OWLS CAN BE ROACHES

EDU DDA Nov. 18, 2025

Summary: This one takes things up several more notched. Not only does it have hedge fund redemptions, this is a well-known name and its actions taken in response to those requests is only going to make everything a lot worse. In these situations, everything comes down to trust. Instead, during the worst cases, that gets quickly eroded by a lack of information, and by reactions that become shadier and more questionable the more obvious the desperation. This one is up there on those counts.

OH YEAH, THIS ONE IS GOING SIDEWAYS REAL QUICK.

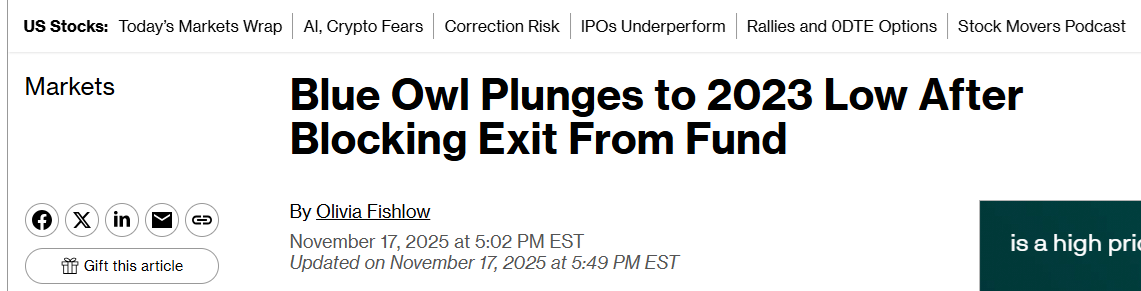

Private credit is spitting out more drama, and this one is a name that should be familiar to those watching the space. Blue Owl has been one of the more well known from among the shadows. Its management is either in total denial, however, or they are playing the same game as always in these situations. History never repeats, but the rhyming scheme comes to be very recognizable.

In other words, right now they’re sticking with we have no idea why people are freaking out.

As far as the freaking out, that much is now confirmed. The fund manager put together a questionable – to put it kindly, the lawyers don’t agree with that characterization – merger whose sole purpose appears to be a transparent attempt to stop redemptions.

Yes, the R-word.

Pieced together with UBS and a few others which had been tied to First Brands, the information which is seeping out and only because of these SEC-mandated disclosures (yay regulations!) is a lot like what we feared where it comes to broader liquidity problems. Investors’ feet do appear to be chilling down to icy status.

The real danger was always if investors and liquidity markets (repo) started pulling funding without asking any questions, indiscriminate inelasticity is historically the Big Thing. It’s understandable why investors in the current era might go that direction given what few answers have been grudgingly provided, typically in the context of bankruptcy courts, have been alarming, to say the least.

Private credit providers like Blue Owl and others have done themselves and the broader marketplace no favors by pitching denials that come off as increasingly desperate for how little they match reality.

We know there has been stupid; or, as Gundlach put it, so much garbage lending. That means there are going to be losses and likely a lot of them, and that’s just from the information available through public sources (like the New York Fed’s Household Credit Survey). It is pure unadulterated lying to claim there is nothing wrong with our portfolios, as Blue Owl is trying to do.

Recent BDC sector volatility reflects technical market pressures, not portfolio fundamentals, which remain strong.

That was from the company’s SEC filing yesterday which just doesn’t pass the smell test.

And it will only ice down even more feet.

The latest

Blue Owl is an alternative asset manager, a private credit provider through its various funds (shadow banks). Some of them are publicly traded therefore are subject to the same disclosures as any stock trading on the NASDAQ, or mostly. Others are strictly private, meaning good luck getting any data.

Early this month, Blue Owl raised a few eyebrows when it announced the intention to combine a couple of funds. The plan was to fold one of its non-traded vehicles, Blue Owl Capital Corp II, into the larger publicly trader version. The former held roughly $1.8 billion in various credits whereas the latter is a behemoth at around $17.5 billion.

Why would they pull this now?

Good question. Management claimed it seeks only to gain efficiency because the two portfolios heavily overlap. Why have two separate managers and administration requirements when it could all get synergized under a single structure. It sounds plausible and maybe would have gone off without triggering enormous backlash had it happened any other time.

In the wake of garbage and cockroaches, however, everyone’s concerns were raised even before yesterday’s disclosures. In them, Blue Owl finally stated that any redemptions in the non-traded fund would have to be halted until after the merger was completed. Not only that, those invested in the smaller fund would be receiving the current net asset value of the publicly traded vehicle, which, because of market conditions, is trading at an enormous discount.

Ahhhh.

Investors, lawyers, even the media immediately smelled the rat (or cockroach-y garbage). Again, management is trying to reassure everyone that everything is fine, this is all just a push for efficiency and that investors who are getting a lower value post-combination are being “compensated” with the higher dividend history (not even a dividend rate, just past payout performance) from the fund they’ll end up invested in.

Legal action started up almost immediately for obvious reasons. This thing appears to be exactly what any rational person would think given, well, everything we know – the non-tradeable fund was getting hit with redemptions and this was the only way to halt them. Not only that, putting the smaller fund together with the larger one whose market price is down so far would also obscure any losses the former might actually contain.

It's being given a 20% discount, which moving forward might prove optimistic.

As stated in the intro, in the regulatory filing management said the same thing it did last month when JP Morgan’s Jamie Dimon first raised the cockroach term; all the portfolios are doing great, fantastic, wonderful. The only reason any of this is happening is that investors are overreacting to bad actors stirring up trouble.

Private credit would never, ever be so garbage as people seem to be thinking. How dare Jamie Dimon for mesmerizing people.

If you recall, this is the same answer given to Bank of England’s top man on the growing mess/disaster. What Mr. Bailey told Britain’s government was that even at this early stage he knew he was getting the run-around from fund managers and management teams:

BOE Governor Andrew Bailey told a Parliament committee on Tuesday that “alarm bells” were ringing in the sector. He cited conversations with industry figures who assured him that “everything was fine in their world, apart from the role of the rating agencies,” in an echo of the confusion over the quality of debt in subprime debt securitizations almost two decades ago.

“I said, ‘Well, we’re not playing that movie again, are we?’” Bailey told a hearing of the House of Lords’ Financial Services Regulation Committee in London. “If you were involved before the financial crisis and during it, alarm bells start going off at that point.”

Oh yeah, they are definitely going to be playing that movie again.

While the scale is clearly different from 2008, the process is far too similar starting with the huge information asymmetry. In fact, the lack of disclosures and answers is historically the biggest unappreciated aspect to crises. Blue Owl’s actions will not help in that regard. If anything, they will only create even more mistrust at a critical time when the macro and financial pressure is still ratcheting up.

Lawyer up

The shape of hedge fund investing is a critical crisis barometer, even more than some generic canary in a credit coal mine. Those equity-seeders are much closer to the source even if they won’t have any better knowledge of what’s been unfolding down in the shadows. Plus, a rush to the exits creates enormous problems which then become forced selling and then it’s off to the races from there.

I recounted the experience with the pair of Bear Stearns high-grade funds and how those fit in the earliest phase of the 2008 crisis – really the pre-crisis precursors – in a DDA which you can find here. It covers all the key concepts as far as the process and the critical role trust plays.

Like now, the big one was the R-word, meaning redemptions rather than recession as in the macro context. However, you get enough R-word from hedge fund feet under these sorts of circumstances and the other one in the macroeconomic sense will easily become a foregone conclusion.

Accompanying the latest news on Blue Owl was this little nugget which only adds more fuel to the growing frozen-footed fire:

Redemption requests in the non-traded fund surged last month, exceeding Blue Owl’s pre-set limit. The firm chose to honor about $60 million in redemptions, or 6% of the vehicle, according to regulatory filings.

You don’t say?

It further establishes they’re lying about why the sudden merger. The combination clearly has nothing to do with efficiency and everything to do with liquidity pressure. And either way you might interpret the move leads to only bad conclusions.

Management could be honest when claiming that its portfolio is fine and that it is taking these steps to preserve the fund lest it suffer more redemptions which create distressed selling that won’t be any good for anyone in Blue Owl or outside of it. If so, they are simply deluding themselves alongside attempting to fool their investors. We know garbage.

Or, they’re simply hiding losses and using the merger to bury the whole thing and hope it goes away, a version of extend and pretend.

It appears everyone’s money is quite literally on the latter. There are already notices being posted by lawyers seeking to create a class action after gating off redemptions, particularly their timing, which just stink. There is zero chance this has anything to do with anything other than stupid garbage and hoping to avoid becoming the latest victim of cockroaches, and, in many ways, becoming a cockroach itself.

A zombie owl of a roach?

Blue Owl’s management had already stirred up ire when last month it publicly responded to Jamie Dimon’s cockroach remark with some of the worst takes on everything. There is spin and then there is obvious lying. This was clearly the latter:

Banks might want to look at their own books for any “cockroaches,” Blue Owl Capital Inc.’s co-chief executive officer, Marc Lipschultz, said on Tuesday, standing in fierce defense of private credit.

Tying private credit to the fallout from the bankruptcies of Tricolor Holdings and First Brands Group is an “odd kind of fear-mongering,” he said at the CAIS Alternative Investment Summit in Beverly Hills, California. “We’re not seeing rising defaults, we’re not seeing companies struggling.”

No? No companies struggling? Come on!

That wasn’t the only one; CFO Jonathan Lamm uttered what may go down as more of those famous last words akin to “subprime is contained” or Bill Dudley’s infamous statement how “nothing is imminent” two days before the entire eurodollar world ended.

The only reason that the sector should be trading off like this is if there is a massive amount of credit defaults coming, which we see no evidence of.

FYI, BDC refers to a business development company, the specific legal vehicle which allows something like a private credit fund shadow bank non-depository financial institution to be traded like a regular stock. And Lamm was right in that share prices of not just Blue Owl’s BDC but nearly all of them had been sinking all year, going all the way back to February.

They took a dark turn in mid-July, right when the dollar started rising and bull steepening got to be more bullish. Defensive measures all around, including, for once, this area of the equity market even as the AI bubble-ness was reaching its absolute apex.

Maybe there won’t be a “massive among of credit defaults coming” but increasingly we’re seeing evidence hedge fund investors don’t care to stick around and find out who might be right about it. That’s even more important and critical than the potential credit losses themselves.

Bubbles rhyme with busts

Information asymmetry was, again, at root in the 2008 crisis. These are credit problems which become monetary ones, the same process which had turned credit fears into deflationary conditions and then depressions throughout industrial economic history.

The 2008 case was only unique in its format, with repo and wholesale markets and everything priced by derivatives and tied together very closely in a global network that participants beforehand believed was sturdy and reinforced, which instead turned out to be bottlenecks rather than backstops.

Going back further, one of the men who can lay claim to being the father of the Federal Reserve was himself very nearly a victim of this same information asymmetry. As a bank owner in Oklahoma during the 1893 panic, Robert Owen nearly lost his firm which, like Blue Owl today, he says was otherwise sound. Only, in Owen’s case there are legit reasons to believe he wasn’t being deceptive.

Before he became Senator for his state, Owen had founded a bank back home only to see it nearly extinguished in that event. As a presumably sound practitioner of bank principles (I have never seen any evidence otherwise of his First National Bank of Muskogee, though that would be something of an obscure historical observation) you can understand why he might detest any process which would in a single stroke destroy “good” firms at the same moment as “bad.”

Indeed, that is what panics have been in all history, the blind withdrawal of actual money from banks, both sound and insolvent, and very likely more of the former than the latter. The appeal of currency elasticity, or what we call today liquidity, was that “objective” mechanisms might be put in place to determine the difference between good and bad banks, and thereby allow a “reserve” system to reject systemic pressure in favor of only those who proved solvent.

This was the Bagehot doctrine – central banks which would lend freely at high rates on good collateral when no one else would in the private marketplace.

That puts the onus upon banks or, in this case, shadow banks to establish in which category any one of them might belong. And therein lies the central problem of all time. Who is to say what’s true? Bank managers like Senator Owen are rarely if ever going to confess they messed up and should be bankrupted; or, exactly what BoE Governor Bailey was implying in his statements.

The problem remains information asymmetry.

This historical problem has been referred to even to this day by quoting Senator Owen in one of his more famous phrases. Former Chairman Ben Bernanke spoke of it on several occasions, noting in one of them, “it is the duty of the United States to provide a means by which periodic panics which shake the American Republic and do it enormous injury shall be stopped.”

FIVE YEARS LATER, THEY DID IT AGAIN

And then he promptly failed at that very mission (a few years after promising Milton Friedman the Fed would never let something like this happen again).

That is not the full quote, however, as Senator Owen had much more to say on the subject even if the full phrase has never gained that same notoriety (as it should):

It is the duty of the United States to protect the commercial life of its citizens against this senseless, unreasoning, destructive fear that seizes the depositor when he has been sufficiently hypnotized by the metropolitan press with its indiscreet suggestions.

The role of villain is played by both sides; or, more accurately stated, both sides blame the other. You can read almost exactly Owen’s sentiment into the statement spit out by Blue Owl in yesterday’s SEC notice. Markets are ablaze with mistrust for reasons that simply escape Lipschultz, Lamm and the boys.

It isn’t hypnosis that is at work here, instead, again, lack of information. What information we do have all points in one direction, that of cockroaches and garbage. To dispel the point requires more not fewer disclosures. And it also requires staying away from transparently dirty tricks like forced mergers at lower valuations.

You want to convince the world portfolios are good, open the books not close up redemptions. We have to give the lawyers – and the metropolitan press – this one.

The irony here is that it is bankers who are being honest, for once, at least one of them, Mr. Dimon. But it’s only because the shadow bankers are now on the other end in many ways with regulated depositories caught in the middle.

The latter aren’t innocent bystanders, only in this case not the greatest garbage.

This is simply how it goes, everything becomes derivative of trust. This is where collateral and not just in the Bagehot sense is supposed to step in. But, as we saw in 2008, collateral abuse sows even more mistrust on both sides. We’ve definitely got that going here in 2025, too.

Had any of the private credit firms said they have good collateral, after Tricolor, First Brands and the others, would the public believe it?

Blue Owl’s antics aren’t going to win either an argument or fans here. If anything, the whole stinky mess is self-defeating, a sort of financial equivalent to the Streisand effect. This thing is so shady, it is far more likely to contribute to cold feet as to convince anyone Lamm et al are being honest about current conditions and limited future loss prospects.

What we’re seeing isn’t just mistrust, people are acting on it and on both sides. Robert Owen would be displeased, though hardly surprised.