FEAR THE STUPID FACTS

EDU DDA Oct. 23, 2025

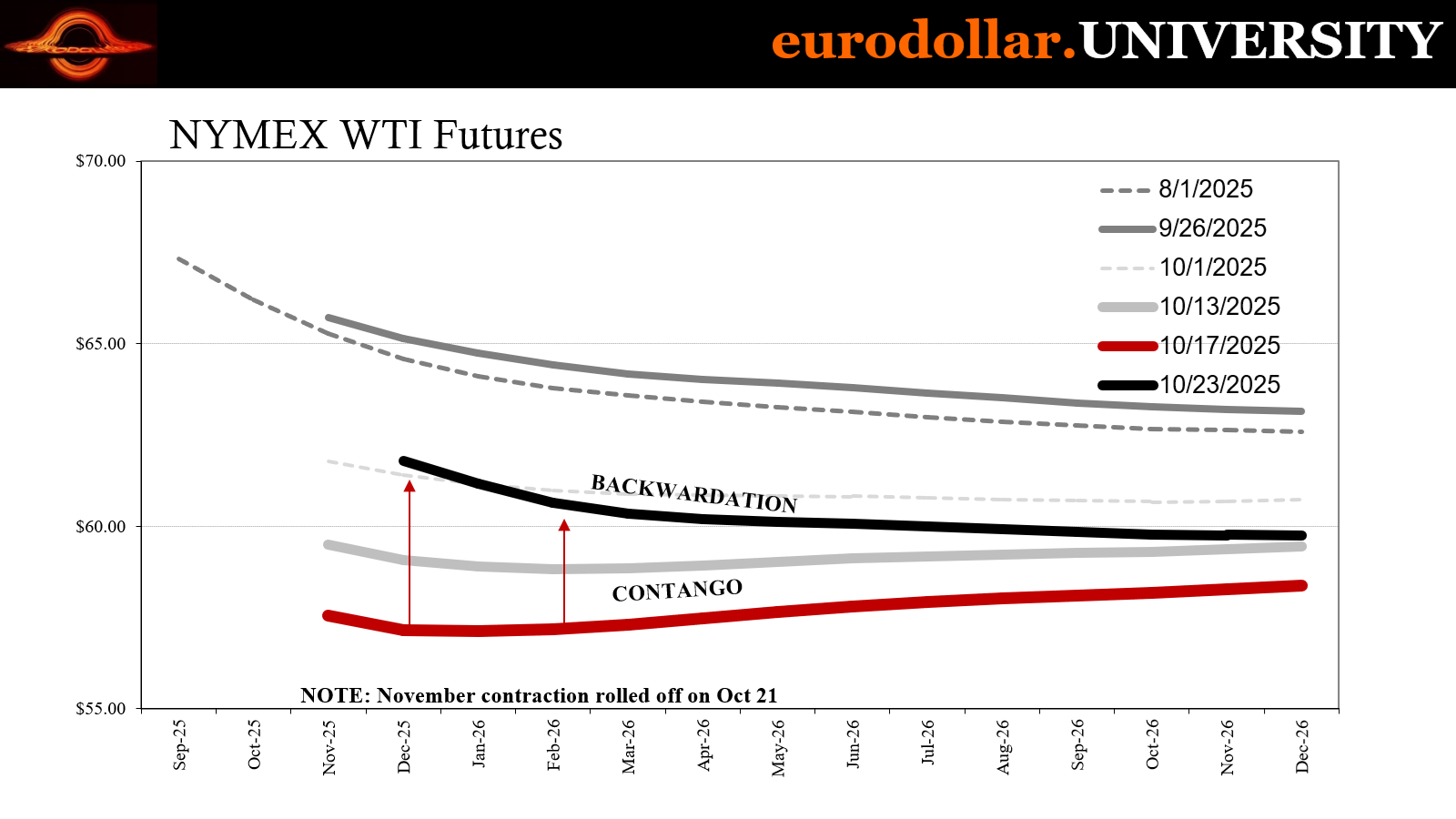

Summary: Geopolitics violently reshaped the WTI futures curve right out of contango and into sharp backwardation again. While this is not uncommon, in this case it’s a bit volatile anyway. In spite of that, the WTI signal remains which is a much bigger fact than most people fear. The reason is the level of stupid that took place in the bubble credit period and why it did. There’s a lot more to it than the public might appreciate. One central banker already mentioned parallels to 2008, and this is the chief one made all the more relevant by more usage of the Fed’s repo, elevated SOFR, not to mention the likely imminent end of QT.

Sanctions on Russian oil aggressively reshaped the WTI curve. In addition to sending crude prices roughly 5% higher at the front, almost all the buying was concentrated around that area of the futures curve and flipping it right out of contango back into backwardation once more. As I wrote when contango first registered, this is to be expected, though not quite to this degree of volatility.

Because the curve flip isn’t from economics, the contango signal holds which, as we’ll discuss, is a lot bigger deal than it might seem. In fact, our theme here is sort of hidden truths and the great effort it takes to stay stupid around them.

Outside of energy, the Fed continues to get a few billion in repo facility use. Someone(s) just today took another $3 billion on UST collateral (with a few testers bidding for $1 million each on UST and MBS). As before, not huge amounts yet also non-zero for fifth time out of the last seven working days.

Something has changed, but what?

Just as expected, mainstream expectations are growing for an end to Fed QT as soon as next week’s FOMC meeting. Two banks, two of the biggest, JP Morgan and Bank of America are calling for an end to the balance sheet runoff. Blame QT has arrived with bank reserves modestly declining.

However, you take the signal from WTI contango (even if off today and maybe for the next little while) and put it together with the information backlash in credit markets, the risk aversion is starting to seem a little too familiar. The Bank of England’s Deputy Governor Sarah Breeden told the House of Lords she saw parallels to the 2008 crisis and it is hard to argue with the spirit of that point.

I still think that’s overdoing it by quite a lot, yet the point remains. The comparisons aren’t in the overall scale of the credit expansion which preceded the monetary panic, rather the mechanics of failure. Basically, how the interconnections between banks around the world and even between the same banks located in different places, obscured far too much.

The technical term is information asymmetry and during credit reversals it can indeed become a killer that officials, save Ms. Breeden, don’t see coming. Outwardly, everything looks good and calm when underneath there’s a maelstrom brewing for all the same historic patterns. People do a lot of stupid when they believe there is no downside to it.

And once that belief is revealed to be a mistake, that’s the clincher for ultra-low interest rates for a long time, just as the start.

We certainly aren’t to that point yet, nowhere near, however as Ms. Breeden pointed out, a few too many eerie similarities to be so complacent. Not when you truly appreciate the levels of stupid getting to the point. That’s where the years leading up to 2025 really do align with the few years before 2008.

Re-backwardizing

From our Daily Briefing:

We are out of contango, but not for good reasons! West Texas Intermediate (WTI) futures surged more than 5%, climbing above $61 per barrel, their highest level in two weeks. The rally followed Washington’s latest escalation in its sanctions campaign against Moscow, targeting Rosneft PJSC and Lukoil PJSC, two state-linked giants that together account for nearly half of Russia’s oil exports, or roughly 2.2 million barrels per day.

The political theater surrounding the sanctions added to the volatility. President Trump announced he would press major buyers to curb Russian crude purchases, with plans to discuss the matter with China’s Xi Jinping next week. The White House also reiterated that India would cut its intake, a move that could further squeeze Russia’s key markets

The contract for the current front month, December, surged by $3.29, or 5.6%, to nearly $62. January, however, “only” gained $2.84, or 4.9%. Meanwhile, out to December 2026, that contract only increased by $0.74, or 1.25%. This yawning disparity front to back took the contango right out of the curve.

Where the January 2026 to December 2026 had flipped to more than $1 last Thursday following Zions and Western Alliance, the same spread is now flopped $0.88 in backwardation. It is not unusual, in fact expected, for initial contango to flip in and out for some time before finally sticking once fundamental confirmation is obtained (tight money as well as lacking demand, the latter piling crude into inventories).

This is just nuts. But like we’ve seen in periods when backwardation itself had skyrocketed for non-economic reasons during the previously engineered supply squeezes, the wild swing from contango to backwardation is hardly a complete rethinking of basic economics. The market remains sensitive to geopolitics in one part because of the lack of inventories.

Supplies are said to be tight right now even with the looming glut. That won’t arrive until next year, not fully (some of it is already showing up especially in waterborne stocks). Energy participants have continuously chosen lower inventories both as a commentary on their lack of faith in demand but also more recently knowing next year’s epic overhang hangs over the entire marketplace.

While the short-term remains in tight conditions, extreme volatility might have to be the norm. Rather than the futures curve flipping back and forth between a little contango and a little backwardation, mainly just flat, this thing just might gyrate wildly from majorly backwardated to steep contango then back again based on unpredictable political factors temporarily seizing the initiative from awful money and macro.

But as those others become the actual glut, sanctions or similar won’t be able to move the needle because demand just isn’t there. And, as we’re going through the rest of today’s deep dive, neither is the money.

Keeping the window busy

Someone or several someones bid for $3 billion Federal Reserves today following yesterday’s zeroes. That makes five times over the last seven business days there has been borrowing. Up to recently, the program had been quiet apart from quarter ends. The one exception was last month’s bottleneck, right on September 15.

While I think that was an initial warning shot given how conditions were evolving even then around the monetary world, it still could have been overlooked on technicals as the absolute low spot on the yearly liquidity calendar.

Here in October, this is something else. For the mainstream, there can’t possibly be a connection between the ongoing demand for the repo facility and the near-regular blowups in subprime autos and broader factoring finance – shadow banks non-depository financial institutions. Therefore, Blame QT is getting dusted off and re-entering the conversation.

I pointed out on yesterday’s YT video and in a previous DDA that the first step toward maybe the inevitable next not-QE is going to first have to be the termination of QT. In addition to the repo facility, SOFR rates continue to be uncomfortably high. While SOFR has come back down from last Thursday’s spike to 4.31%, six basis points above the upper limit for fed funds, yesterday it was only down two basis points from Tuesday’s 4.23% despite no need for Fed repo.

FRBNY won’t post today’s SOFR rate until tomorrow, though it wouldn’t be unreasonable to expect it to have gone back up again. That’s in a range roughly ten to twelve basis points above where it “should” be (notice on the chart how SOFR tends to be well underneath the FOMC’s upper limit; the fact that is no longer is said to be evidence reserves are no longer plentiful and might even be tight when the rest of the real world is already tight and getting more averse).

Like 2019, the elevated repo rates that go into SOFR (after they get filtered and bastardized before become the “official” benchmark) are certainly going to be the second item on the FOMC agenda next week. First, the debate about the next rate cut is almost certainly decided (see: charts below), barring some massive surprise tomorrow from the release of the delayed September CPI.

The consistent repo volatility already makes the Fed’s argument for termination of QT. Everything in their world is bank reserves, and if key money market rates are going to be persistently a problem, then bank reserves will be adjusted in response (notice, again, everything is always a reaction, never any proactivity).

Several Wall Street shops now suddenly agree:

Strategists at JPMorgan Chase & Co. and Bank of America Corp. expect the Federal Reserve to stop shrinking its roughly $6.6 trillion balance sheet this month…Both banks brought forward their calls on when the Fed will end quantitative tightening — the unwind of its portfolio of Treasuries and mortgage-backed securities — citing a recent rise in borrowing costs in dollar funding markets. They previously forecast the runoff, which began in June 2022, would end in December or early next year.

What necessarily would follow after the end of QT would be a restart of QE, which will never be given that label, so the second not-QE QE in recent memory. It would have to take some more money market volatility to go that far, though. There’s already enough taking place to clear the lower hurdle for ending QT, but getting to not-QE QE especially when the committee is so inflation-obsessed would be a little more challenging.

Unfortunately, the entire system seems up to it.

Stupid is as stupid did

It sounds like I’m exaggerating when I say Jay Powell invited this mess, but it’s absolutely true in several critical ways. Private credit shadow banking NDFIs went looking for excuses to pile on the risks, to reach for yield, to make leveraged returns that rational analysis otherwise would have never touched. Upsides are always too much for human nature to resist.

When you add the go-ahead from the all-insightful Fed Chair and its sophisticated (garbage) models, the imprimatur is more than simply psychological. Under Jay Powell’s solid economy, you aren’t going to be questioned for doing really stupid stuff. After all, whomever might offer any criticism is likely to be doing the same thing for the same reasons.

You gave that guy money? Jay Powell said there’s no downside. Heck, because Powell did, I didn’t even bother asking for any vital information from him.

There gets to be this rush to just do deals no matter what, a dark veil of rationalization or tunnel vision where the only factor which matters is volume even if at the complete expense of minimal scrutiny. That was one of the key factors which made 2008 its own Great.

Those specific parallels are all over the shadow bank sector right now, only suddenly the marketplace now cares about details:

And yet the breakneck speed at which all of them happened [bond price crashes for certain bad company debts, including First Brands] is so unusual that a nagging worry is beginning to grow louder on Wall Street: What if these kinds of collapses, capable of taking bonds from par to cents on the dollar in a matter of days or weeks, are not an aberration after all? What if they represent the new normal in a go-go market that’s so frothy it chooses to assume — almost without exception, almost regardless of the risk involved — that everything will work out fine?

“Wall Street shouldn’t have been financing this company [First Brands],” said Anton Posner, chief executive officer of Mercury Resources, a supply-chain logistics company, and a board member of the Americas chapter of the International Trade and Forfaiting Association, which serves the trade-finance community. “They didn’t dive enough into due diligence,” he said, and “didn’t even know its business model.”

These aren’t the one-offs people are hoping they are, either. Instead, we’re getting one after another which share all the same deficiencies now being uncovered by the weaker economic and monetary circumstances. But even that’s still being downplayed by the same thinking, as the same article cited above goes on to add, “The fear isn’t that a crisis is brewing — at least not as long as the economy continues to grind along.”

See what I mean about contango?

That’s a red flag of red flags on “as long as the economy continues to grind along.” What creates the biggest backlashes is this combination of rushing to get deals done at the expense of care and a range of misinterpretations starting with the state of the economy and really the degree of danger it might be in.

Contango isn’t being driven by fear, nor is it ignoring the key relevant facts.

Because if there is a flat Beveridge in our future, the names already on our list of shadow failures won’t be - can’t be - just a few aberrations. People are starting to finally get the sense of both; the lack of information and misidentified macro and market risks that badly need to be corrected.

The absence of basic due diligence under Powell’s cover of rationalizations argue the correction might have to be more widespread and severe. Too many tons of stupid.

The outward illusion

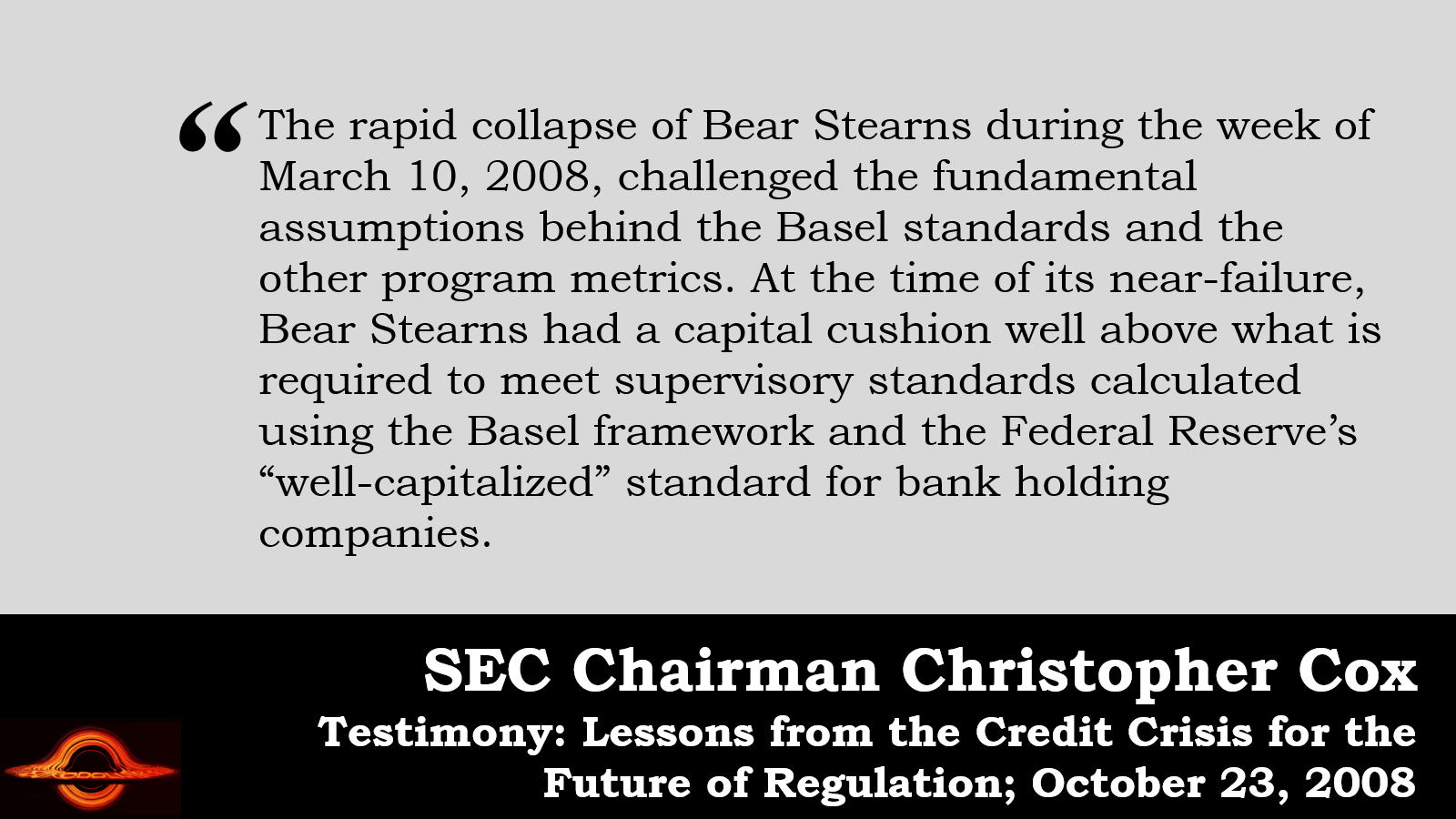

Since we’re talking parallels to 2008, without making that our expectation, it’s useful to go back to that experience for direction and guidance. It’s not just that policymakers didn’t truly get what they were doing, they didn’t even know what they were seeing for all these same problems, starting with not taking market signals for what they clearly stated.

On July 15, 2008, then-Chairman Bernanke was before the Senate attempting to be cautiously optimistic. Sure, there had been a lot of nasty surprises, he said, but there was a growing sense the worst was behind. For the policymakers at the FOMC, they had already let themselves believe Bear Stearns might have been the end of it.

While that was his main message, it was completely overwhelmed by Fannie. And Freddie. The GSE’s were in trouble again, not that anyone in any position of authority agreed with the assessment. Markets were wrong, they claimed. One who made exactly that remark was Senate Committee Chairman Christopher Dodd, of Dodd-Frank fame, who opened Bernanke’s Humphrey Hawkins examination with the following absurdity:

In considering the state of our economy and, in particular, the turmoil in recent days, it is important to distinguish between fear and facts. In our markets today, far too many actions are being driven by fear and ignoring crucial facts. One such fact is that Fannie Mae and Freddie Mac have core strengths that are helping them weather the stormy seas of today's financial markets. They are adequately capitalized. They are able to access the debt markets. They have solid portfolios with relatively few risky subprime mortgages. [emphasis added]

What were those “crucial facts” markets were unable to figure, caught as they supposedly were in the irrational grips of fear? As it turned out less than two months later, the GSE’s did not survive. They were turned over to federal government conservatorship the week before Lehman. Then all hell broke loose everywhere.

In order to scold the stock market for daring to question “crucial facts”, joining Ben Bernanke at his Congressional appearance on July 15 was Treasury Secretary Hank Paulson and SEC Chairman Christopher Cox. Mr. Cox’s presence was even more noteworthy than Secretary Paulson’s. Just that same day the agency imposed a ban on naked short selling, not just for shares belonging to the GSE’s but also those of primary dealer commercial banks.

YEAH, ONLY AFTER LEHMAN DID COX REALIZE WHAT THE FACTS WERE ALL ALONG

It was the proximate cause of all that came next. Oil prices, importantly, peaked on July 14, 2008, falling sharply with pretty much everything when news of the short selling ban was released to the public. The crucial facts that the global markets began contemplating July 15 and after was that authorities, especially Ben Bernanke, had no idea what they were doing.

In policy terms, however, everything was simply rearranged starting with the whole financial frame of reference. If July 2008 was about how Bernanke believed the Federal Reserve had prevented some truly bad stuff from happening, by July 2009 it was purposefully switched to how the Fed had prevented some truly bad stuff from becoming truly truly bad stuff.

Speaking before Congress in the summer of 2009 again because of Humphrey Hawkins, Bernanke claimed the government including the Federal Reserve “may well have averted the collapse of the global financial system.” As Congressman Barney Frank, of Dodd-Frank fame, noted on the same day, “no one has ever gotten re-elected with the bumper sticker that says, 'It would have been worse without me.'”

THE FED DID NOT SAVE ANY JOBS WHATSOEVER

As a staunch defender of the central bank, he actually meant that as a compliment to Bernanke. Criticism, supposedly, was lacking crucial facts and people were starting to get the sense that maybe a global monetary panic maybe should not have happened to maybe any degree at all. In the years since, Frank’s words have attained more literal truth than figurative defense. Nobody wants to believe the central bank is little more than a monetary passenger, yet the nagging feeling persists.

One reason why is that as ignorant as many shadow lenders have been about their borrowers and the collateral facts they entail, the Fed is just plain clueless about a whole bunch more. For starters, then, that means having followed the Fed’s lead for the last several years isn’t just a small miss and error.

Officials then and now don’t know how credit works. They don’t know the monetary capacities (bank reserves will solve everything!). Policymakers can’t even adequately describe economic circumstances and the risks to them. None of those seem to matter while everyone is under the spell of stupid.

Once the stupor begins to dissipate, dead canaries begin floating to the surface to the shock and surprise of the Bernankes and Powells then everyone else who hasn’t been paying attention to spreads, curves, and now contango.

What makes this cycle especially insidious is that its roots reach back to the pandemic and really the price illusion. It was indeed an illusion, but for many it was a reason to go to sleep, to make bank out of shadow banks without having even the slightest inkling to take reasonable care.

The government’s “success” invited a free-for-all for a time. First, it was the permanent plateau of prosperity; that government “stimulus” hadn’t just worked, it actually worked so well the world was red-hot and inflationary.

Even when the world began to emerge from the mirage into forgot how to grow, in stepped Mr. Powell with his strong and resilient rhetoric to keep up the stupid though the fundamentals had gone further and further out of hand.

So, more reaching for yield under cover of the Fed in spite of the risks demonstrated by Silicon Valley and its friends. You want to know why SVB and Credit Suisse feature prominently on all the world’s bond markets, this is it. Another missed signal, another time when arrogant top-level officials claimed markets were unable to distinguish between fear and facts.

Their mistake is painted as fact on every important bond yield chart, which the stupid always went to great pains to ignore out of fear of missing out on strong Powell. The facts are no one practiced nearly enough fear, as Anton Posner adequately explained.

So, now all hope rests upon “as long as the economy continues to grind along” to which we keep getting signals the only grinding is on the road to flat Beveridge.

And that road not coincidentally happens to be the same one leading to interest rates which go down by a lot to stay for a long time. It was hard to see that a few years ago when the signals started up. Still quite difficult just last summer while job market data threw up a bunch of red flags. Even this summer in the aftermath of April, when the world wanted to believe the economy was again resilient since it didn’t immediately collapse under trade war pressure.

The situation really is becoming more not less certain. Fear stupid, that’s a fact.