SHE’S COOKED. CHANGES NOTHING.

EDU DDA Aug. 26, 2025

Summary: They are trying to make us care about the Fed’s independence. Lisa Cook was fired by President Trump unleashing a tempest in a teapot. The truth of the matter is, with or without Ms. Cook rates are going down. The evidence continues to pile up for this coming from every direction. Housing prices fell again, consumers are expecting recession like they had in April, and copper-to-gold is hundredths of a pip above another multi-decade low. Not only are low rates coming, they are solidly NOT inflation as some continue to claim.

A METAPHOR FOR THE ECONOMY, TOO.

We keep getting told that threats against, and now the firing of, Federal Reserve Board member Lisa Cook are themselves threats to financial stability and worldwide, too. Frankly, I could not care less in that sense nor should you. It is political theater, sure, but almost nothing hangs in the balance. Short-term interest rates are going lower regardless of whether Ms. Cook is there today, tomorrow, or next year.

As far as the Fed’s independence, that’s something we can easily chuckle under our breath. From LBJ’s infamous jeep ride given to then-Chairman William M. Martin to President Joe Biden’s pow-wow with Powell in 2022. Political pressure exists, therefore so does the myth of independence.

The Board itself has undergone upheaval before and relatively recently, too. Several governors were on the verge of being dismissed for financial “irregularities” just a couple years ago. Cook’s position is a tempest in a teapot that avoids any real economics (small “e”).

THE FED DOES NOT MATTER.

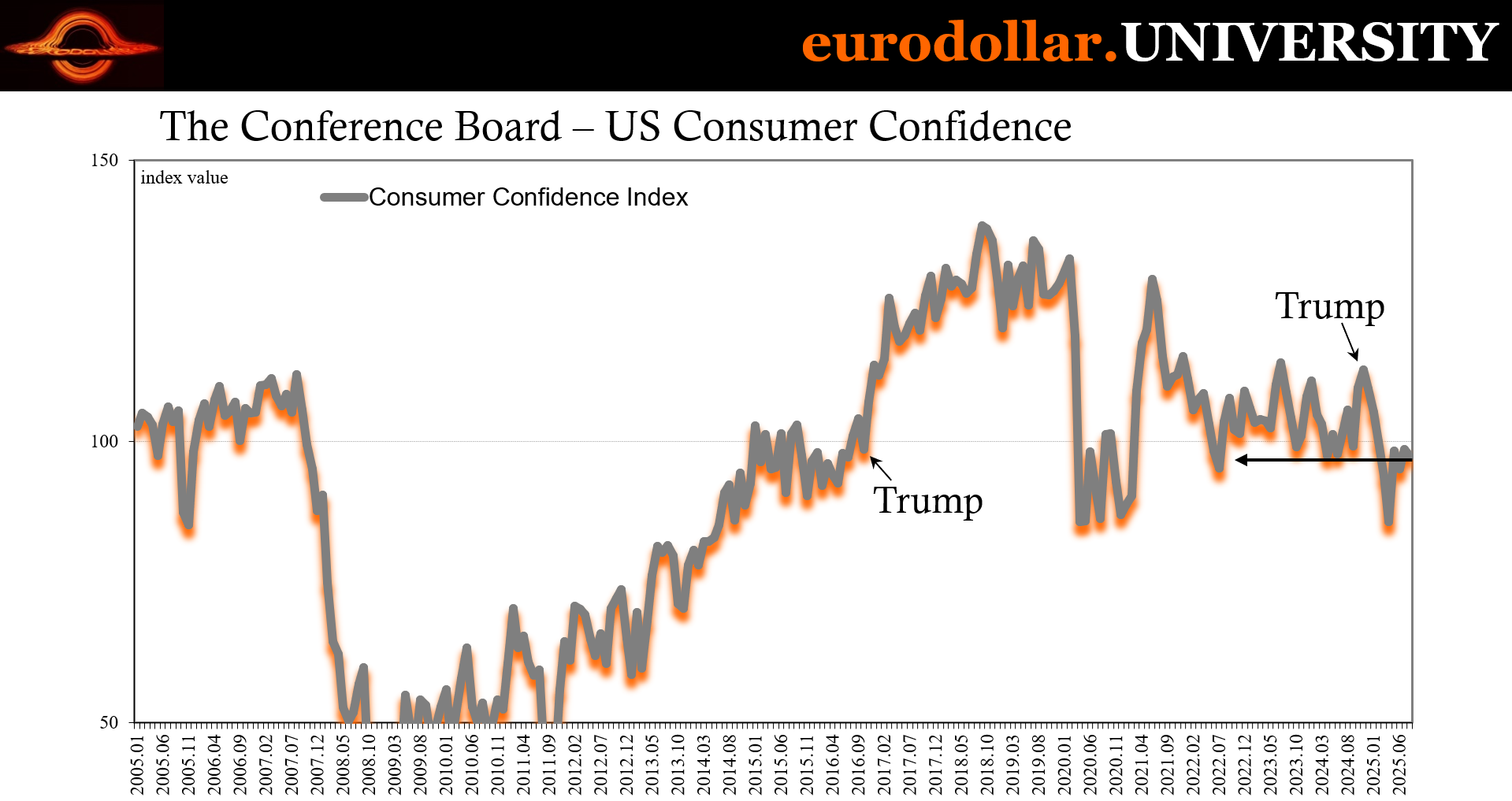

IN THE SPACE OF A ONLY A FEW HOURS, BLOOMBERG HAD ALMOST A DOZEN STORIES ABOUT DEAR FED.

Even when it seems to, at the end of the day, eventually reality forces the FOMC to get with the program as is taking place again currently. Given the range of incoming data from all over the place, rates are going down whatever anyone at the Fed or in the government might want them to do.

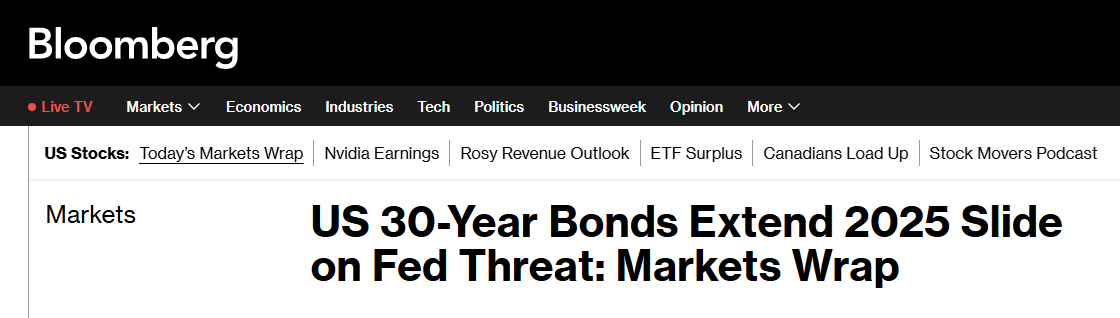

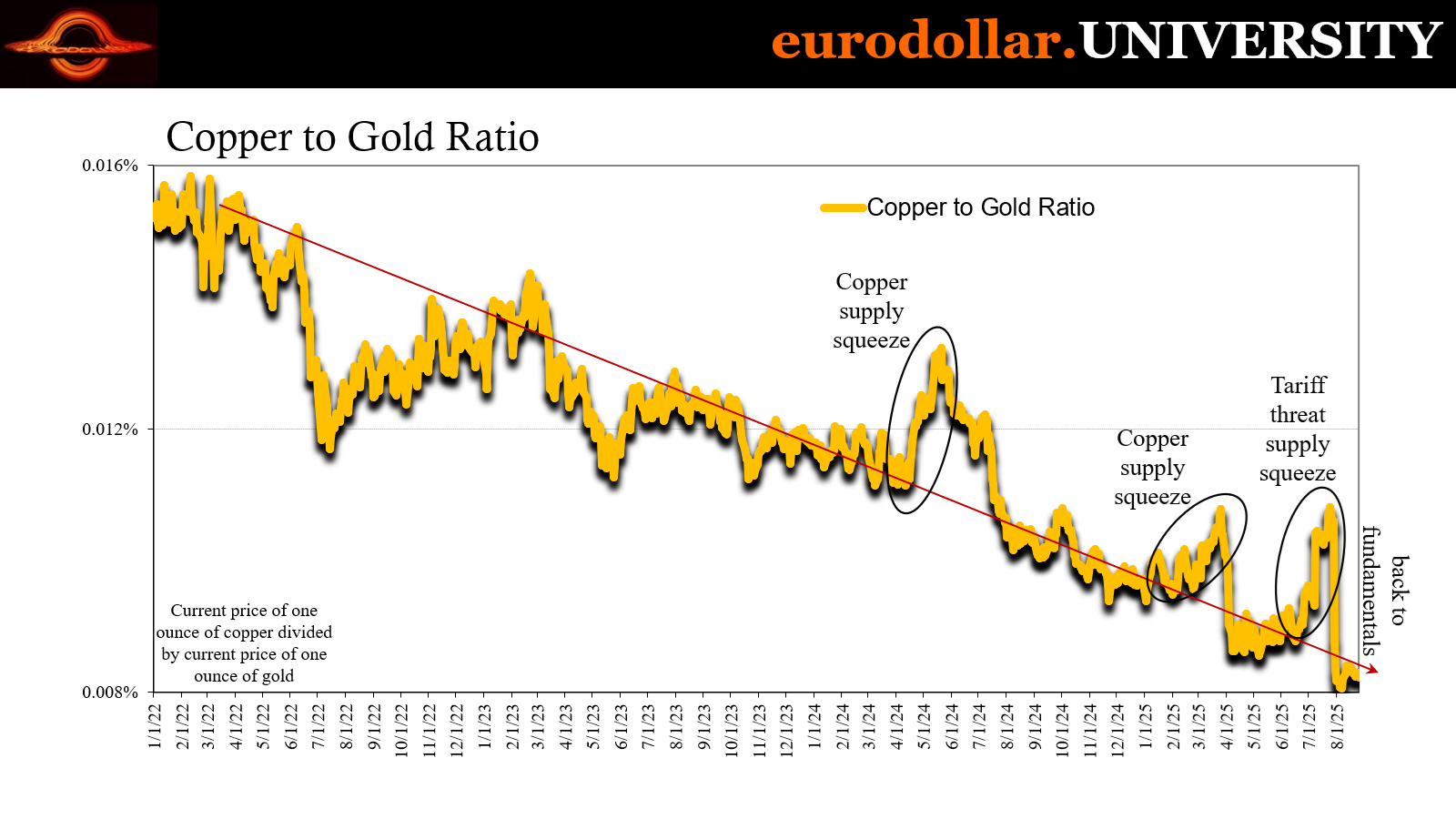

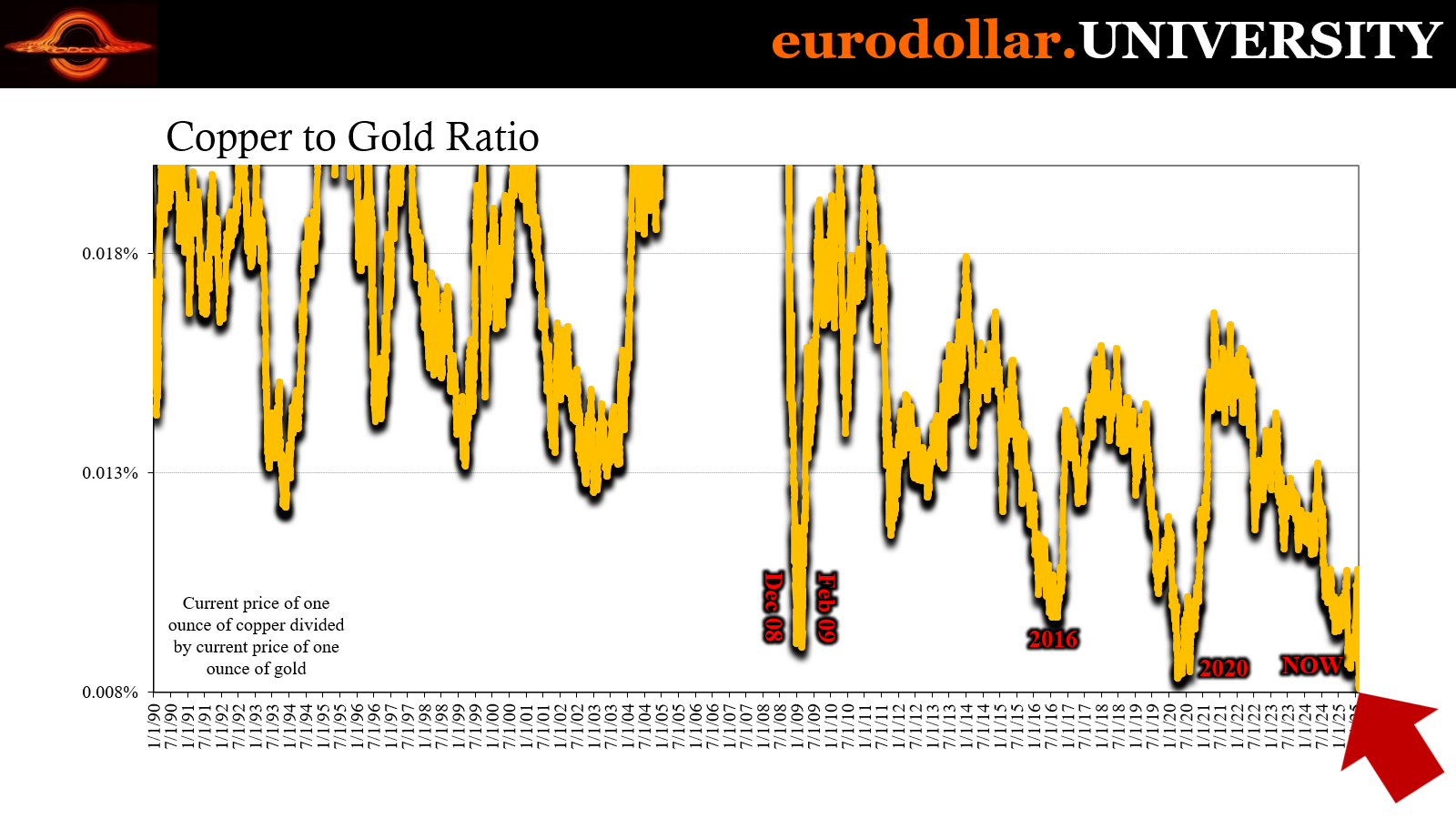

As a result, the curve is bull steepening, home prices are falling, copper-to-gold has sunk to incredible lows and stayed there. Consumer confidence slides again keeping the Conference Board’s index solidly in recession territory, meanwhile consumers themselves report still-rising fears for their jobs and their own highest specifically recession fears since April.

Nothing other than the stock market was fixed in between.

All roads lead to lower rates - however they might get there.

Teapots from tempests

Having warned FRB Governor Lisa Cook she should resign over alleged mortgage application improprieties, today President Trump officially removed her from that position, triggering the usual and political hand-wringing amongst mainstream commentary which values the purportedly independent Fed far, far more than the real world does.

To me, the only real matter to discuss is why Chair Powell hasn’t come out and announced the Federal Reserve is conducting an official internal investigation into the matter. By every account, there is reasonable suspicion of wrongdoing, which the institution should take very seriously; or at least pretend to be taking seriously. A thorough dive into Cook’s paperwork should be welcomed by everyone, from the rest of the FOMC to the embattled former(?) governor herself.

This is not the first time top-ranking Fed officials have been under suspicion for financial irregularities. Two branch presidents – Dallas’s Robert Kaplan and Boston’s Eric Rosengren – even ended up resigning (“retiring”) in 2021 after only being presented with possible “irregularities” in some of their stock trades; trades that had to be disclosed. Vice Chair Richard Clarida “voluntarily” gave up his seat for the same just a year after the other two.

“HEALTH ISSUES”

For her part, Cook appears intent to fight which will only serve to fill media stories about protecting the independence – weirdly not the integrity – of the allegedly hallowed institution. Few if any where it matters hold the Fed in such regard. As I’ve pointed out, the real markets love betting against the place and its policies. Whether in cash markets (curve inversions) or derivatives, especially swaps where spreads get to be more negative as positions are staked out directly in opposition to the philosophy and interest rate policy execution.

Where it comes to financial markets, only parts of the stock market still cling to the idea of a capable gang of technocrats feeding them directly from a punchbowl that never existed.

The fact is the narrative of an all-powerful and independent Fed serves that market rather than any real effect from interest rates or QE. It is easier to sell risky assets to the general public if the general public truly believes in the Wizard.

Cook’s battle might chip away at the presentation. That’s not a threat to the economy or monetary system by any means. If anything, it might actually help pull back the curtain.

Simple rejection

There are, as you might imagine, all sorts of wondrous ideas about what Cook’s removal might lead to: real chaos, dogs and cats living together, mass hysteria. Some especially in mainstream circles are trying to say that if President Trump gets his way and bullies the Fed to lower rates it would counterproductively lead to inflation which would then push yields back higher.

In other words, removing Cook gives the President a majority which then acquiesces on rate cutting. Since, everyone says, lower rates are powerful stimulus, and since the economy, they also claim, doesn’t really need any more, already verging on tariff inflation as it is, dropping the fed funds benchmark a hundred basis points or two risks pushing the whole thing over the edge – the inflation cliff.

Economic illiteracy on full display.

Falling ST rates are consistent with the bull steepening the yield curve has been experiencing for going on two years now. The fact it began almost a year ago already with zero inflation from it should offer a clue. The still-inverted curve remains inverted out to the 3-year spot meaning regardless of Lisa Cook or whatever tariff fever, markets continue to expect and position for significantly lower rates. That has not changed only the timing has.

The yield curve itself was always going to un-invert and there’s only one way to do it – ST rates would have to move to les than LT rates. That process isn’t the market suddenly pricing the inflation it has consistently said has zero chance of happening.

At issue is what ST rates truly represent. For the punchbowlers, they are massive stimulus therefore inflation. To them, it doesn’t matter how ST rates come about, and even if the market is expecting them it should also be anticipating inflationary consequences.

This is where a broad survey of signals does help. If anyone really is conflicted on the curve steepening and the alleged inflationary potential lower rates might represent, then other market positions should correspond to that notion. And the simpler the better.

To begin with, few are aware of the swap market and this includes most of the hedge fund types in the marketplace or those running huge portfolios of assets you see on CNBC. I’ve run across quite a few in my own experience and, to a person, they have no idea what the market is or what it means. They are all interpreting shadows on the cave wall.

If there was any inflation potential in that market, we’d see it as a swap “smile.” In other words, spreads would be downward sloping in the short run but then at farther maturities they’d shoot upward reflecting that future inflation “inappropriately” low ST rates will supposedly unleash. Not only is no one in swaps smiling, the LT maturities go even deeper negative the farther out in time meaning that the most important market that exists (no matter if no one outside of it knows this) says rates are going down to stay.

UNAMBIGUOUSLY ANTI-INFLATION

If that’s all too complicated, there are any number of other signals which don’t require intimate knowledge of dealer conditions and synthetic duration (issues we are going to be tacking in soon-to-be-released EDU member classroom videos). Copper-to-gold, for one, is easy to calculate and even easier to understand. On the one side, the numerator, copper prices reflect general economic demand – when not distorted by non-economic supply squeezes.

The other is gold, the denominator, which is not an inflation hedge but one against major, big-time risks and errors (like 2008, an episode that was not in any way inflationary). Put the two together, what you get is a very simple, easy to see and digest inflation/deflation signal. Clean, mostly unambiguous, not really open to much interpretation other than those short run fluctuations driven by other unrelated factors.

If you’re looking for an unambiguous inflation/deflation signal, you’ll find no better, none with a clearer signal and little noise.

Lower lows

Following the last one of those, copper prices cleared back to fundamentals which, in relation to gold which has been remarkably steady (red flag already), led the copper-to-gold ratio to crash not just back to reality but also to a new multi-decade low; less than every prior rate from 2020 as well as all of 2008 and 2009.

It was established in the days immediately following the July payroll report. Worse, and more to our point here, the ratio has remained very close to that low all throughout August, despite some lingering angst over tariff inflation (largely due to a misreading of the July PPI) not to mention the growing widespread acknowledgement ST rates are about to head lower again. Had the market viewed this as inflationary, demand for copper would have risen while demand for gold should have declined as has repeatedly been the case during reflationary periods.

Since we haven’t actually seen any inflation since the seventies, the ratio would at least have to transit through unmistakable reflation on its way to those levels. Given how depressed it has been for so many years, you’d also have to believe the shift would be violent in order to traverse from deeply deflationary to somewhat inflationary the more ST rates seek to be moving downward.

THEY MISSPELLED S-T-E-E-P-E-N-I-N-G

In other words, an inverse relationship.

Of course, that’s all nonsense simply because lowering ST rates is every bit consistent with deflationary CtG, which is why, over longer time periods, they are directly correlated.

One of the key issues surrounding CtG, or even just gold, is that there seems to be a huge disconnect between what the ratio appears to be saying and what we see or, really, don’t see today. What I mean is, even for those who don’t fall for inflation from lower interest rates, it seems like far too much of a leap to get from the Fed lowering rates over moderate labor market concerns to 2008- or 2020-levels of the ratio.

The measure seems to be way too negative therefore something seems off about it.

But that’s not what CtG is indicating. Markets aren’t preparing for a general crash in the economy, banks or financial markets, they are instead pricing the depressionary aftermath of one. In fact, this is what the low ratios had been indicating all throughout the 2010s; not a crash replay, instead the ongoing painful long run repercussions in destroyed potential.

We already had the next trigger here in the 2020s in the form of the pandemic and lockdowns. What all these markets are pricing in their own ways is the eventual economic and monetary payment for them – a collective bill yet to be fully paid back. That comes in the form of fewer jobs and less income, the very macro symptoms which get the Fed on track to reducing policy rates to begin with.

Ultra-low CtG is a signal for a long run which has little if any upside (thus, zero inflation) and a lot of downside in the form of more deterioration yet to come in a lot of different facets: from China’s credit crisis (currently pricing out in soaring stocks in Shanghai), to Europe which can’t buy a plausible path to recovery, to now the US facing increasingly recognizable difficulties not just in jobs but also now houses, too.

All of those things, like ultra-low copper-to-gold, are consistent with ultra-low ST interest rates. But to get there in the Treasury market, the curve has to first steepen which is exactly what it has been doing since last September.

More triggers for lower rates

Reasons for ST rates, or any market interest, to go lower keep piling up come from every direction. Earlier today, the Conference Board said consumer sentiment was slightly lower as consumer fears over jobs grew even more. Not only that, CB also reported expectations among Americans for recession (full-blown) are back to the highest since April since nothing has been fixed in the real economy.

On top of all that, as mentioned at the end of last week, the US housing market has been strongly suggesting the same; or, providing yet another justification for the Fed to go in that direction. A legit housing bust, even if no necessarily a crash, will definitely get the FOMC’s attention with or without Lisa Cook on the board.

THAT’LL GET RATES DOWN WITHOUT ANY RISK OF INFLATION, TOO

Last week, construction data showed homebuilders curtailing building intentions in response to weak new home sales that have led to an unwelcome and costly buildup of unsold even finished house inventories. The latter have surged to their highest since 2007 (only slightly lower in July than June’s high). Prices, therefore, are dropping.

As they are in the wider residential property market where the same imbalance has likewise arisen. There are more homes now for sale after many years when no one wanted to sell for any reason. Property owners were wary of moving out of their current residence having to trade one low-cost mortgage on their current dwelling for a much-higher rate loan.

This is yet another area where lack of income growth dooms everything, the one common feature (lack of labor recovery) which both unites markets and real economy while also helpfully explaining the trajectory all these signals from them are pointing toward. Had the labor market truly recovered, it would have spun off more than enough earned income for homebuyers to pay higher mortgage rates on top of higher costs of living.

Over the past year or so, now home sellers are showing up just as the few home buyers there were now retreat over justified concerns for their jobs. Again, the same imbalance with more sellers than buyers, rising inventories therefore falling prices.

Today, both the FHFA and S&P Case-Shiller further confirmed as much, reporting lower home prices on average across the US. For the latter set of indexes, values have fallen four straight months through June (the latest figures) and are very likely to show the same in July given what we already see for real estate from the other data series. And while FHFA has only fallen three straight months, the two prior to the drop were basically flat anyway.

In short, the real estate market is definitely in a downturn and property prices are reflecting its growing severity. This doesn’t necessarily mean a crash, just like we’re not expecting one in the general economy, but it does add more negatives to an already-difficult situation. That gives the future Fed two more possible reasons to lower rates, a housing bust plus the negative macro implications of it.

It's more of what’s in the CtG ratio. Not only would a housing bust get rates lower in the short and intermediate terms, the fallout from it would absolutely help keep them there for a lot longer without the slightest hint of inflationary anything.

See what I mean? Lisa Cook or no Lisa Cook. The President’s wishes or not. Interest rates are going lower because all roads continue to lead right to there.

Almost all of these inflation calls are based on misinterpreting bull steepening on the yield curve which is itself nothing more than the natural progression following that very same path laid out in swaps or CtG. It isn’t the market losing faith in Treasuries, nor is it the idea that rate cuts are going to overstimulate an inflationary economy.

We are living in the deflationary aftermath of a false recovery. One that everyone also said was inflationary.