THE REAL LEGACY OF SVB IS TRENDING

Summary: The dollar soared in December and January. Everyone said it was Jay Powell. We now have more than enough evidence to conclusively show, no surprise, it wasn’t. Instead, a pretty significant dollar crisis when primary dealers hoarded massive amounts of Treasuries and foreign central banks and govts used massive amounts of theirs. But it’s the background which led to this which needs reviewing for what it means about a lot more than this recent monetary breakdown. This starts with Silicon Valley Bank.

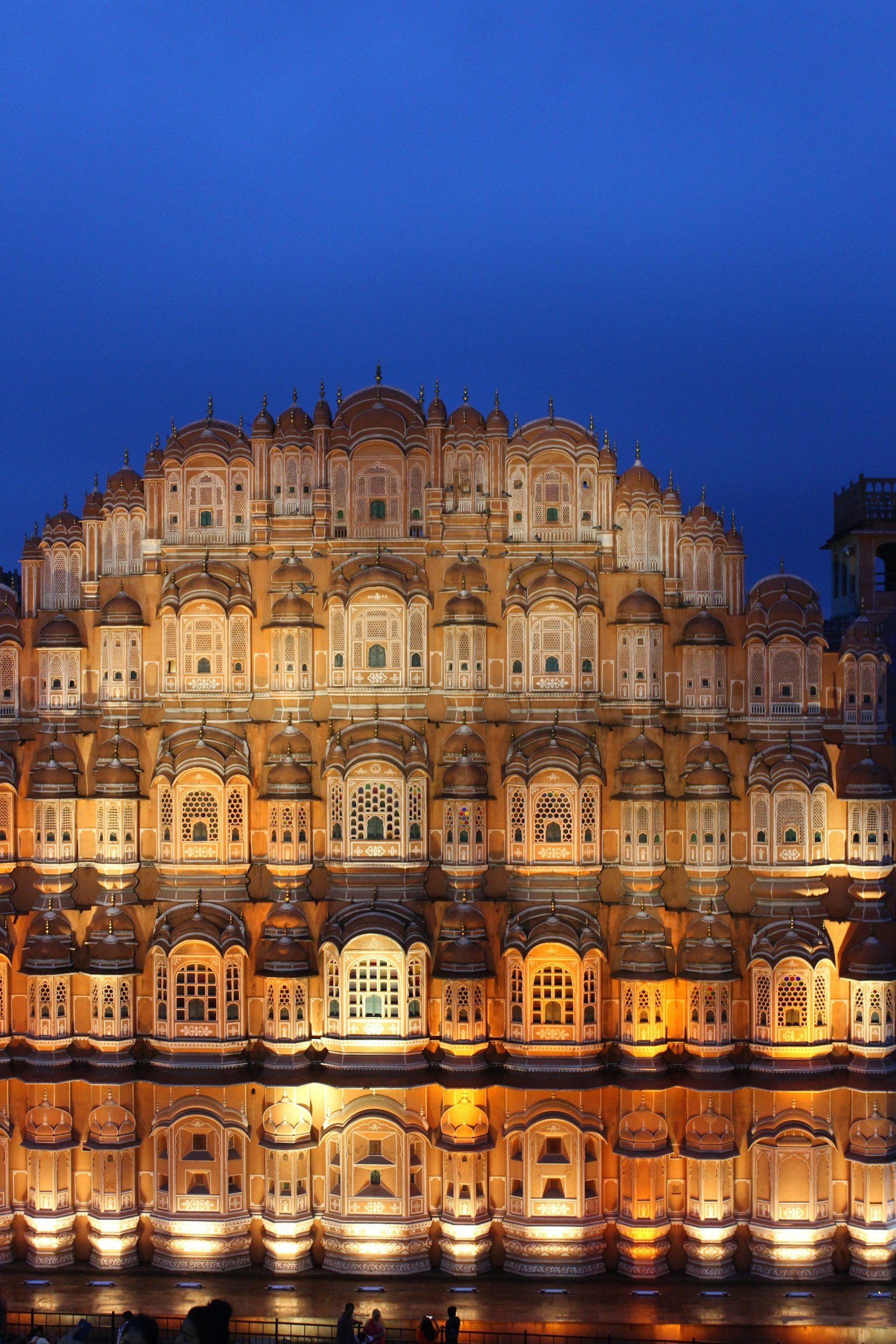

INDIA PREMIUM

Summary: India’s banking situation has gotten to be a disorderly mess. RBI has had to initiate swaps, TOMOs, repo auctions, what they even called a “bazooka” to calm things down. Where did all this come from? Consequences from the eurodollar premium. According to the latest indications from it, such as primary dealers hoarding another massive record high in Treasury assets and very low yields on Japanese bills, this latest disruption isn’t yet done. The dollar has lost some of its urgency on trade wars fluctuations, not its background premium.

THE FREEZING ECONOMY’S HOT CPI

Summary: At first, these seem like contradictions: a “red hot” CPI at the same time one of the world’s oil giant’s reports laying off one-fifth of its entire workforce. After all, the latter is in response to the realities of oil and gas prices and margins which are main inputs into consumer price measures. Reconciling these two outcomes is not all that difficult once you realize it isn’t a hot CPI so much as a heated interpretation of it, one free from legit economics. It is economics (small “e”) which helps us explain a lot, including the danger of the Beveridge Curve represented by all these things.

JUST CALL IT STEEPENING

Summary: Payrolls were ugly in October and that wasn’t the only problem nor the worst part. Despite what sure looks like recession in the jobs market, the long end of the yield curve keeps selling off, rates rising when it seems like they should be doing just the opposite. The short end is, with bill rates more aggressively going lower as, at the very least, the next set of Fed rate cuts is basically locked in at this point. How, then, do we explain this odd curve divergence? The answer is that there is nothing odd about this at all.

SENTIMENTAL PARALYSIS

Summary: The FOMC announcement went as everyone expected. It was the language used in conveying the statement which caused some commotion. For his part, Chair Powell made things clearer by offering to clear up nothing. Officials have no idea what to think on the economy, particularly prospects for trade wars. That’s more than curious because policymakers have an enormous volume of scholarship on the subject from which to form solid opinions. Still, they refuse. Why?

OKUN NEEDS A BEVERIDGE

Summary: November JOLTS was grim, everything beside job openings which, not surprisingly, everyone focused exclusively on. Hires way down, quits at a new low, layoffs on the rise. Worst of all, where the current JOLTS - including job openings - fits on the Beveridge Curve. This isn’t just an academic matter, the concept behind it will decide the biggest question of them all: where on the curve indicates which way the long run economic potential is most likely to be.

JUST CALL ME TROUBLE

Summary: We have to question what the recession question even is before then asking the only question that gets to the root of the matter. First, the December CPI and an update from China with more money market turmoil. Afterward, getting to that potential unit question starting with Germany’s latest update then reviewing the history of “technical recession.” What we might call not-recovering is of secondary importance, at best, since what Germany shows is that whatever the labor it is indeed happening.