Daily Briefing 5/13/25

Consumer Price Index (BLS)

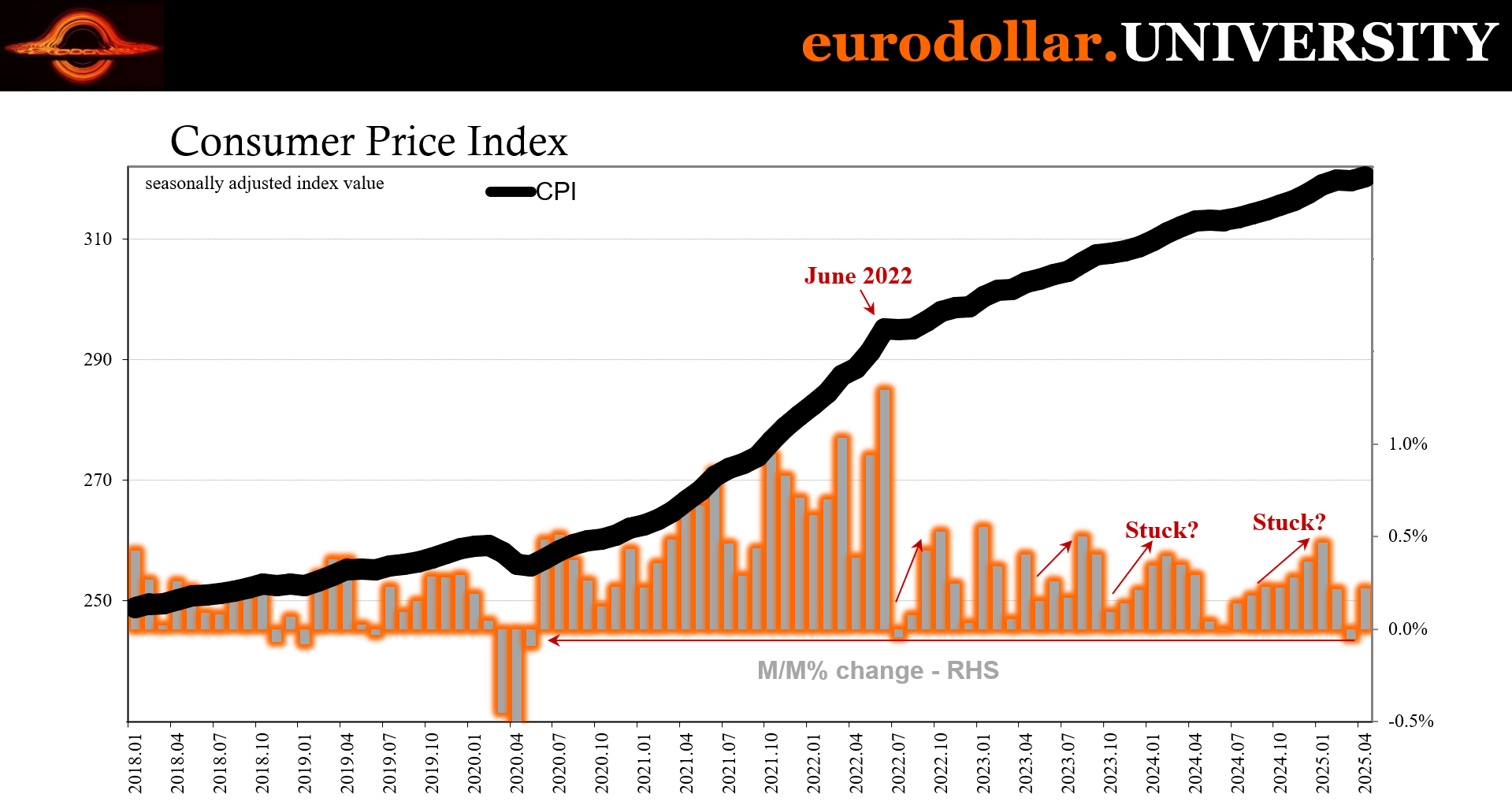

In April, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.22% on a seasonally adjusted basis after a 0.05% decline in March. Over the past 12 months, “inflation” rose 2.3%, marking its lowest level since February 2021. Shelter costs drove more than half of the monthly increase, rising 0.33%. Energy prices rose 0.67% month-over-month, primarily due to higher natural gas and electricity costs, while food prices declined 0.1%, led by a 0.4% drop in grocery store food prices. Excluding food and energy, core “inflation” rose 0.24% in April and 2.8% year-over-year. Energy prices dropped 3.7% year-over-year.

Interpretation

“Inflation” in the US continues to cool modestly, offering a potentially reassuring signal to consumers, markets, and policymakers though most importantly also points out to a weaker-than-usual demand. In April, the Consumer Price Index (CPI) rose 0.2% on a seasonally adjusted basis, reversing March’s slight decline. Over the past year, the CPI increased 2.3%, marking the lowest 12-month inflation rate since February 2021, according to the Bureau of Labor Statistics. This deceleration reinforces the narrative that price pressures are easing, even as certain categories remain sticky.

Shelter once again dominated the monthly increase, rising 0.3% and accounting for more than half of the overall gain. Since most of these are imputed – basically derived from sources dealing with the housing market as it was eighteen to twenty-four months ago – factoring for shelter leaves little price changes anywhere.

Energy prices rebounded 0.7% in April, led by significant increases in natural gas (+3.7%) and electricity (+0.8%), although gasoline prices edged down slightly on a seasonally adjusted basis. Over the past 12 months, energy prices have dropped 3.7%, with gasoline down 11.8% - a “deflationary” force in the broader index (especially when it comes to transportation and manufacturing).

Food prices offered consumers a slight reprieve, falling 0.1% in April. Grocery prices dropped 0.4%, the sharpest monthly decline since September 2020, driven by falling prices in five out of six major categories. Notably, egg prices plunged 12.7%, though year-over-year, they remain up a staggering 49.3%. Restaurant meals, however, continue to get pricier, with the food away from home index up 3.9% annually.

Core “inflation”, which strips out volatile food and energy prices, rose 0.2% in April and 2.8% over the past year, indicating that underlying price trends remain stable but still elevated above the Fed’s 2% target. Services inflation - especially in housing, medical care, and auto insurance - remains sticky. Airline fares dropped sharply for a second consecutive month, providing some offset (and pointing out to a cautious behavior of US consumers).

In spite of confident assurances that tariffs were going to be inflationary, thus far they aren’t even showing up in the CPI at least in the short run.

The (rhetorical) question is, why?