumer borrowers. We have to consider corporate credit, as well. That will be tougher since right now FOMO is all over retail, therefore mutual funds and similar, the more visible end of that spectrum.

Private credit, however, has been a big player in corporates. The flipside of job shedding is, of course, employers who are facing major difficulties. That would indicate an unhealthy rising proportion of distress, not simply major companies seeking to “streamline” their operations and raise profits so as to reignite share price enthusiasm.

Smaller and mid-sized firms which may be stretched by these conditions to the point they are laying off workers are every bit the enhanced credit risk and problem as those workers who are laid off. This is also the very category private credit shadow banks have been most firmly attached to.

It’s also where First Brands bankruptcy may be playing a role. The company appears to have leveraged itself as a way to stave off its insolvency, only to have the economy (auto market) worsen rather than pick up as had been promised. Doubling down on borrowing in that way is classic late-stage cycle behavior.

That’s where today’s ISM services PMI comes in to reinforce the downside case. It presents more than just the same weak economic performance, the “usual” forgot how to grow stuff. There does appear to be a more determined downturn acceleration which would light a bigger fire under those now rushing to reevaluate credit profiles, exposures (no matter how indirect it might seem today) and funding proclivities.

What the ISM reported was its September headline index sliding to fifty, already one of the worst monthly results of the cycle so far. Expectations had the number dipping only a small amount to 51.7 from August’s 52.0. I’ll remind you again that any reading under 53 indicates trouble, meaning the services sector seemed to be deep in it over the last seven months.

However, what came with the drop to fifty today was the business activity index falling to 49.9, the tiniest amount below neutral and into contraction. While that may not seem too much of a big deal, this was the first time ISM had reported activity on the wrong side of fifty since May 2020.

Why?

Costs are still rising and more service providers are trying to pass them on to customers than goods producers. The effect is a loss in volume, to the point that activity is the weakest it has been this cycle and has slowed down more this summer. This is also why “tariff inflation” ends up becoming labor market deflation; rising costs which only are partway passed to consumers leading to falling volumes can mean only one thing, cutting labor.

OK, two things: cutting labor while also securing more “short-term” credit seeking to buy a few more months to stave off bankruptcy while it might still be available.

Naturally, ISM’s employment index for services remained significantly in contraction for yet another month.

Maybe the most visible example of the economy tailing off the past few months, the 6-month average for the headline slid to just 50.7. Like many of these other numbers, that doesn’t sound all that bad, but it is actually the lowest average for the PMI since March 2010!

It’s lower than any time in 2020 plus nearly the entire decade of the 2010s Silent Depression up to the very beginning of it. More evidence for unusual weakness over and above the forgot-how-to-grow, consistent with an economy transitioning, or already transitioned, to flat Beveridge.

Understanding that so much of the shadow credit system wanted to look the other way on the economy, being forced instead to confront conditions that were nothing like what they were supposed to be especially for jobs and incomes, the whole thing comes as a total shock. Jay said solid, so lend, lend, lend.

Job shedding and rising employer distress?

Pull back eurodollars and take second, third, and fourth looks at exposures. That July payroll report may prove to have been a real watershed, not in transforming forgot-how-to-hire into remember-how-to-fire, but of the wider system’s awareness and, more importantly, growing acceptance of it.

The next question is, where does all this go from here? Financial crisis? Credit crisis? Monetary crisis? Another false alarm?

That’s what we’re going to look at in more detail next week. We already know, or anticipate with high probability, the long-run future of lower interest rates for longer, so everything showing up since early August does at least fit with that direction of travel.